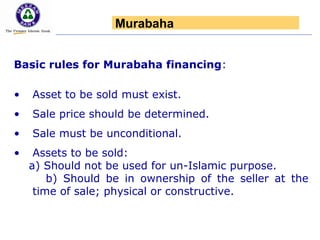

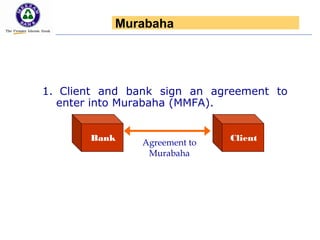

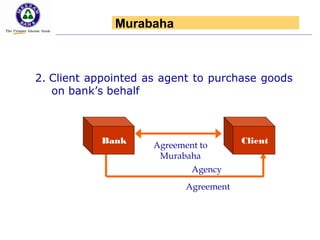

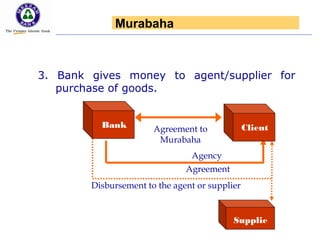

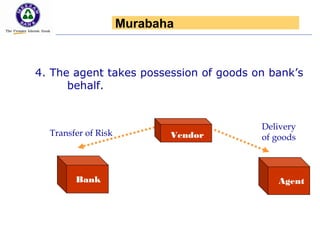

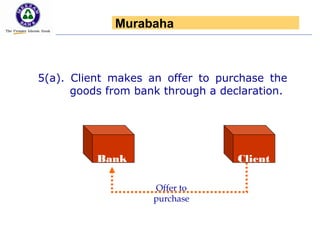

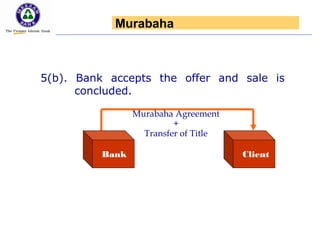

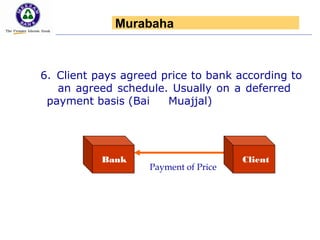

This document provides an introduction and overview of Murabaha, an Islamic financing structure. It defines Murabaha as a sale where the seller discloses the cost of goods to the buyer and adds a known profit. The key features are that the asset being sold must exist, the sale price must be determined, and the sale must be unconditional. It then outlines the basic 6 step process for Murabaha financing between a bank and client, where the client acts as an agent to purchase goods on the bank's behalf that are then sold to the client. Finally, it lists some common applications of Murabaha for meeting working capital needs, long-term purchases, and trade finance.