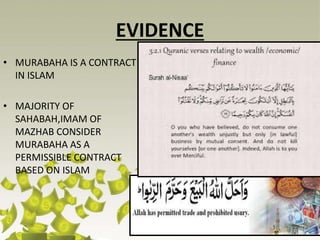

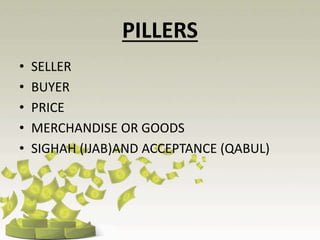

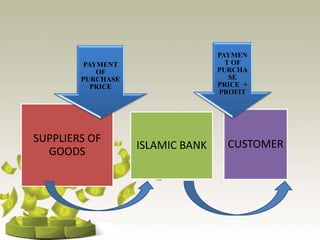

This document provides an overview of Murabaha, an Islamic financing structure. It defines Murabaha as a sale where the seller discloses the cost of an item and sells it for a higher price, adding a known profit. The document outlines the difference between Murabaha and Musawamah sales, basic rules of Islamic sales, evidence for Murabaha's validity, how it is structured as a financing transaction, potential issues, and mistakes to avoid. It concludes that Murabaha must be implemented carefully according to Islamic principles, as a legitimate sale rather than an interest-based loan.