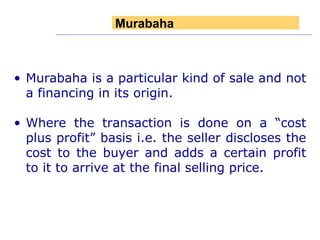

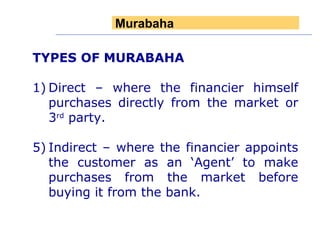

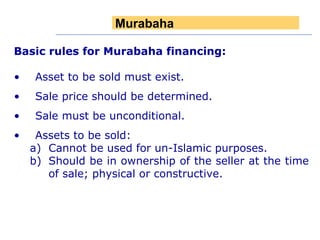

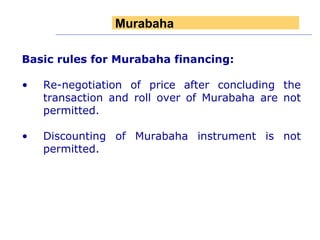

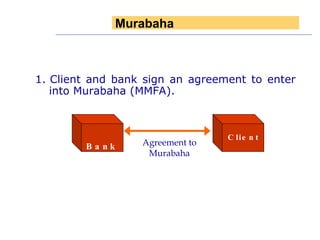

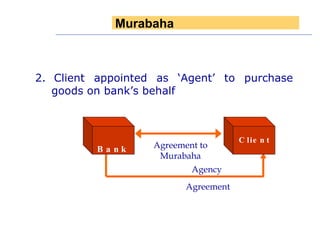

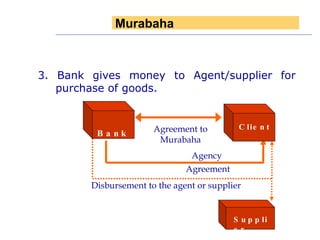

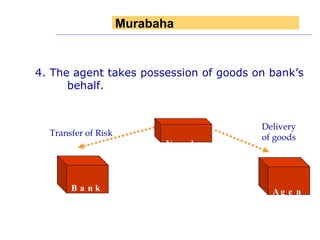

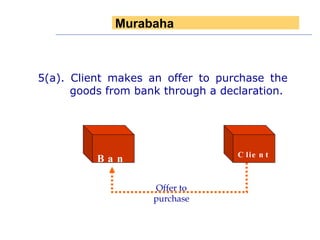

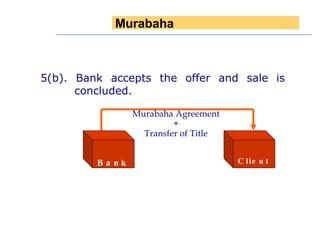

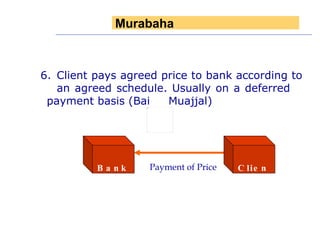

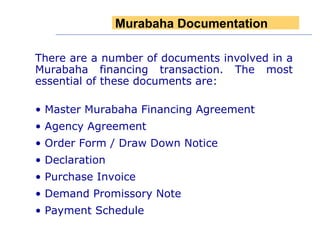

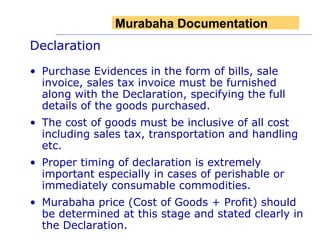

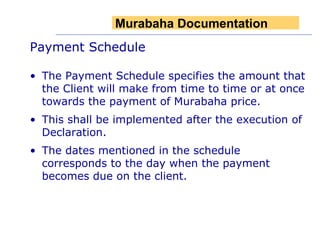

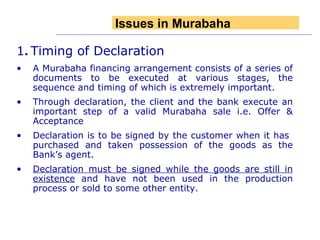

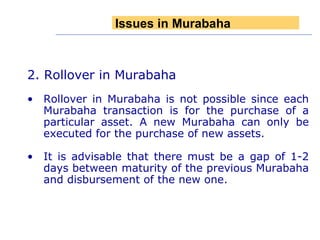

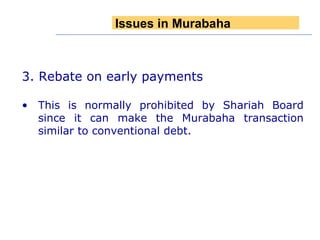

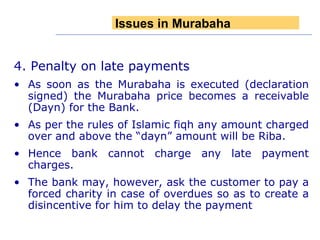

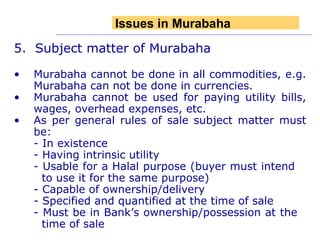

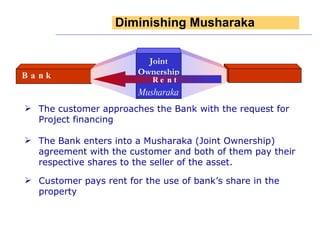

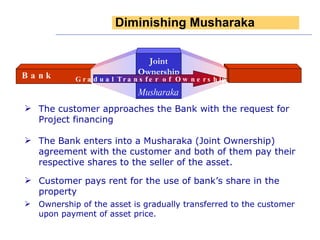

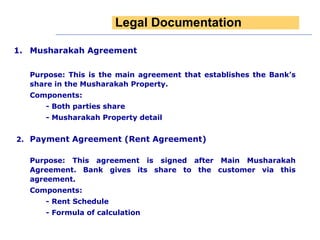

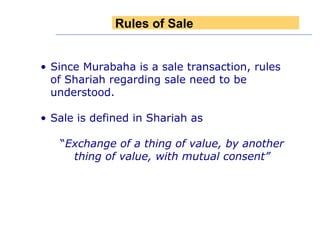

The document provides an overview of Islamic finance instruments, with a focus on Murabaha. It defines Murabaha as a sale transaction where the seller discloses the cost of goods to the buyer and adds a known profit margin. The key steps of a Murabaha transaction are that the bank appoints the client as an agent to purchase goods, then the bank sells those goods to the client on a deferred payment basis at a marked-up price including the disclosed profit. Several legal documents are required to structure a Sharia-compliant Murabaha deal.

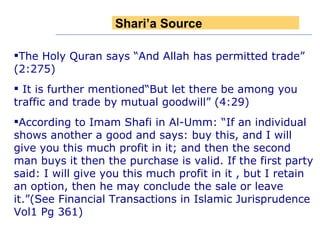

![“ But Allah has permitted trade” [2:275], “ But take witnesses whenever you make a commercial contract” [2:282], “ But let there be among you traffic and trade by mutual good will” [4:29], “ It is no crime for you to seek the bounty of your Lord” [2:198]. Legitimacy of sale](https://image.slidesharecdn.com/islamicfinance-1228509744416520-8/85/Islamic-Finance-5-320.jpg)