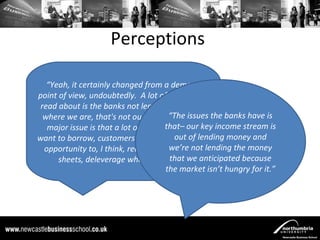

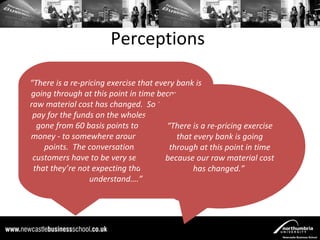

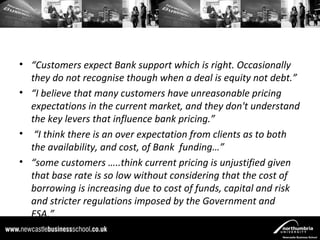

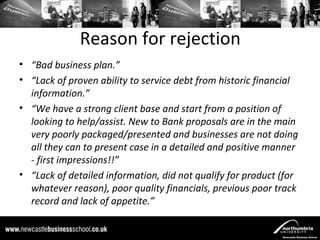

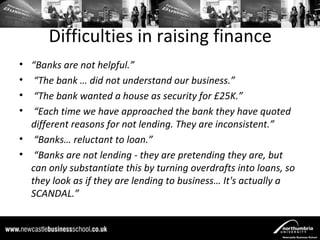

The research investigates the challenges faced by SMEs in securing finance, highlighting that a significant portion struggle to access needed capital due to lack of knowledge and complex processes. Interviews reveal that banks exhibit inconsistent lending practices and reluctance to finance, while SMEs express a desire for better support and clearer information in the funding landscape. The report underscores the need for improved communication and simplification of the financing process to enhance SMEs' success in obtaining funding.

![Guidance and support

“…having somebody who could pull my

application together for me, who knew exactly

“Awareness and communication….

what the funders were asking, who could tell

me that… ‘your business plan saysif there was one place which I

think X - we’re not

changing the business plan but you need to what

know is probably

highlight why’ and that’s what they’re lookingmeant to be –

[organisation] are

but one place could pull all that

for and that was absolutely invaluable.”

together and communicate it out

regularly to the business

community, I think that would be a

massive difference.”](https://image.slidesharecdn.com/jackienea2fpresentation3rdjuly2012-120731165805-phpapp02/85/Jackie-nea2-f-presentation_3rd-july-2012-13-320.jpg)

![Appetite

• “Some sectors have an additional layer of decision-making

within the credit process.”

• “Limited appetite for lending in certain sectors.”

• “Caution is [applied to] certain sectors.”

• “More defined policies and guidelines around many sectors.”

• “We became more conservative.”](https://image.slidesharecdn.com/jackienea2fpresentation3rdjuly2012-120731165805-phpapp02/85/Jackie-nea2-f-presentation_3rd-july-2012-18-320.jpg)