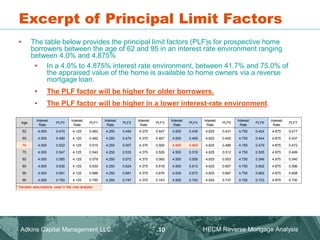

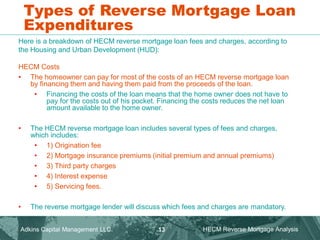

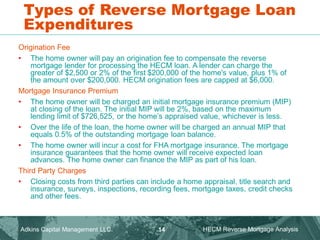

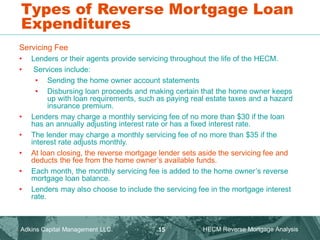

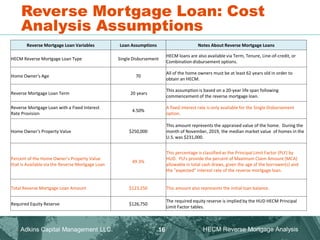

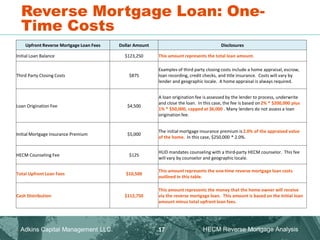

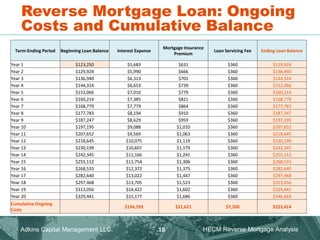

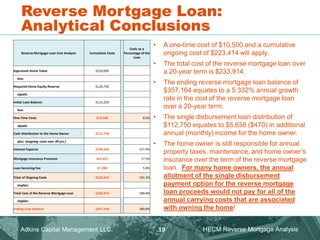

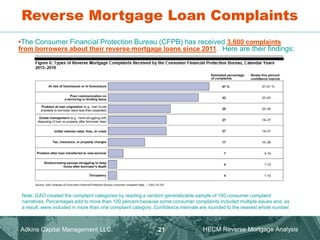

This document provides an overview and analysis of reverse mortgage loans in the United States. It discusses the history and key features of reverse mortgages, including eligibility criteria, loan disbursement options, and how the amount that can be borrowed is determined based on the homeowner's age and interest rates. The document also analyzes the various costs associated with reverse mortgages, such as origination fees, mortgage insurance premiums, interest expense, and servicing fees. It provides examples of how these costs are calculated and can accumulate over the life of the loan.