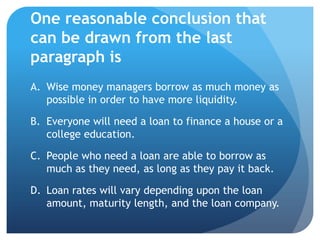

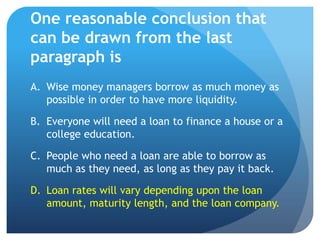

The passage says loans are "typically" needed, not that everyone will need one.

�C. People who need a loan are able to

borrow as much as they need, as long as

they pay it back.

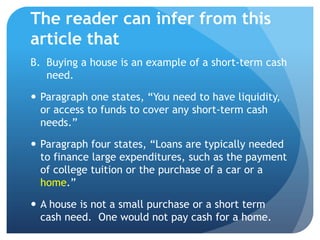

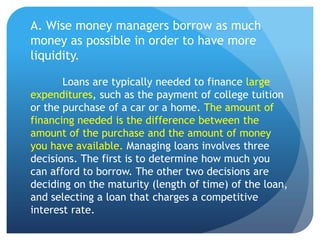

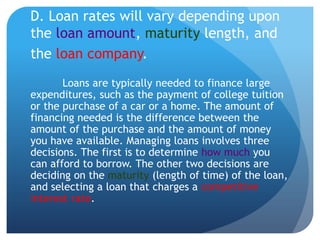

Loans are typically needed to finance large

expenditures, such as the payment of college tuition

or the purchase of a car or a home. The amount of

financing needed is the difference between the

amount of the purchase and the amount of money

you have available. Managing loans involves three

decisions. The first is to determine how much you

can afford to borrow. The other two decisions are

deciding on the maturity (length of time) of the loan,

and selecting a