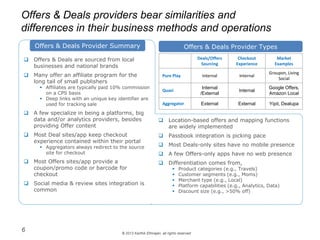

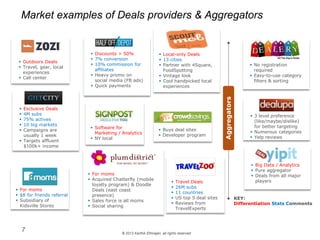

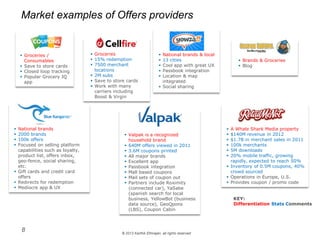

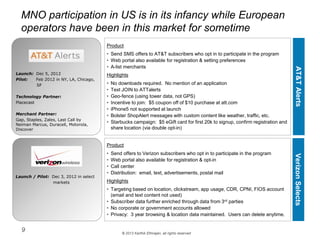

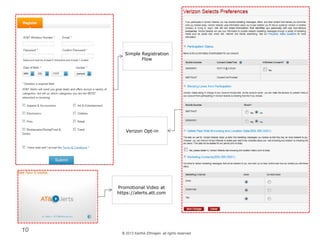

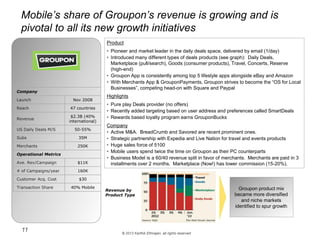

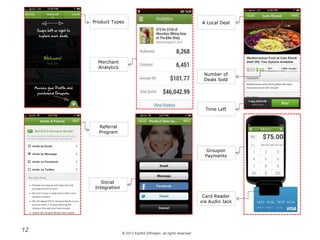

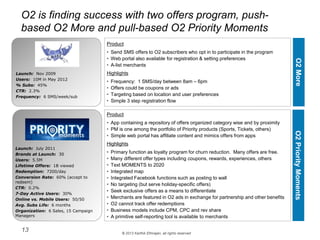

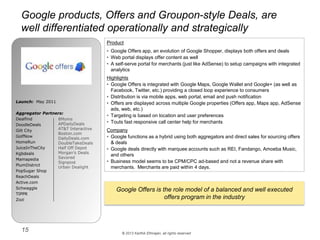

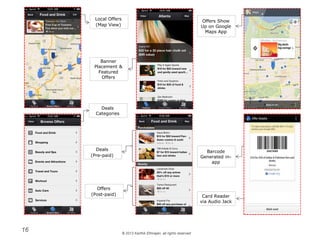

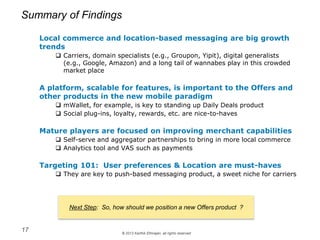

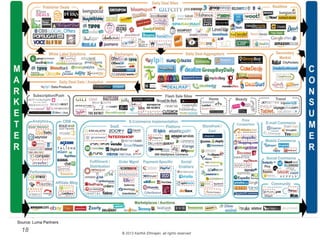

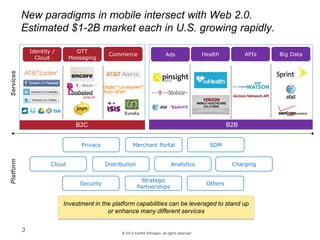

The document provides an overview and analysis of the offers and daily deals market. It discusses the value chain and business models of major players like Groupon, Google Offers, O2 More and Priority Moments. The key differences between daily deals and offers are outlined. It also analyzes the mobile strategies and product portfolios of various providers, and how operator programs like AT&T Alerts and Verizon Selects work.

![© 2013 Karthik Ethirajan, all rights reserved

The complexity of an Offers product value chain varies

with functionality

4

Offers products are offered by carriers, domain specialists (e.g.,

Groupon, Yipit) and digital generalists (e.g., Google, Amazon)

Aggregator

Direct

Sales

Care

Offers

Deals

Reporting

mWallet

Email

App

Web

SMS

Notification

Ad

Pull Push

Subs

Non-Subs

In-App

Online

Store

Redemption

Merchants Merchant

Portal

Distribution

Campaign

Targeting

Technology Partners

[Social Integration]

•Local Commerce

(Long Tail)

•Big Brands

Business Model

•CPM / CPC

•Revenue Share](https://image.slidesharecdn.com/9a247afe-b37f-48bf-bf52-718544019bb8-161014180843/85/Offers-Market-Analysis-4-320.jpg)