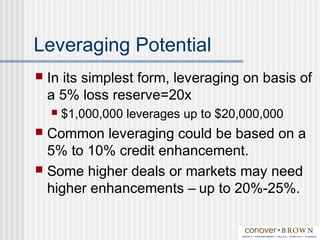

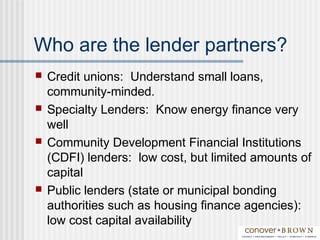

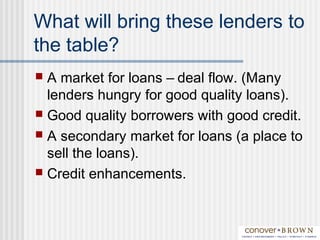

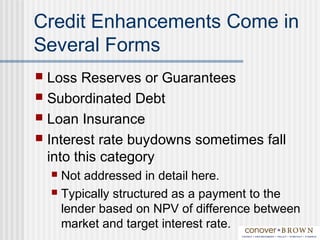

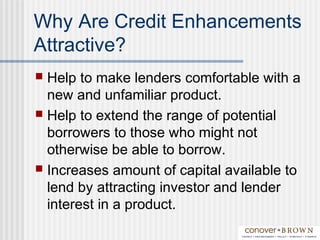

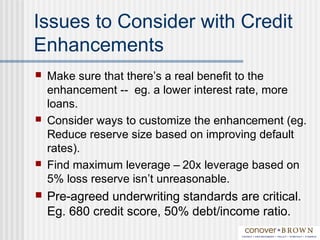

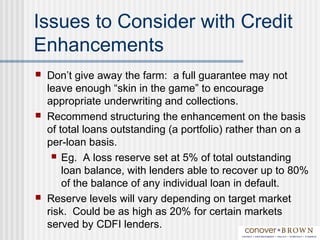

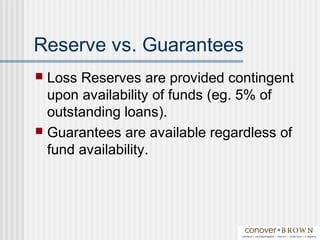

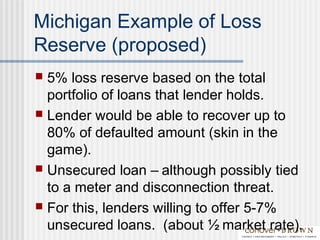

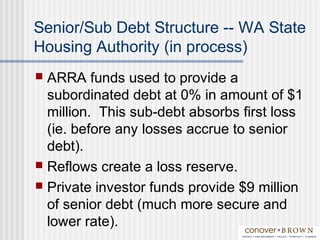

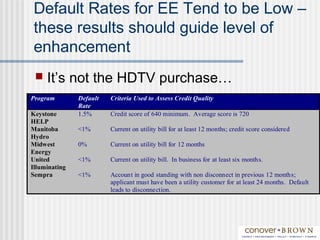

The document discusses financing strategies for energy efficiency projects, emphasizing the need for private investor capital to complement government and utility funding. It highlights the role of credit enhancements in making lenders comfortable with new financing products and extending loan accessibility to a broader range of borrowers. The document also outlines the structure and importance of loss reserves, guarantees, and the potential for leveraging capital in energy finance initiatives.