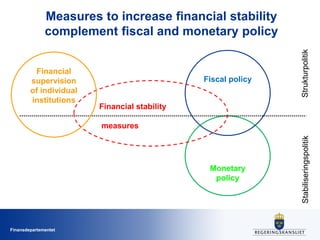

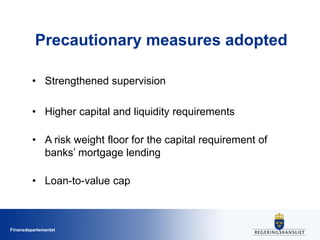

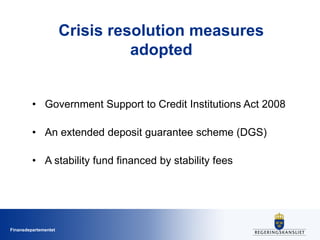

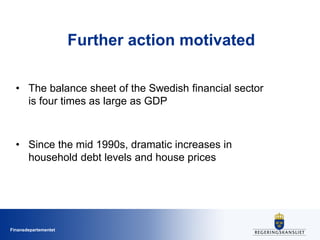

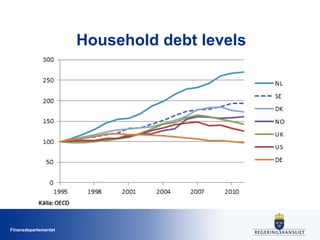

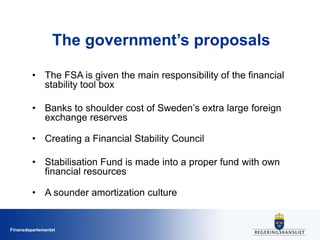

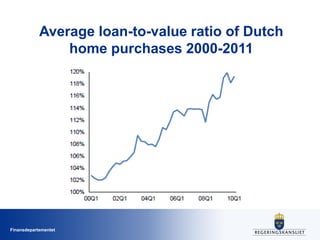

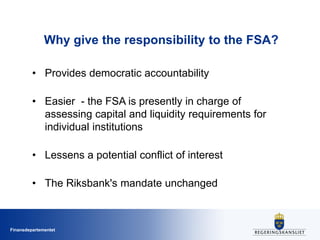

Mr. Peter Norman, Minister for Financial Markets, outlines Sweden's approach to financial stability and reforms since the 2008 crisis, emphasizing the need for a stable financial system for economic recovery in Europe. The government proposes enhanced responsibilities for the Financial Supervisory Authority, the establishment of a Financial Stability Council, and measures to mitigate risks associated with rising household debt. Ongoing monitoring of the financial sector is essential, with readiness to act further if necessary.