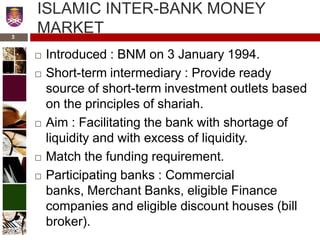

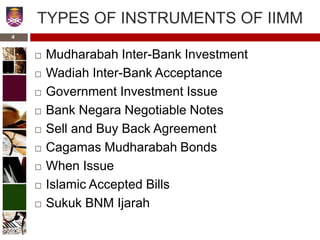

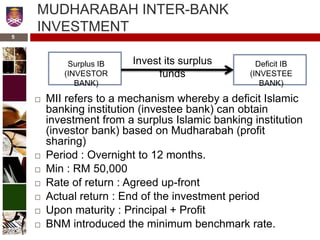

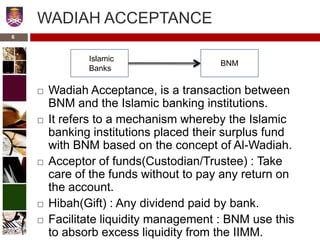

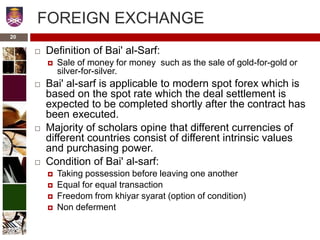

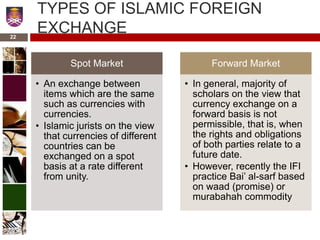

This document provides an overview of Islamic banking and finance practices in Malaysia, including the Islamic Inter-Bank Money Market (IIMM) and foreign exchange trading. The IIMM facilitates short-term liquidity management between Islamic banks using various Shariah-compliant instruments like Mudharabah Inter-Bank Investment and Wadiah Inter-Bank Acceptance. The document also outlines Government Investment Issues, Bank Negara Monetary Notes, and other instruments that Islamic banks can use for liquidity management. It describes the concepts of foreign exchange trading like Bai' al-Sarf that are applied in Malaysia in accordance with Shariah.