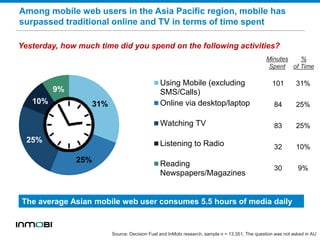

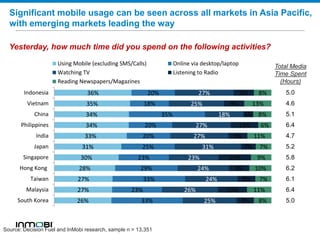

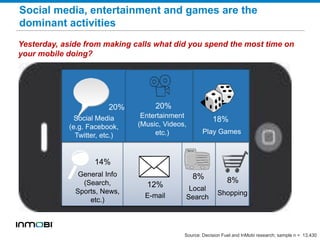

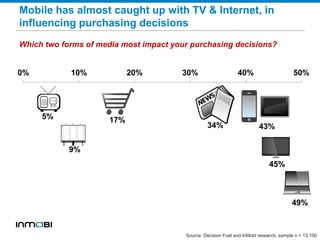

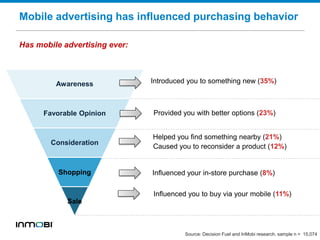

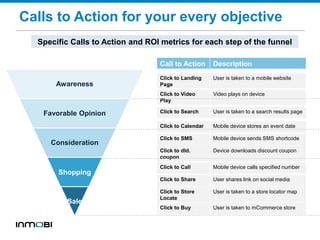

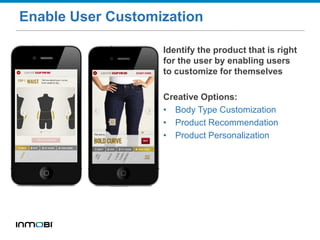

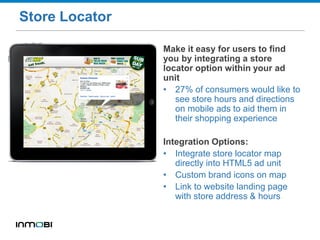

Mobile users in Asia now spend more time on their mobile devices than any other form of media. A survey of over 12,000 mobile users in Asia found that 31% of users' media consumption time was spent on mobile devices, exceeding time spent on desktop/laptop (25%) and watching TV (25%). Mobile is also now the preferred medium for many user activities like communication, entertainment, and searching for information. The survey also found that mobile advertising is influencing purchasing behaviors, with ads introducing users to new products and services as well as influencing in-store purchases. The document outlines how brands can engage mobile users through mobile advertising strategies that incorporate interactive ad units, coupons, store locators, social media integration, and gam