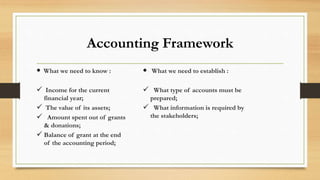

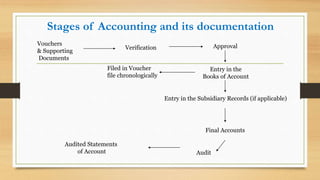

This document discusses the financial management and accounting practices of non-profit organizations (NPOs). It outlines the objectives of NPO accounting as knowing funds received and spent annually and ensuring funds are properly utilized. It describes the accounting framework, stages of accounting documentation, key issues like foreign and local fund transactions, and types of financial reporting including internal reports like budgets and external statutory reports for compliance.