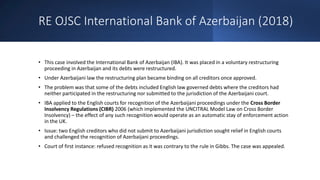

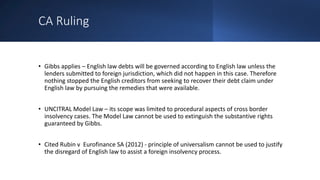

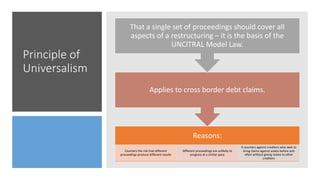

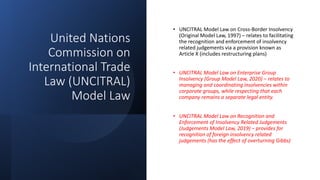

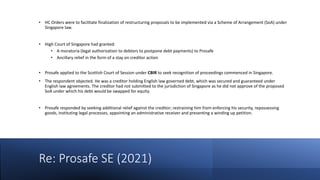

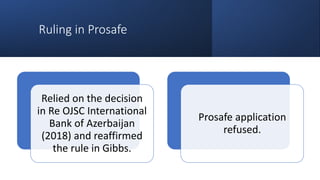

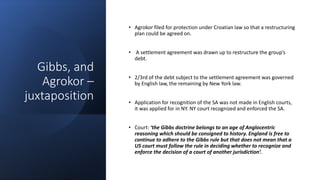

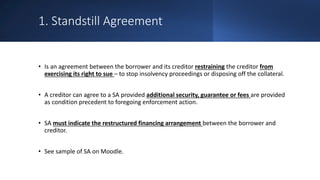

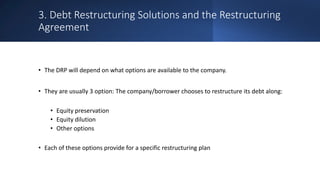

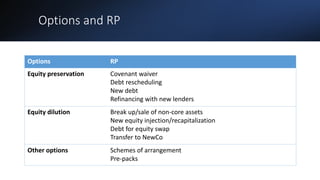

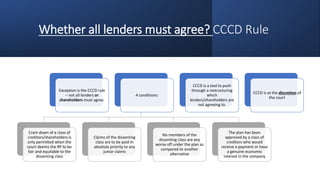

The lecture discusses debt restructuring, focusing on when it occurs and its legal implications, particularly under the rule in Gibbs and various cross-border insolvency regulations. It outlines the three stages of debt restructuring, including negotiating agreements, assessing company value, and implementing restructuring solutions, while detailing exceptions under the cross-class cram down (CCCD) rule. Key case laws, including those of re Ojsc International Bank of Azerbaijan and re Prosafe SE, highlight the complexities and legal landscapes shaping debt restructuring in the UK and internationally.