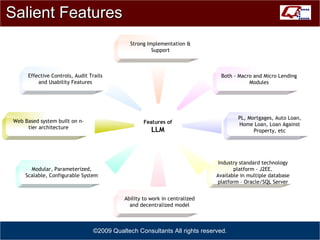

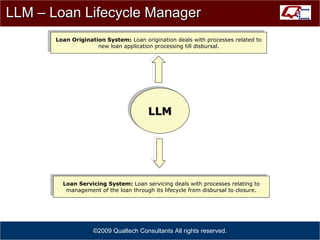

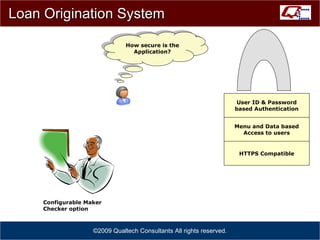

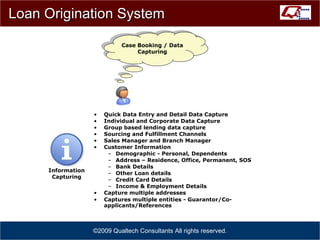

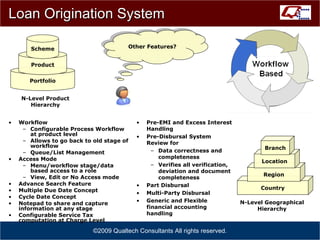

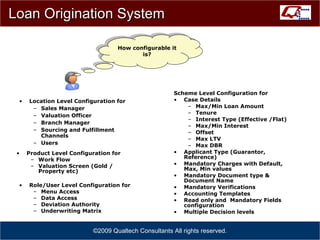

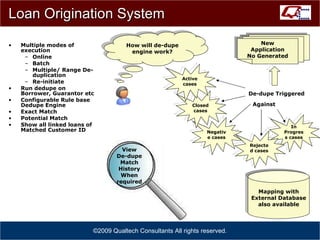

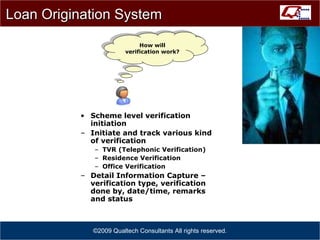

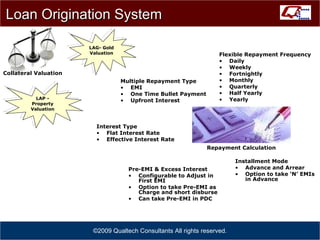

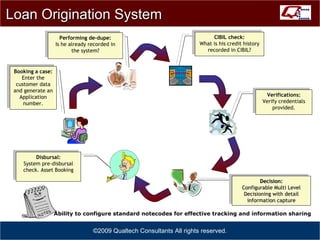

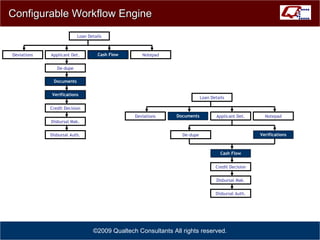

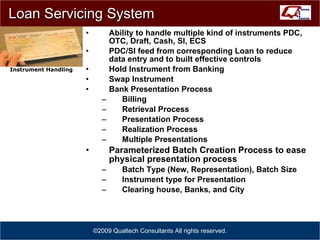

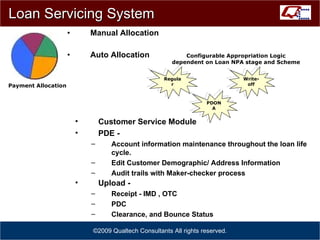

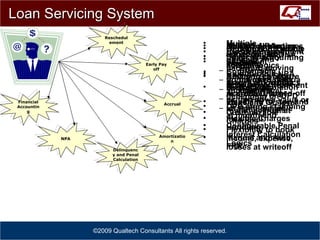

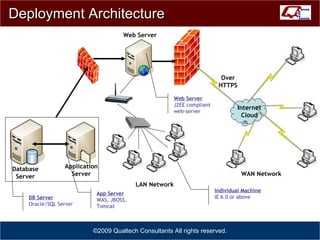

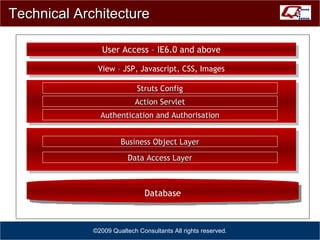

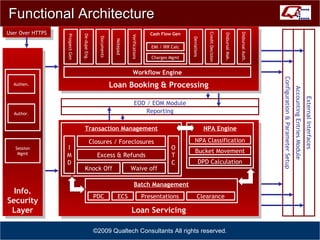

The document describes the key features of a loan lifecycle management system. It includes features for loan origination, servicing, and a configurable workflow engine. The system allows for processing new loan applications, managing loans throughout their lifecycle, and configurable underwriting, deviations, charges, and financial accounting. It has a web-based architecture using J2EE and can integrate with external databases.