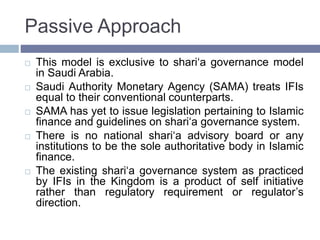

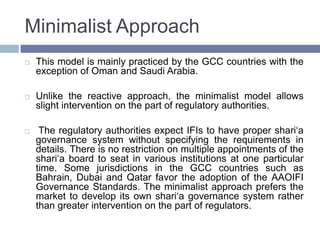

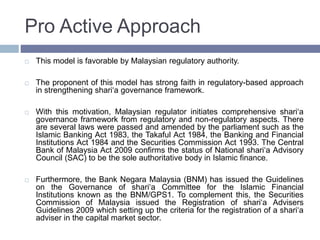

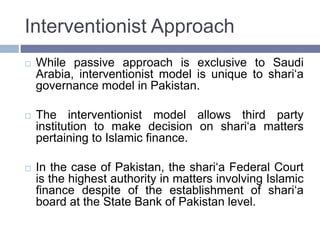

This document discusses five different models for regulating Islamic securities: reactive, passive, minimalist, proactive, and interventionist. The reactive model is used in the UK and Turkey, where regulators only intervene in Islamic finance issues if problems arise. The passive model in Saudi Arabia treats Islamic banks like conventional ones, with no dedicated Islamic finance regulation. The minimalist model in other GCC states sets loose guidelines for sharia governance. Malaysia follows the proactive model, with comprehensive laws and a national sharia board providing regulatory guidance. Pakistan's interventionist model gives a federal sharia court authority over Islamic finance matters.