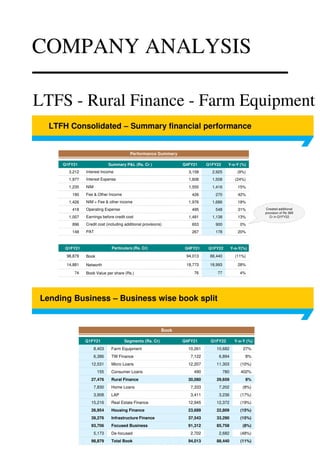

The document provides details of Mohit Prasad's summer internship at Larsen & Toubro Financial Services (LTFS) from August 10, 2021 to July 15, 2021, where he gained experience in marketing and sales operations. It describes his duties as a marketing intern, which included supporting the sales team and shadowing marketing and sales professionals. The internship helped Mohit gain valuable insights into achieving success in the rural finance industry and developing skills like listening and collaboration.