This document provides an overview of keynesian economic concepts including:

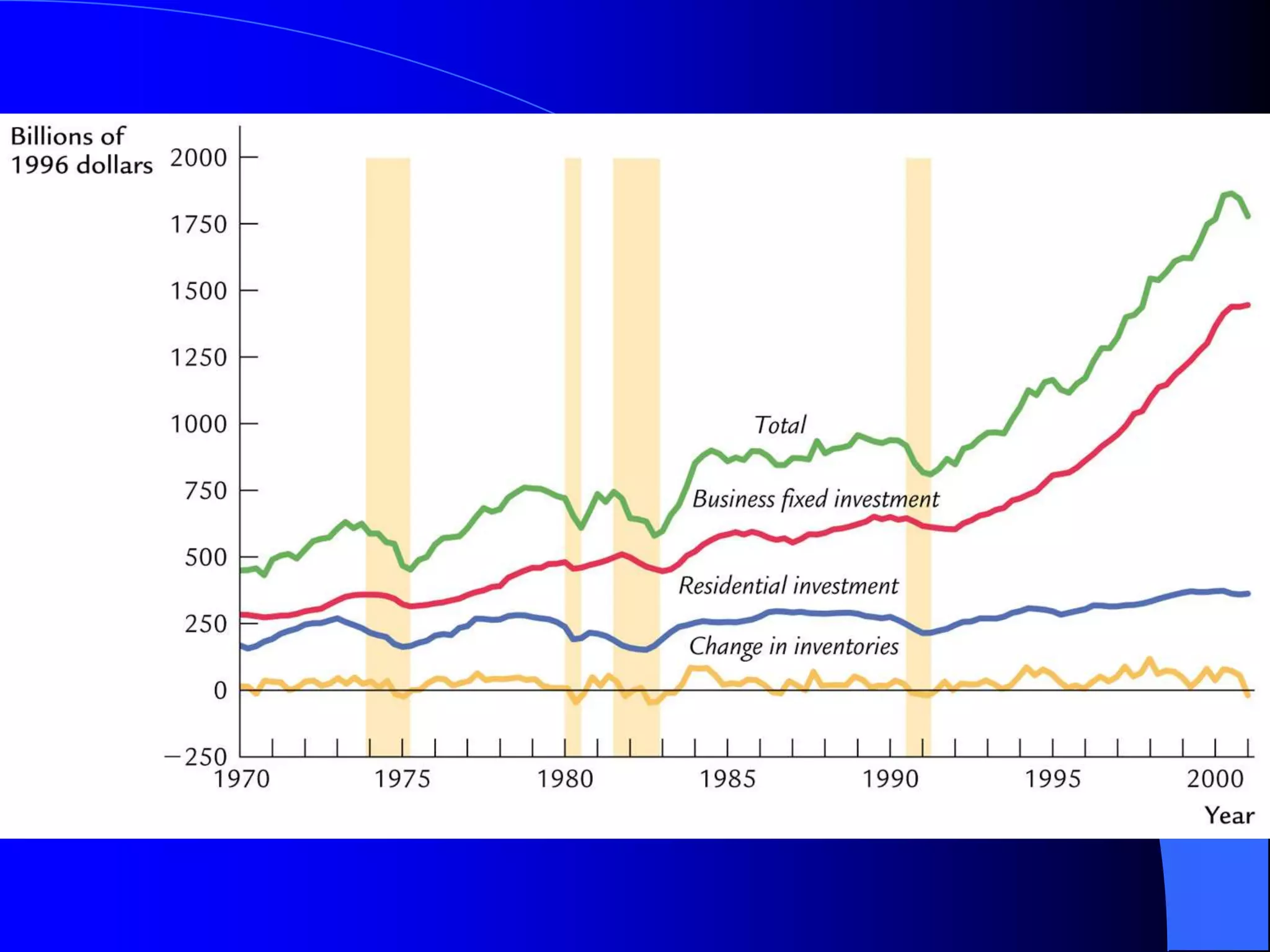

- Consumption and saving behavior based on disposable income and the marginal propensity to consume

- Equilibrium between total expenditures and income in the economy

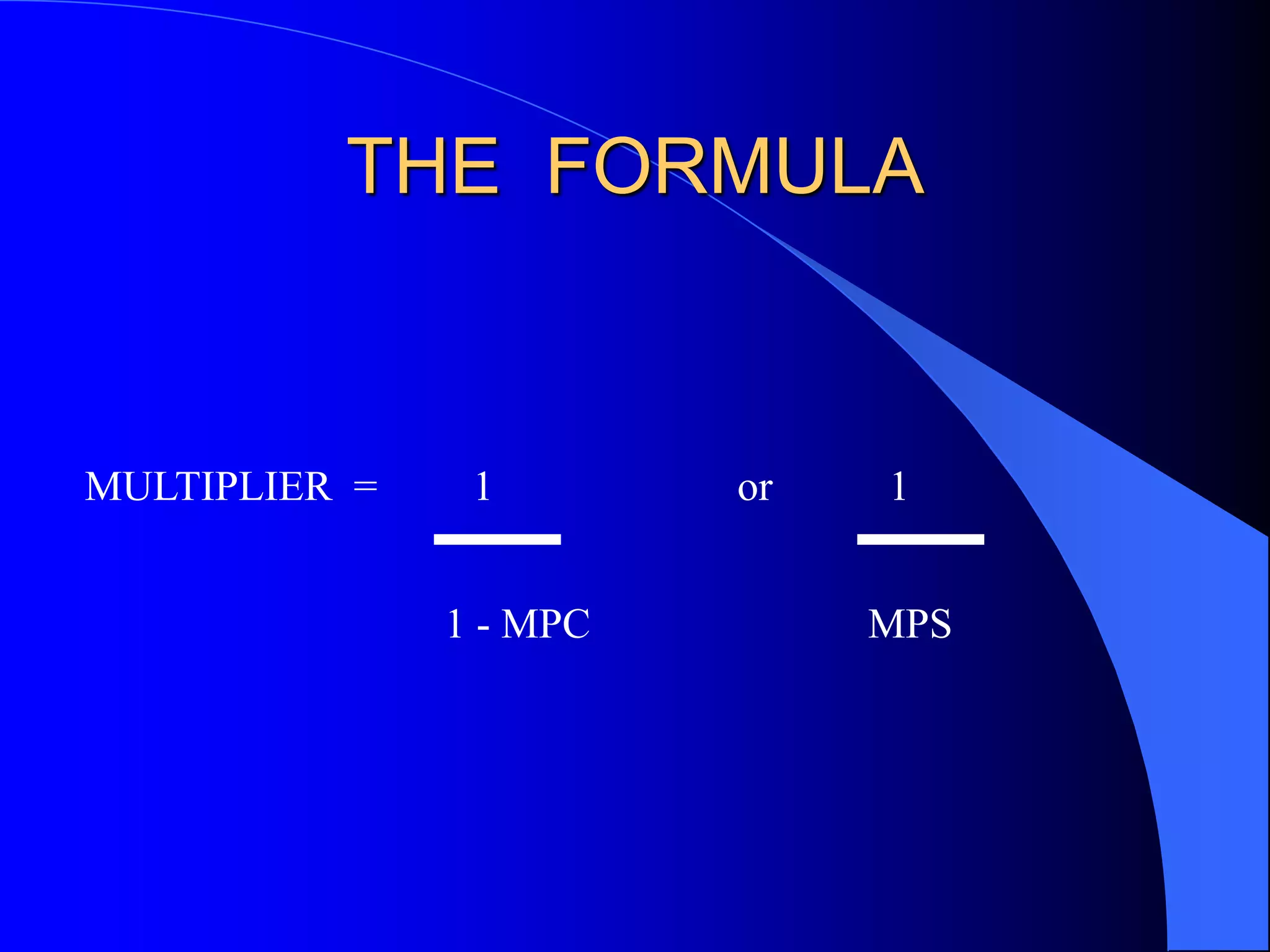

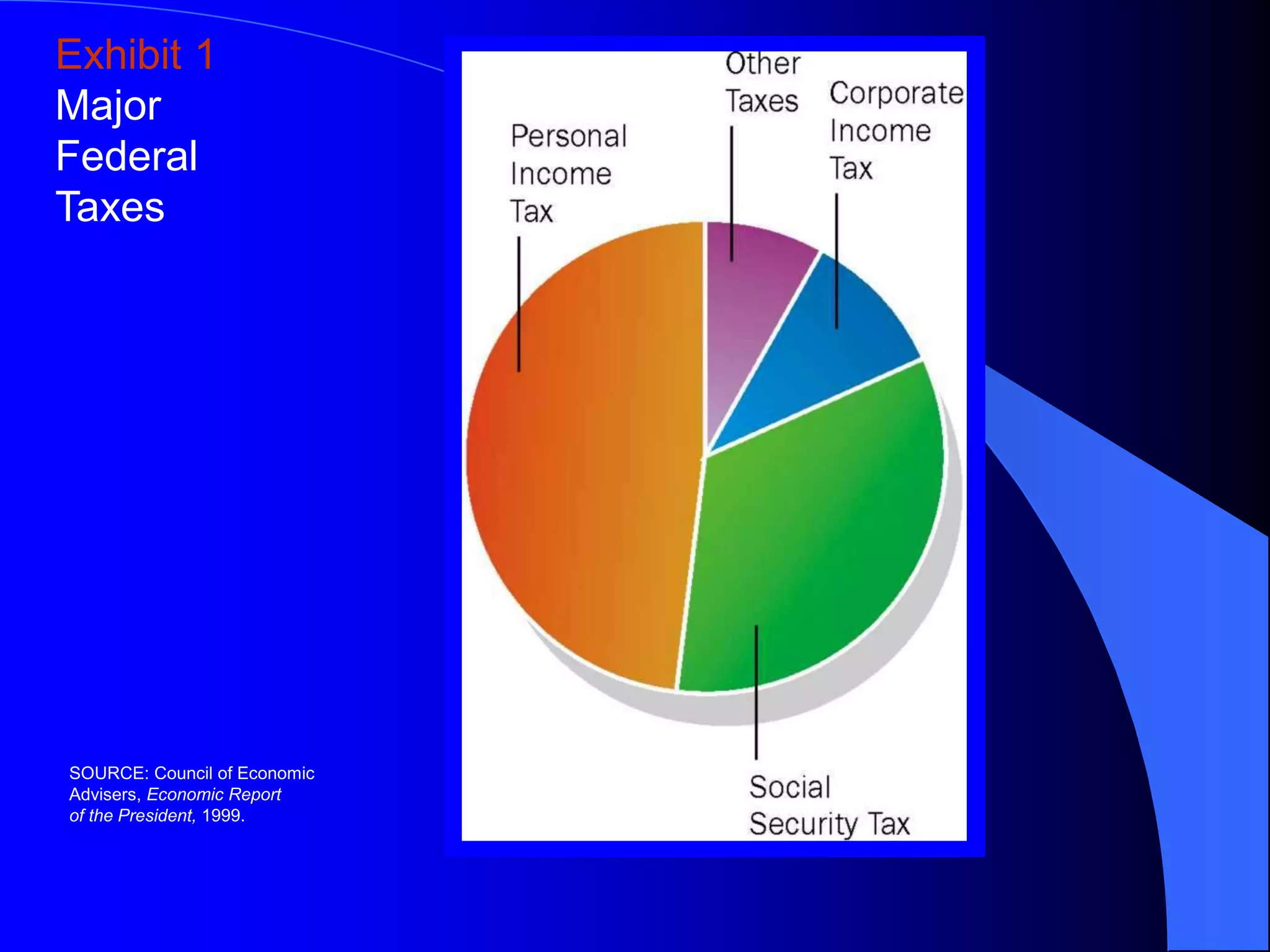

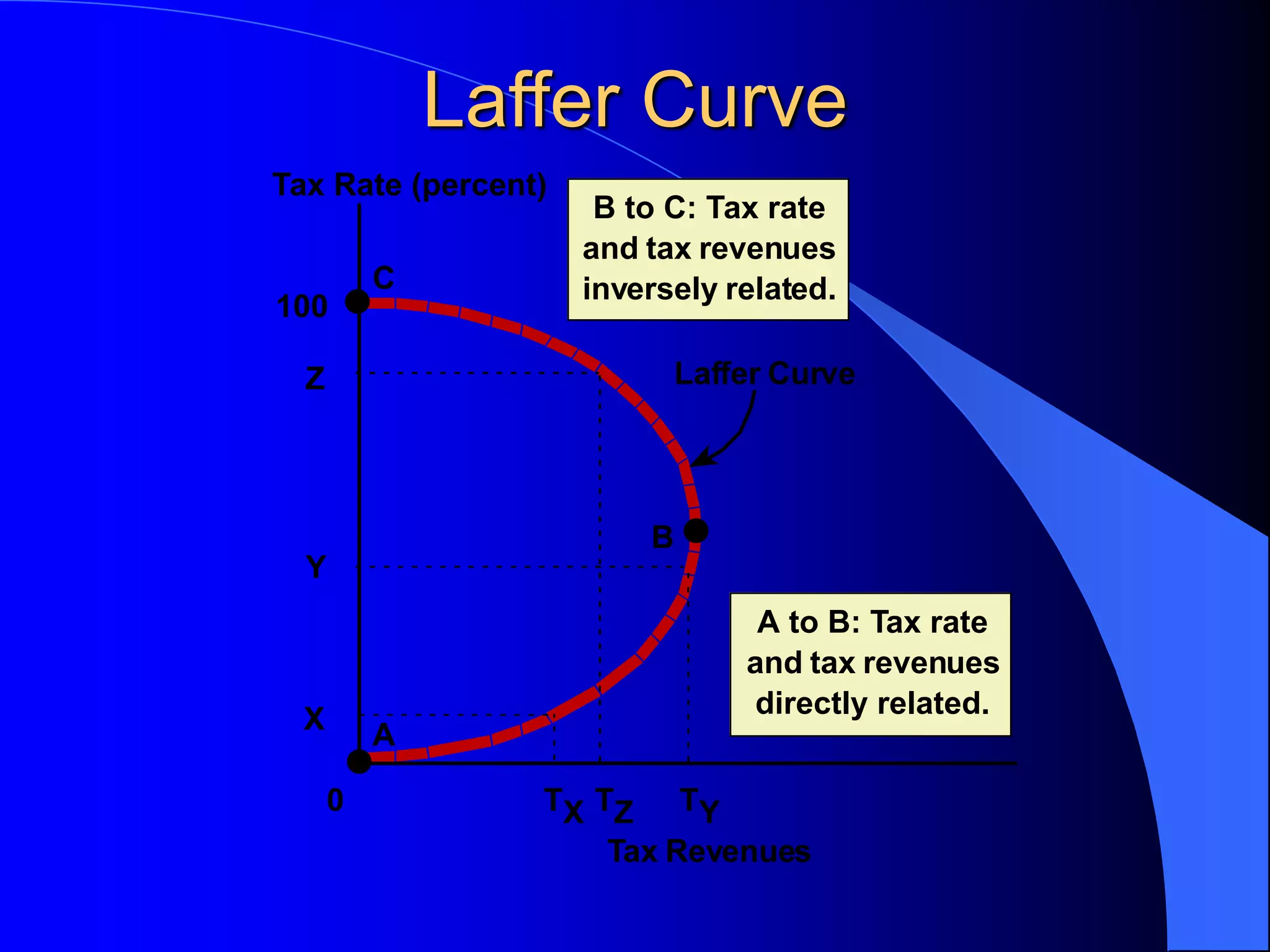

- Fiscal policy tools like government spending and taxes that can be used for stabilization through the multiplier effect

- Challenges of discretionary fiscal policy including lags and potential crowding out of private spending