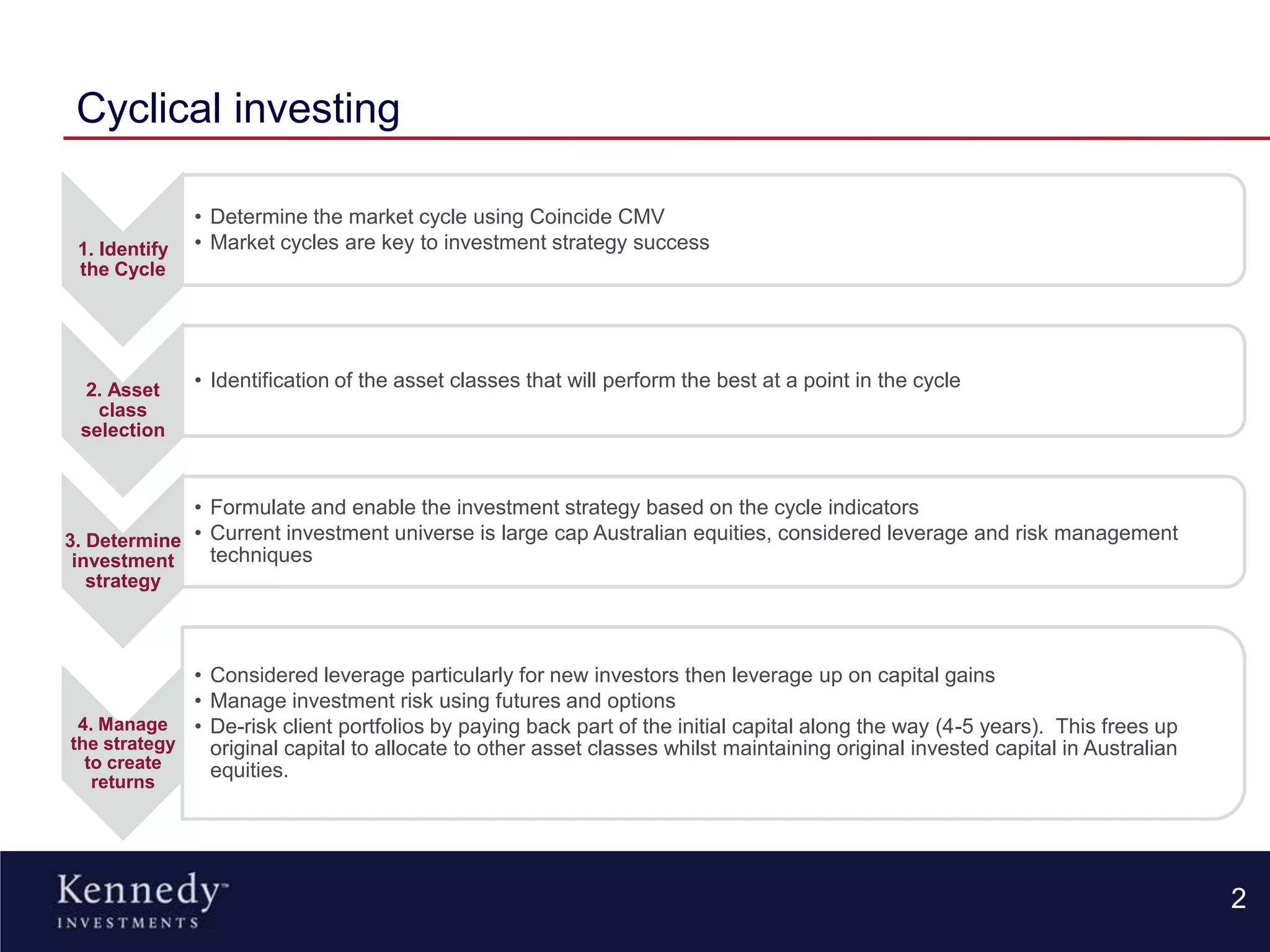

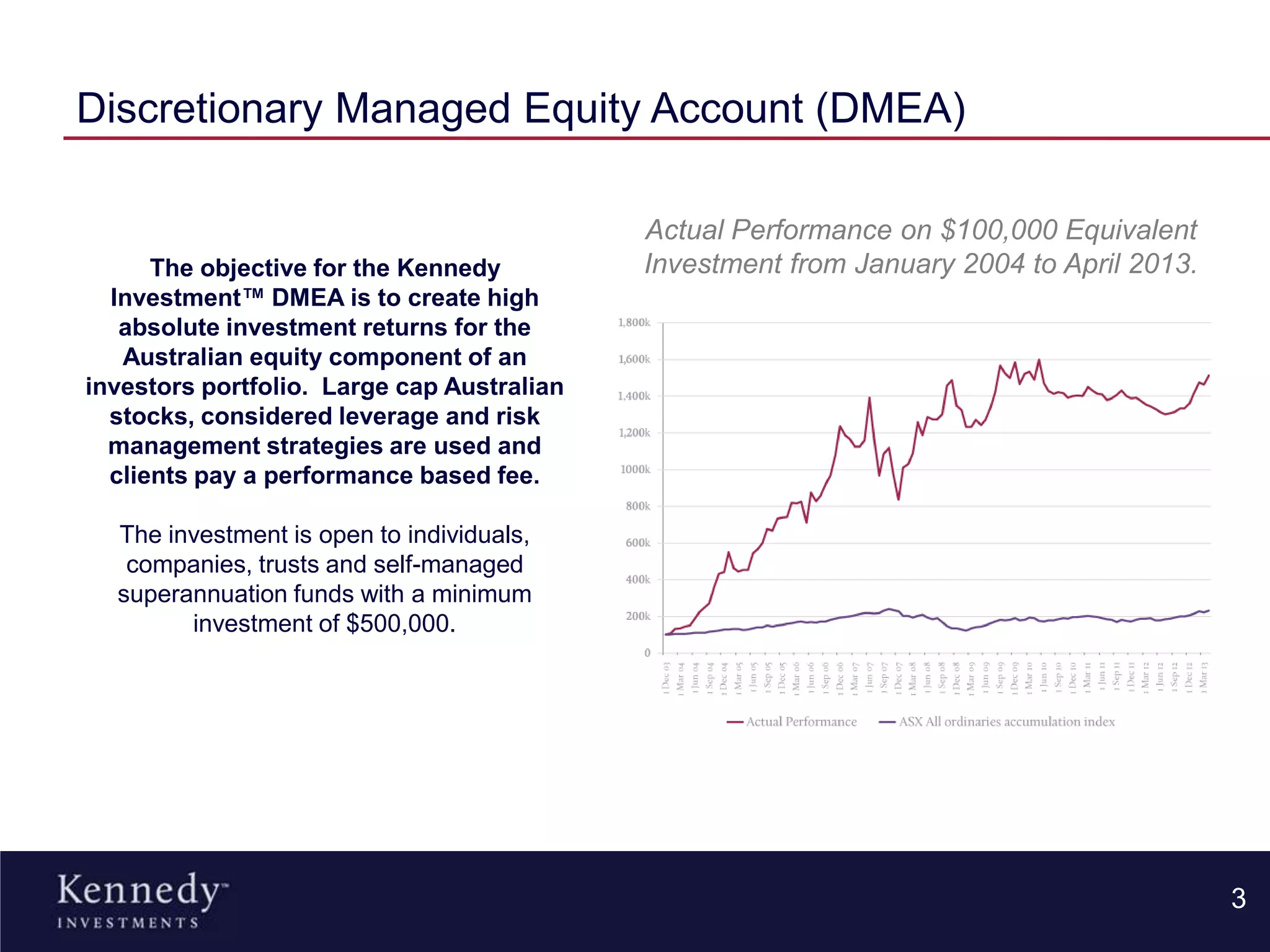

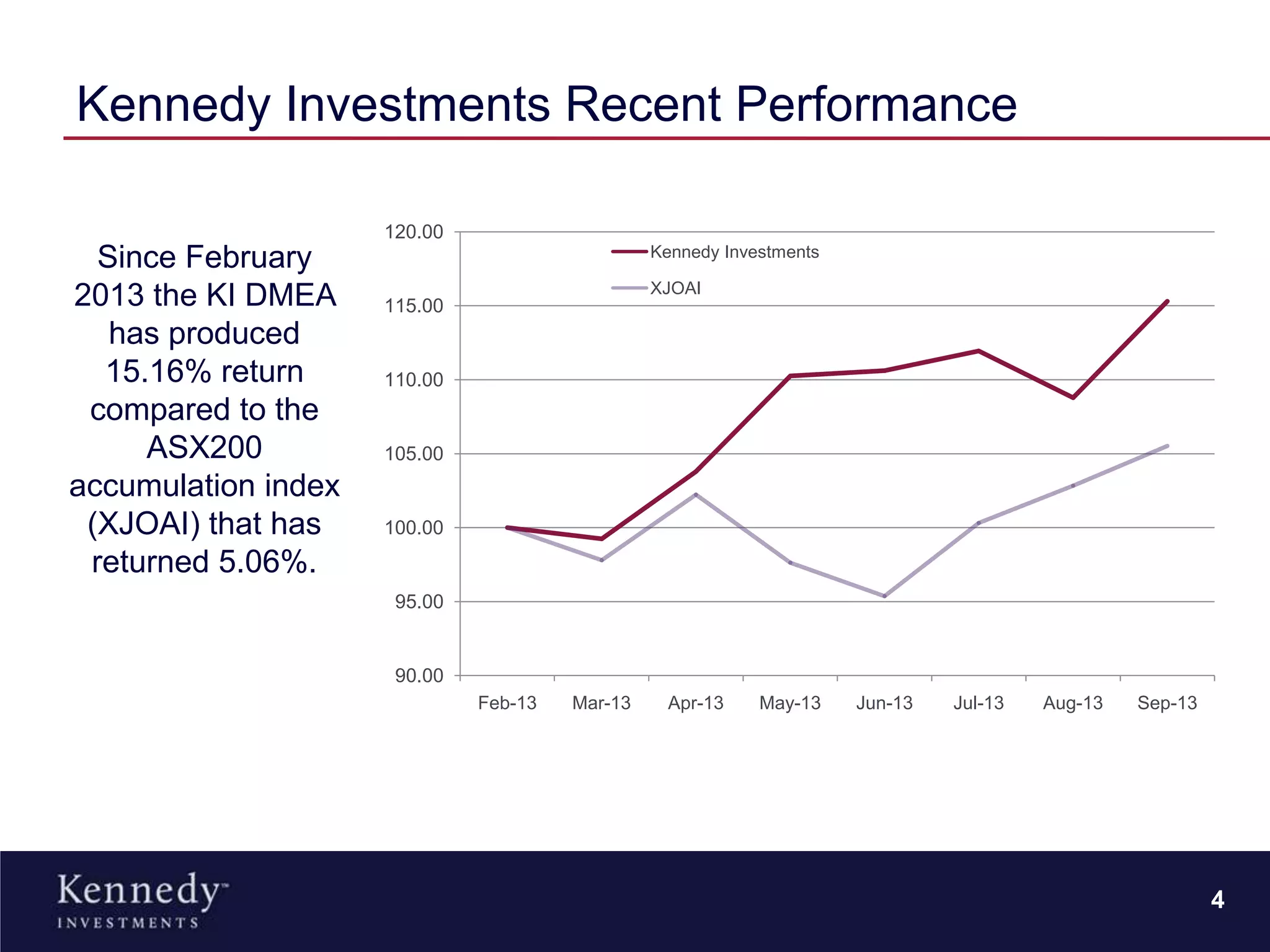

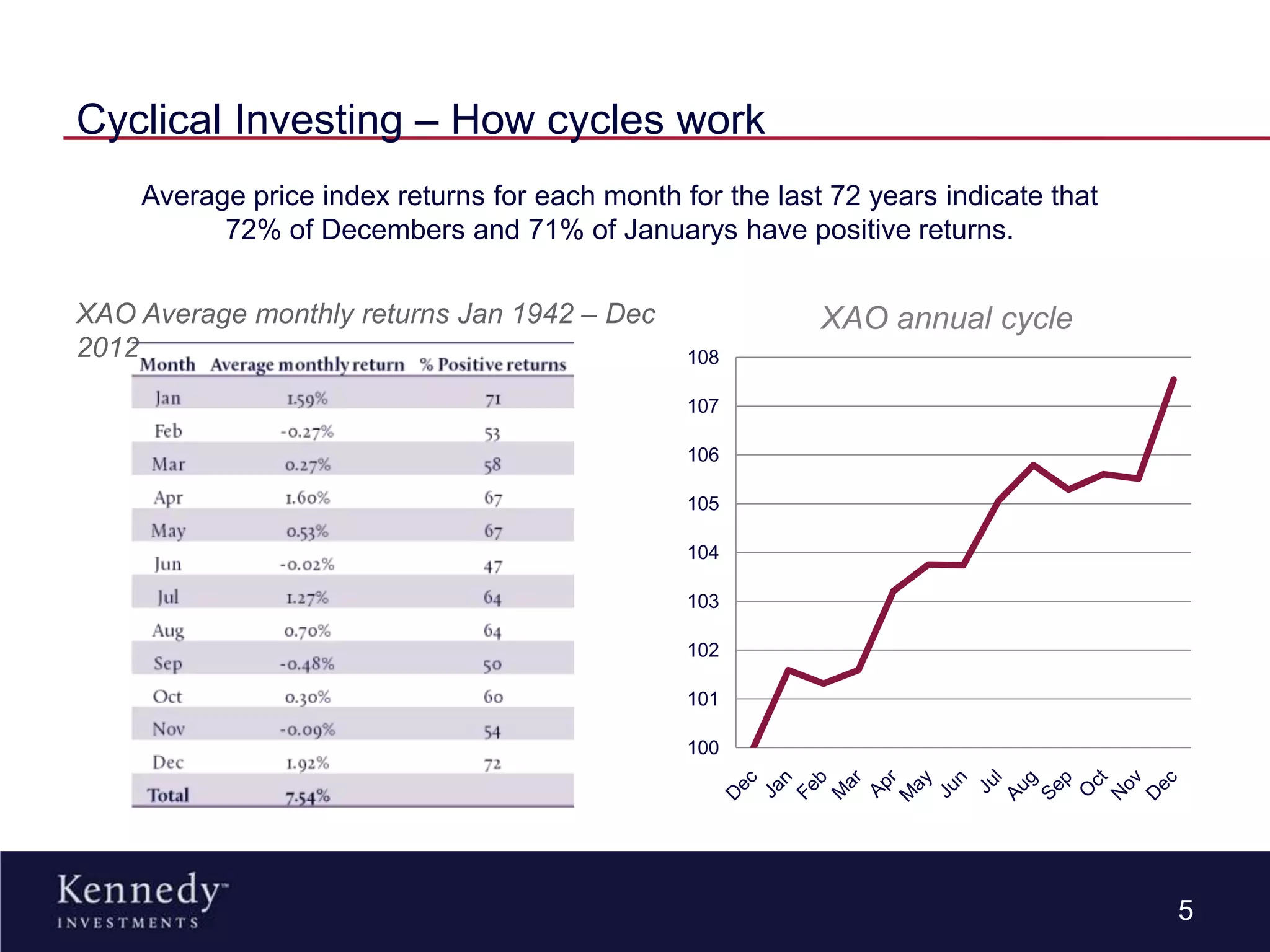

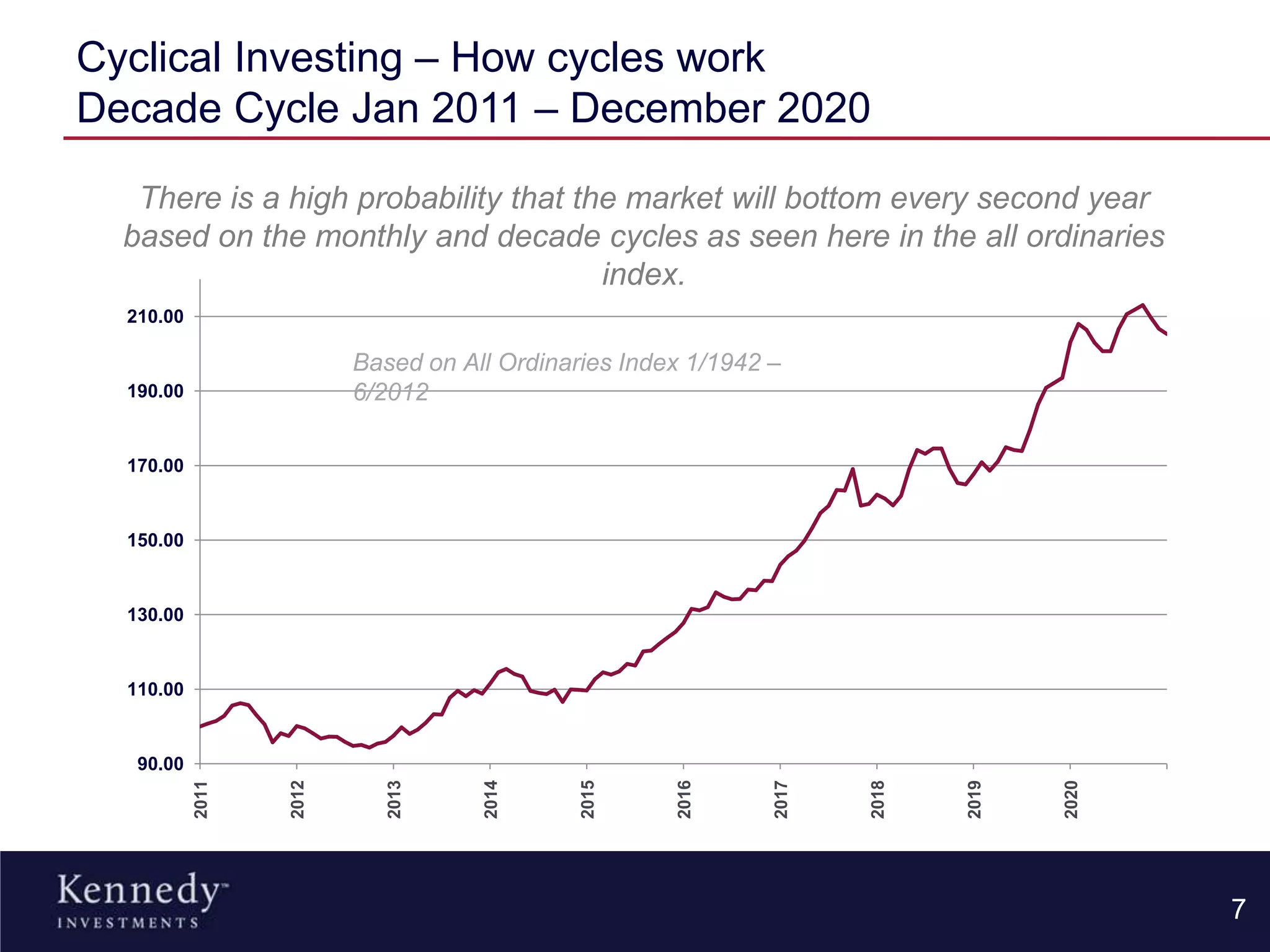

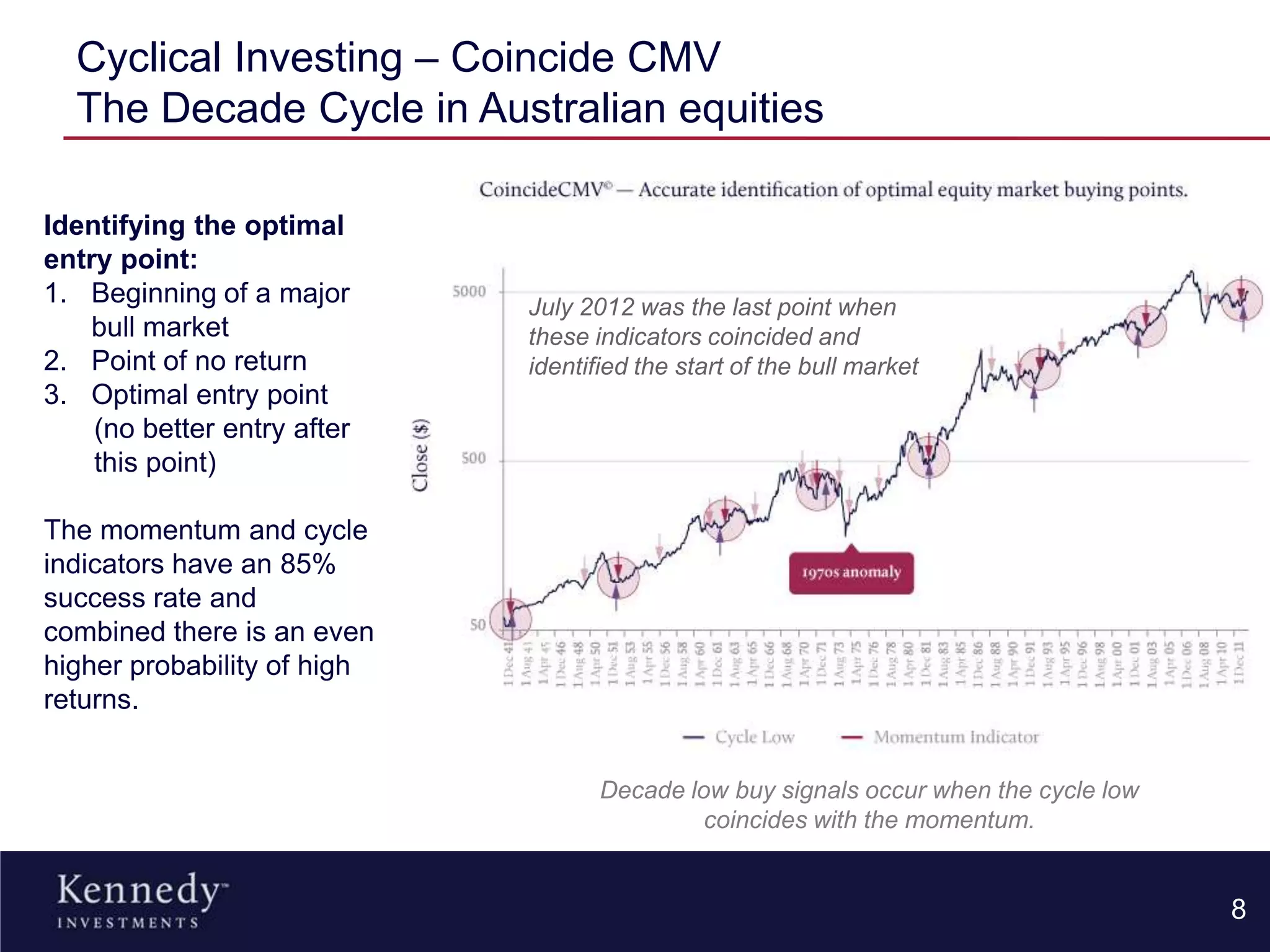

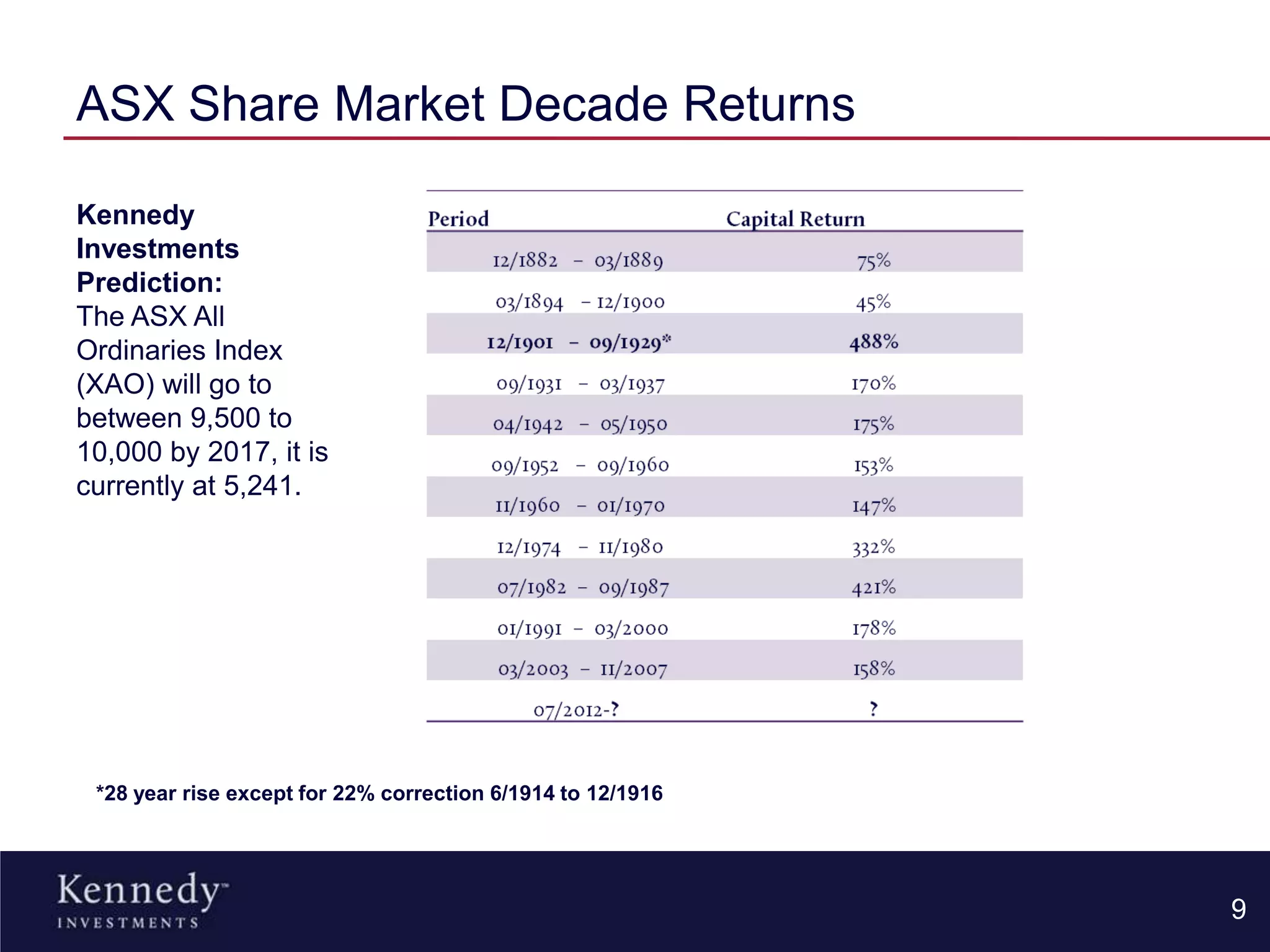

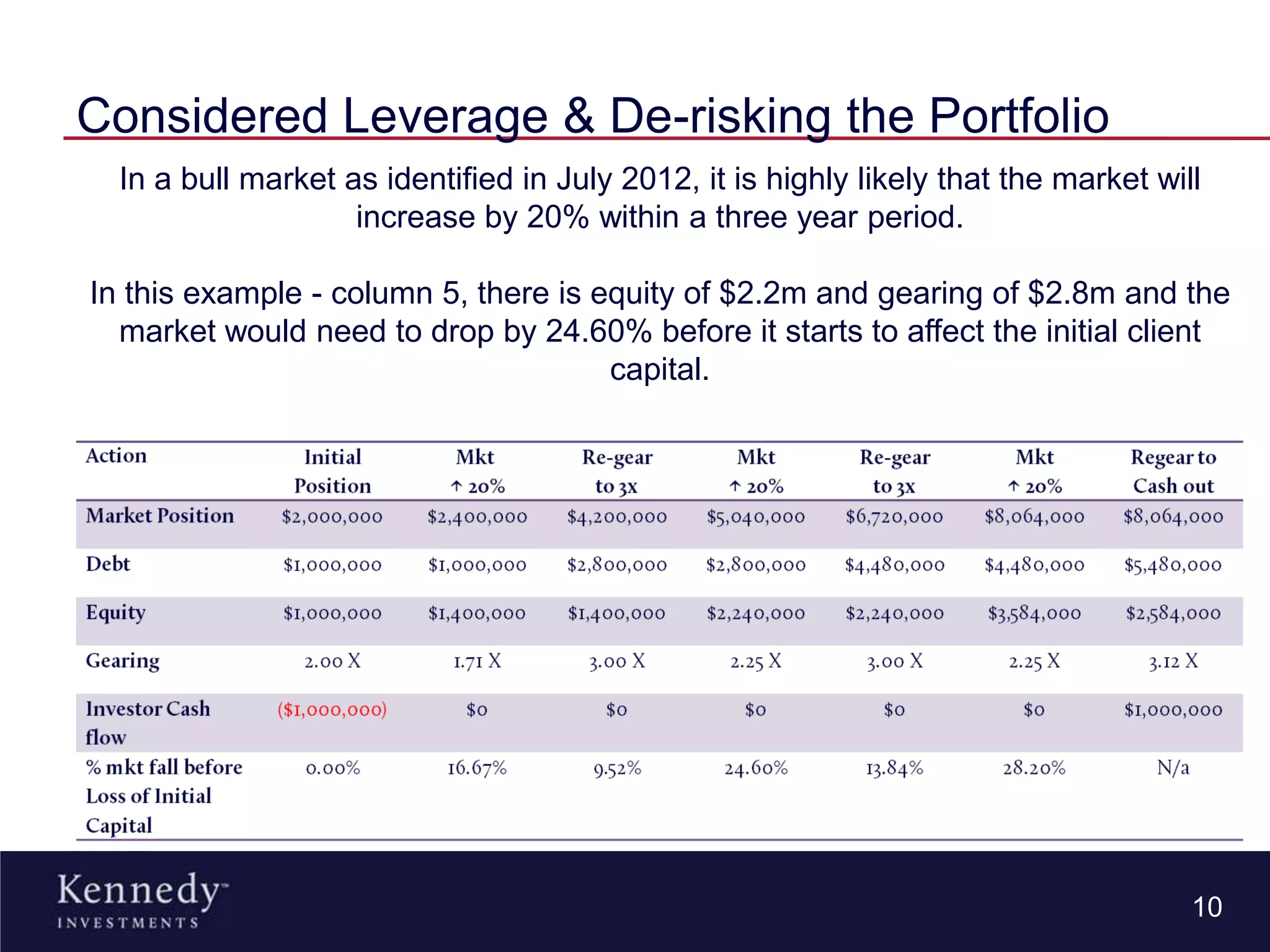

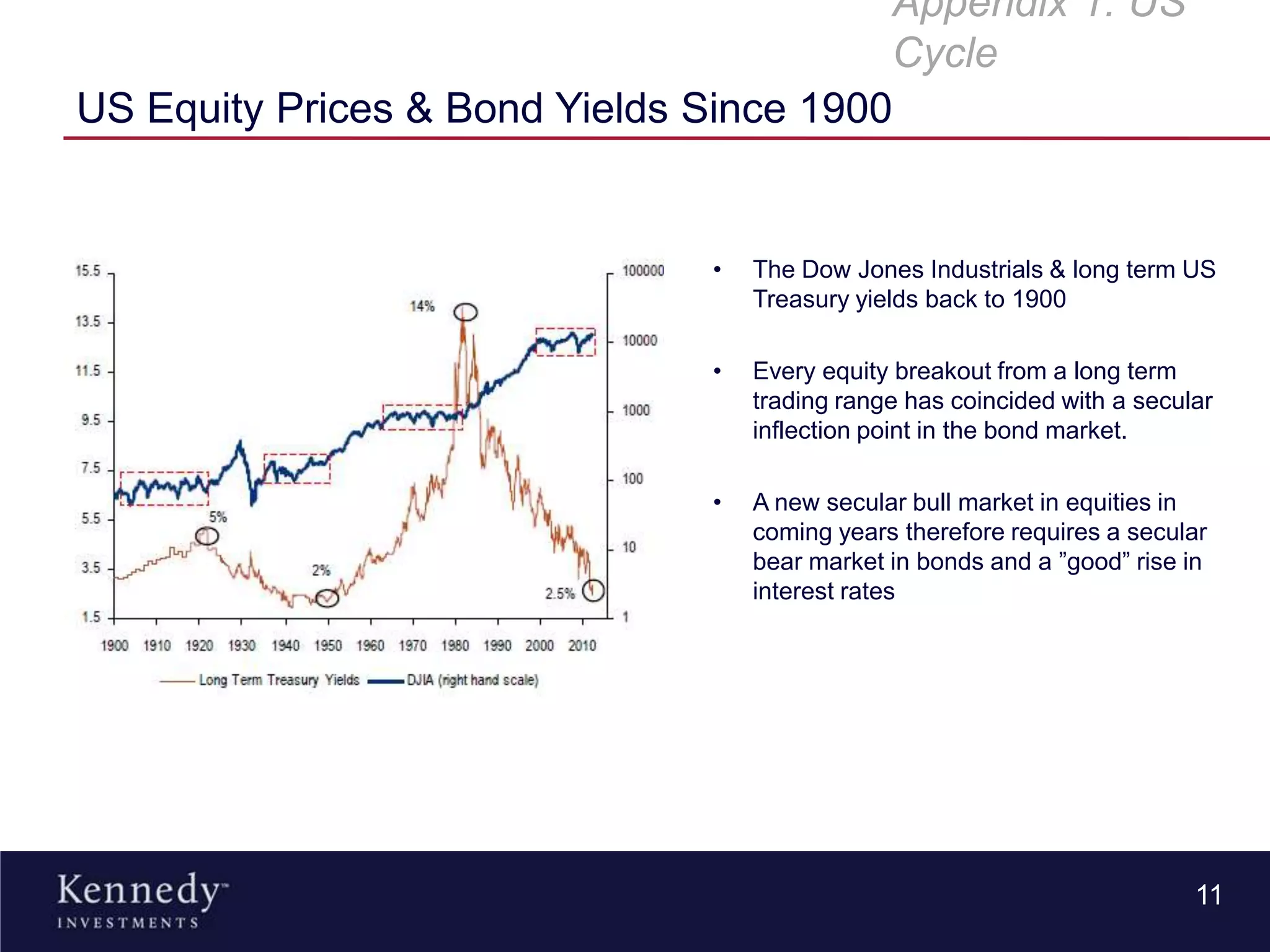

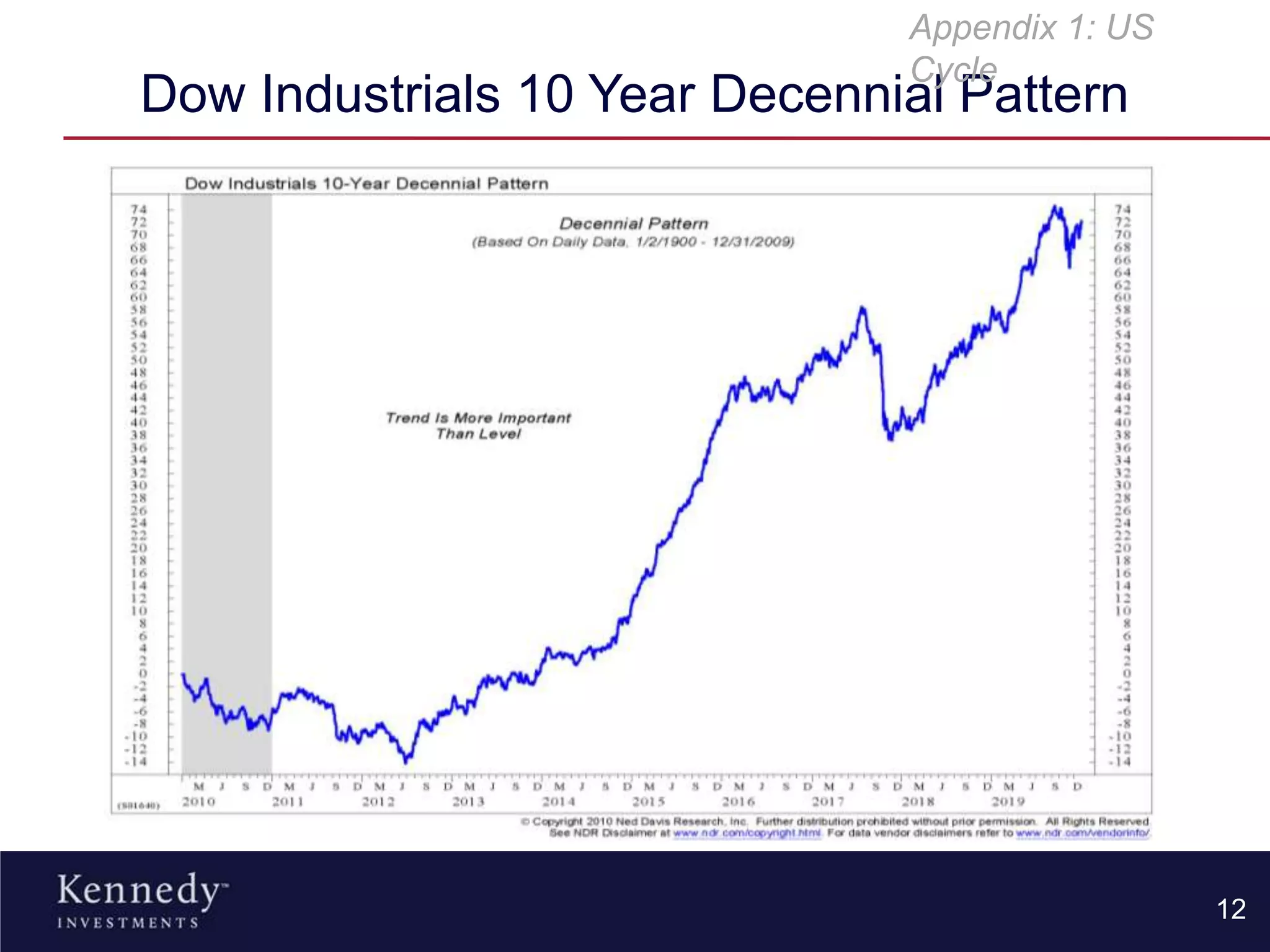

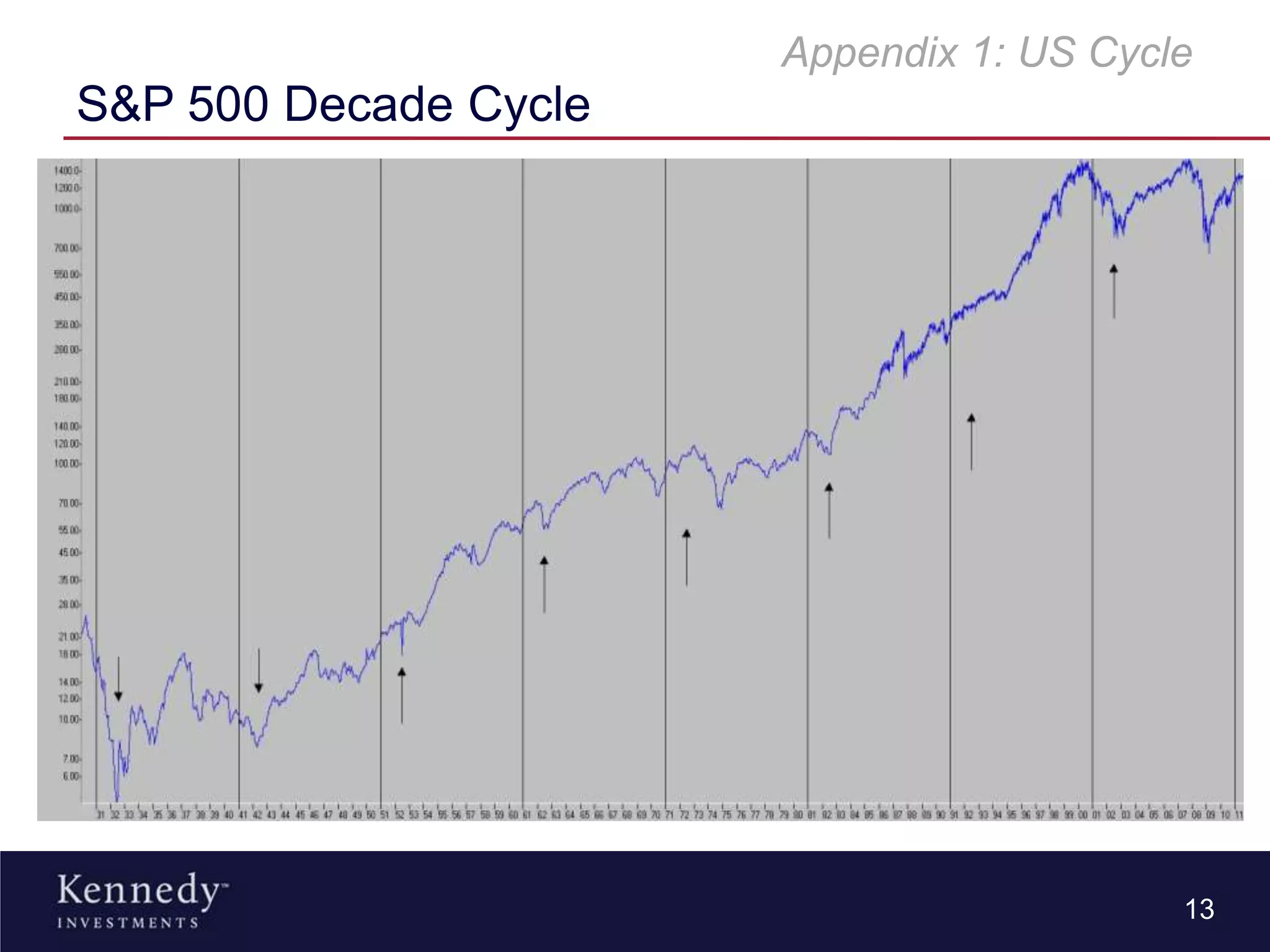

The document discusses cyclical investing strategies, emphasizing the importance of identifying market cycles for successful asset class selection and investment strategies. It details the Kennedy Investment DMEA, which aims to create high absolute returns in large cap Australian equities, and outlines performance metrics indicating strong returns compared to the ASX200 accumulation index. Additionally, it predicts a significant rise in the ASX All Ordinaries Index by 2017, fueled by identified bull market conditions and leveraging techniques.