This document discusses project financing and financial analysis for solar photovoltaic projects. It covers key topics like:

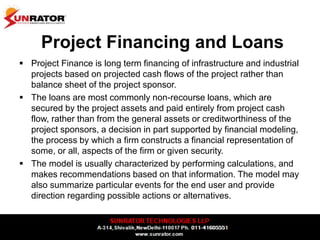

- Project finance through non-recourse loans secured by project assets and paid from cash flows, rather than sponsor balance sheets.

- Financial modeling to construct representations of aspects of the project and make recommendations.

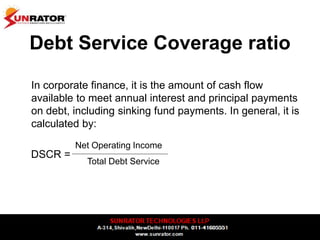

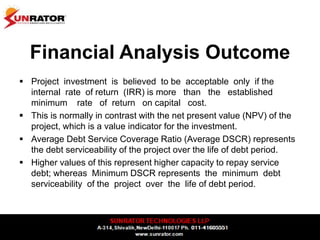

- Key financial indicators used in models like Debt Service Coverage Ratio and Internal Rate of Return.

- How financial models serve purposes like demonstrating market opportunity, business model, path to profitability, investment needs, and facilitating valuation.

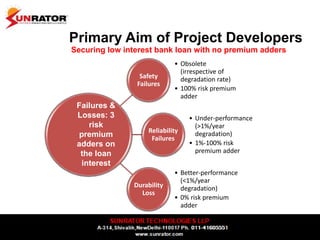

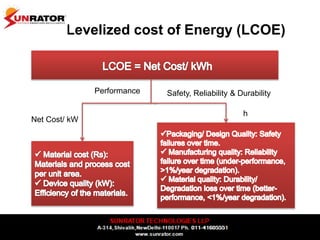

- Primary aims of project developers to secure low interest bank loans without risk premiums added based on project safety, reliability and durability.