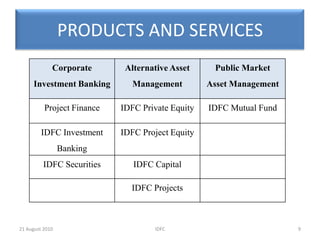

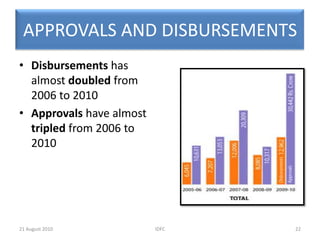

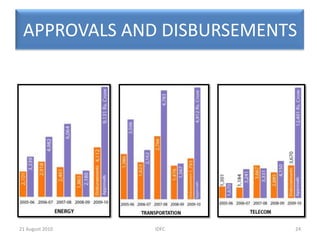

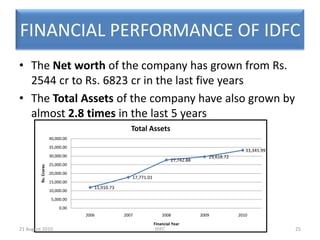

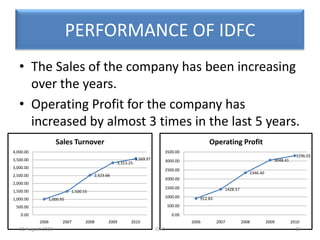

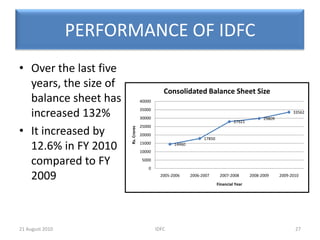

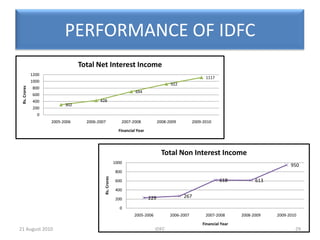

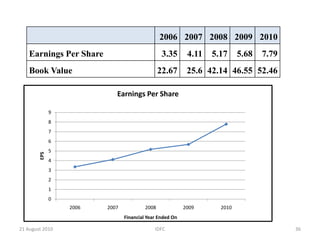

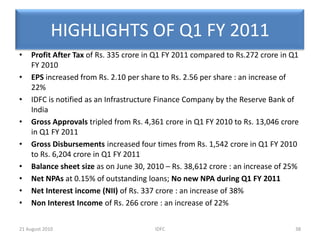

IDFC is a major provider of infrastructure financing in India. Over the past 5 years, it has tripled its project approvals and nearly doubled its disbursements. It offers a wide range of financial products and services including project finance, private equity, asset management, and investment banking. IDFC has grown significantly in recent years, with its net worth increasing over 2.5 times and total assets growing nearly 3 times from 2005 to 2010. It aims to further support the development of infrastructure across India.