Embed presentation

Download to read offline

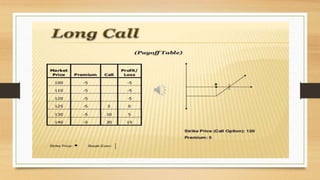

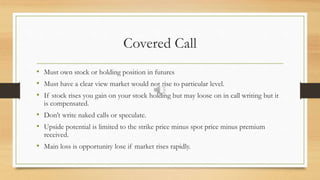

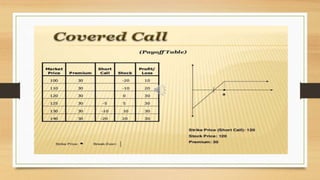

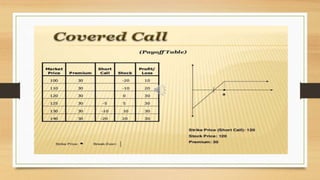

Options can be used as hedging strategies to reduce investment risk. Hedging involves taking an offsetting investment position to limit losses from the primary position. One hedging strategy is covered calls, where an investor writes call options against a long stock position to generate income from premiums while limiting upside potential to the strike price in exchange for downside protection. The main risk is opportunity cost if the stock rises rapidly above the strike price.