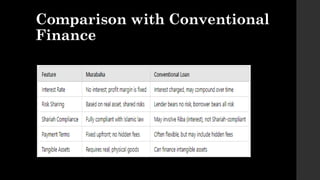

Murabaha is an Islamic financing structure where a seller sells a good to a buyer at an agreed price that includes a profit margin, avoiding interest and ensuring compliance with shariah law. The process involves several steps including financing request, agreement on terms, purchase, sale, payment terms, and transfer of ownership, often used for home, vehicle, and trade financing. While it offers transparency and fixed profit margins, challenges include higher costs for buyers and limited application to tangible goods.