Embed presentation

Download to read offline

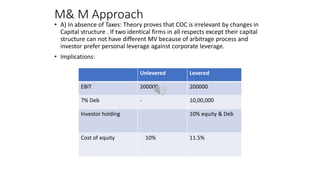

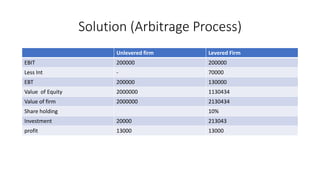

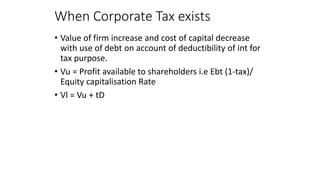

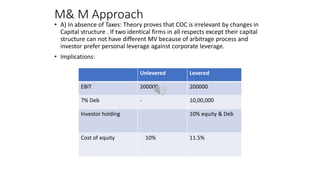

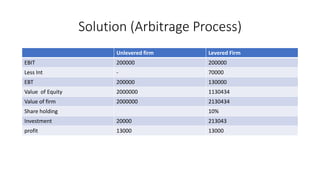

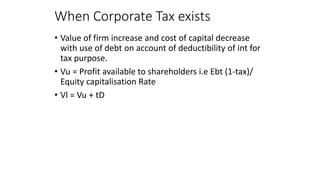

This document summarizes Modigliani & Miller's capital structure theory. It discusses two key aspects of their approach: 1) In the absence of taxes, the capital structure of a company is irrelevant as arbitrage will cause identical firms to have the same market value regardless of debt use. Investors can replicate corporate financing decisions individually. 2) When corporate taxes exist, the value of a company increases with debt as interest payments are tax deductible, lowering the overall cost of capital. The value of a levered firm equals the value of an unlevered firm plus the present value of tax shields provided by debt. 3) An example calculation is provided to illustrate how to determine the value of an unlever