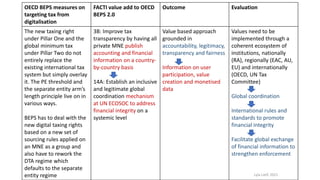

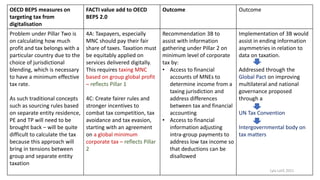

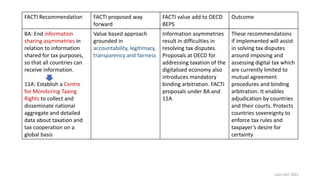

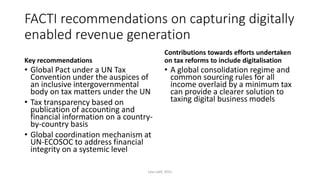

The document discusses the FACTI recommendations related to the OECD's BEPS 2.0, emphasizing the need for improved tax transparency and global coordination to address issues of digital taxation. It outlines key proposals aimed at ensuring fair taxation of multinational corporations (MNCs), including a global minimum corporate tax and enhanced information sharing mechanisms. Overall, the recommendations seek to resolve tax disputes, enhance accountability, and adapt to the challenges posed by digitalization in the economy.