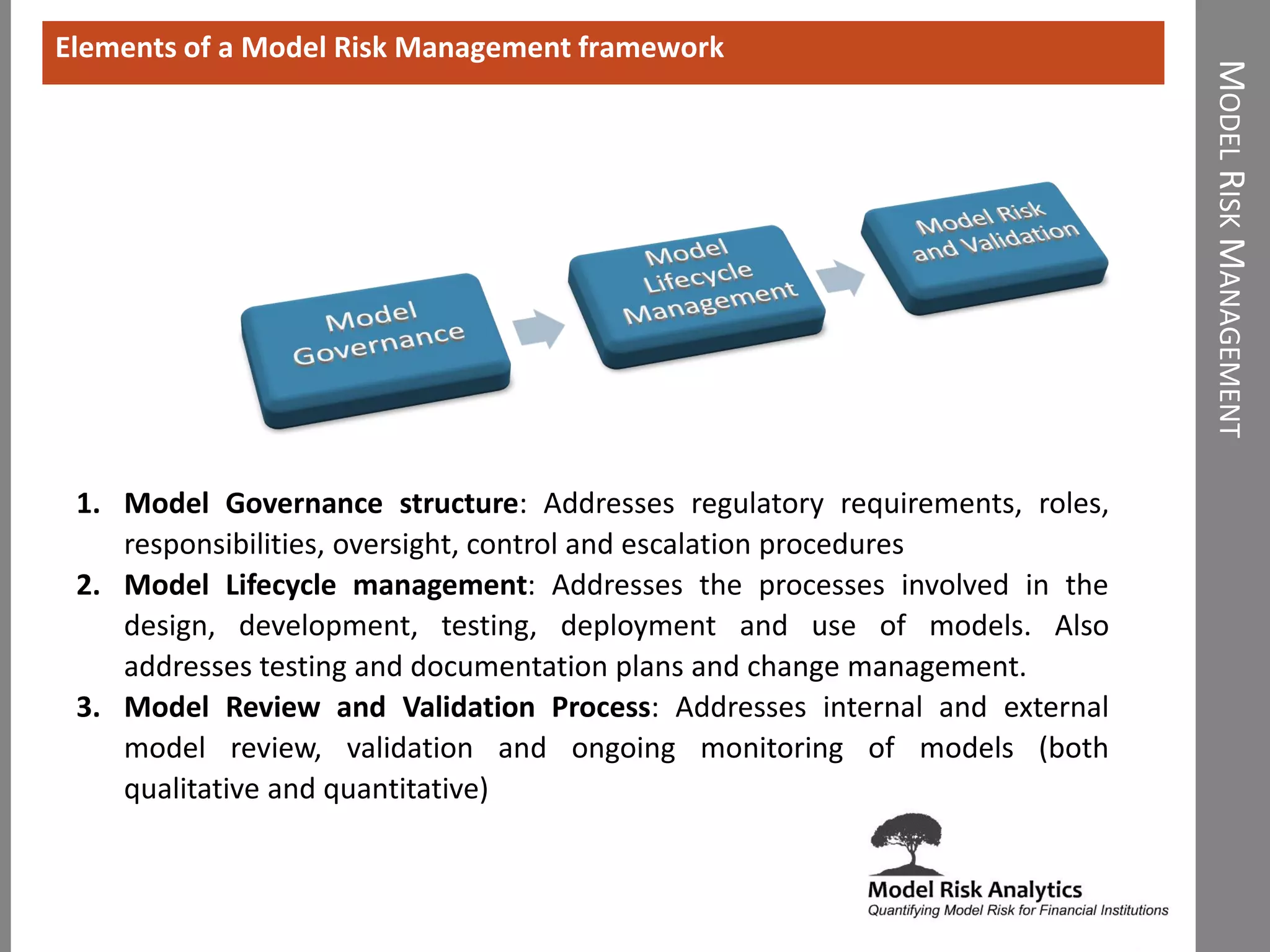

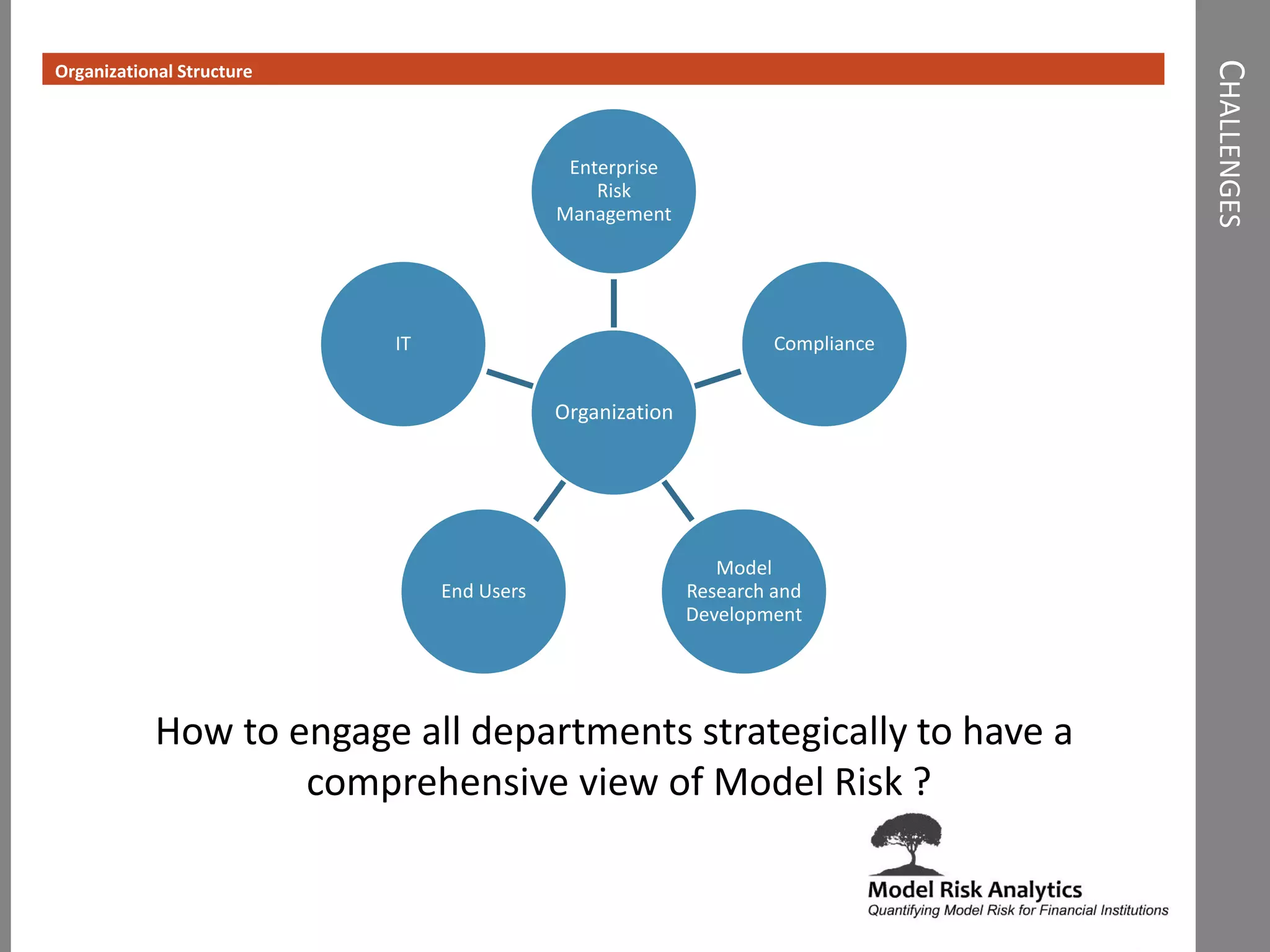

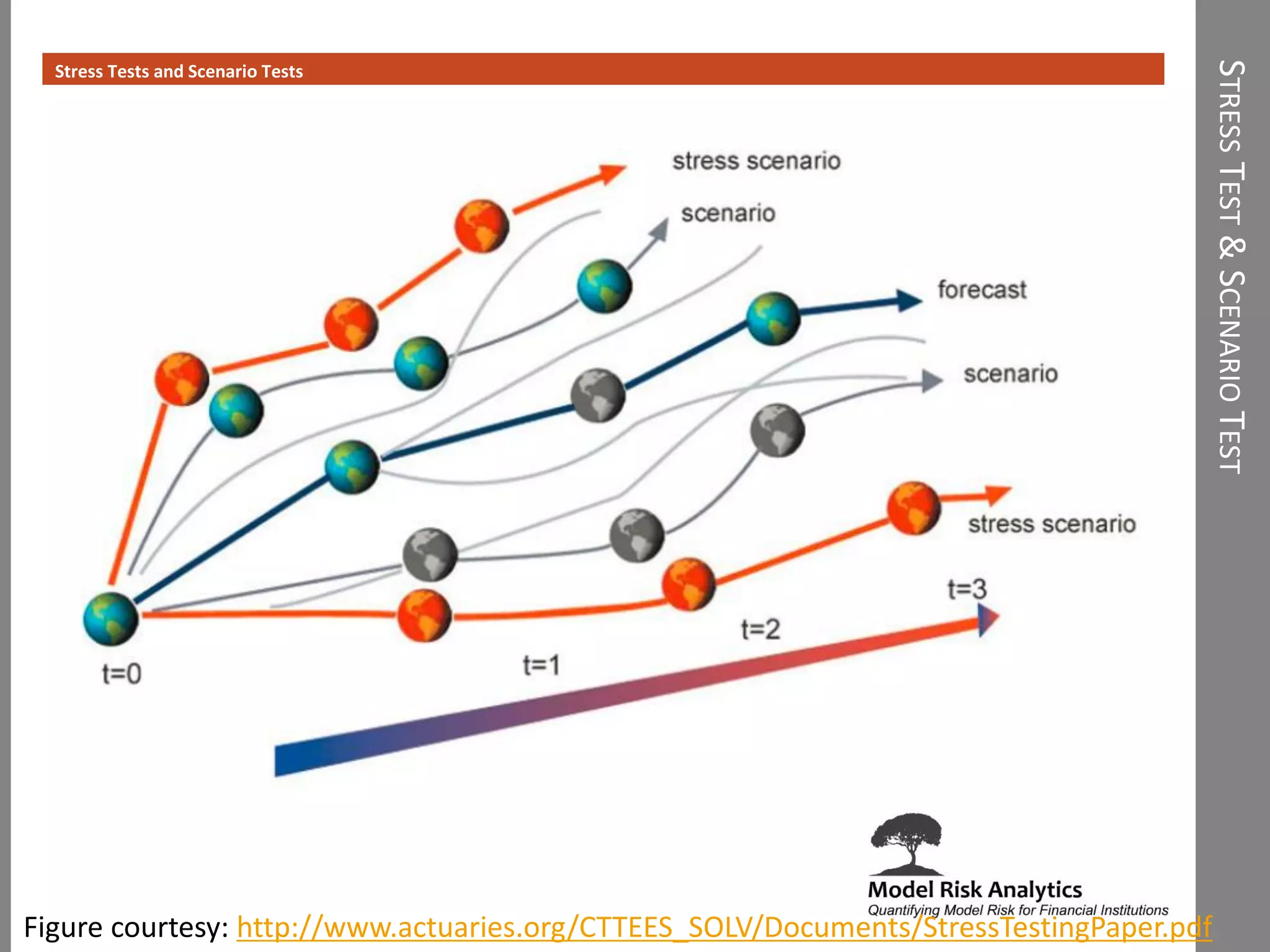

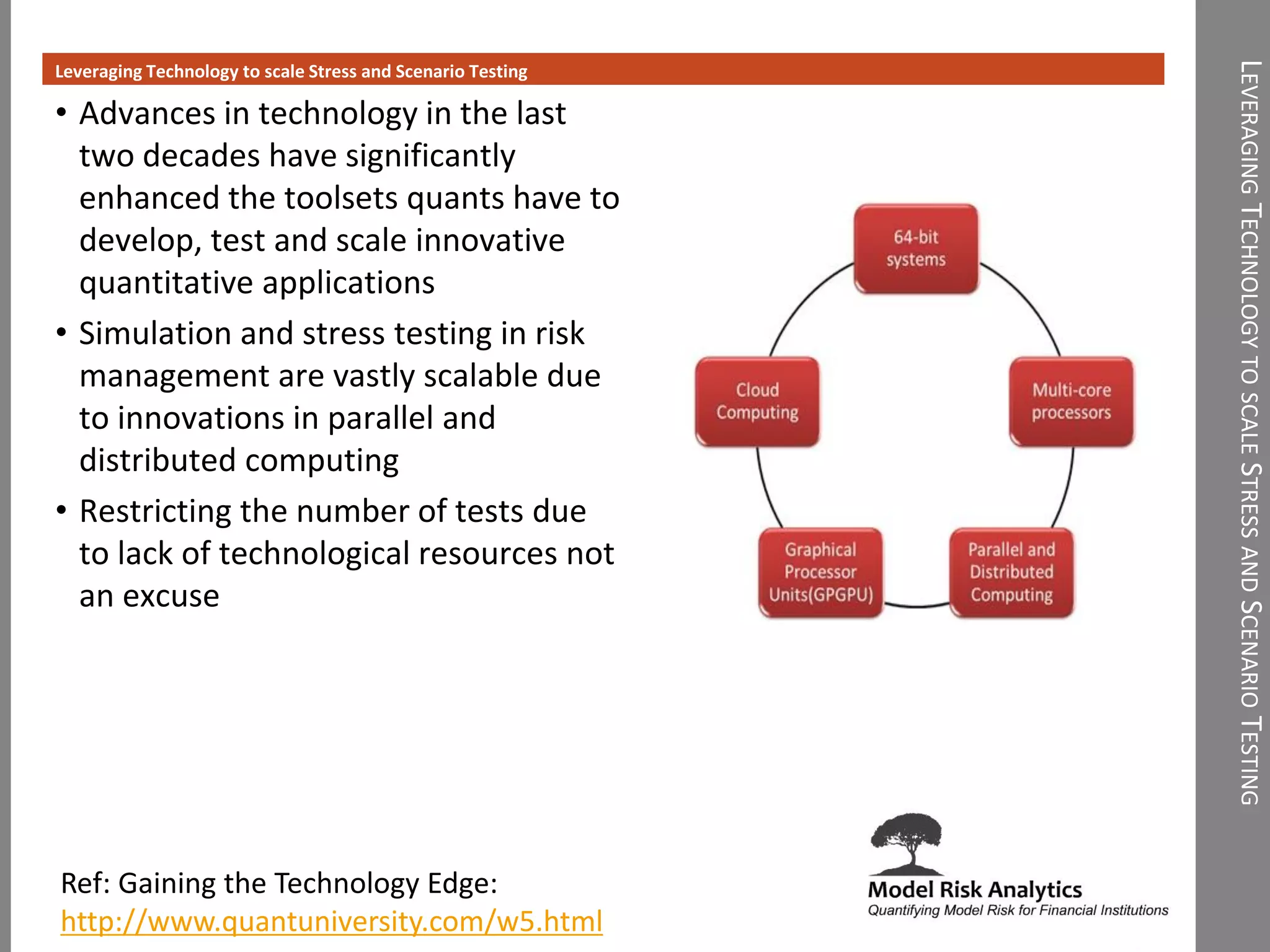

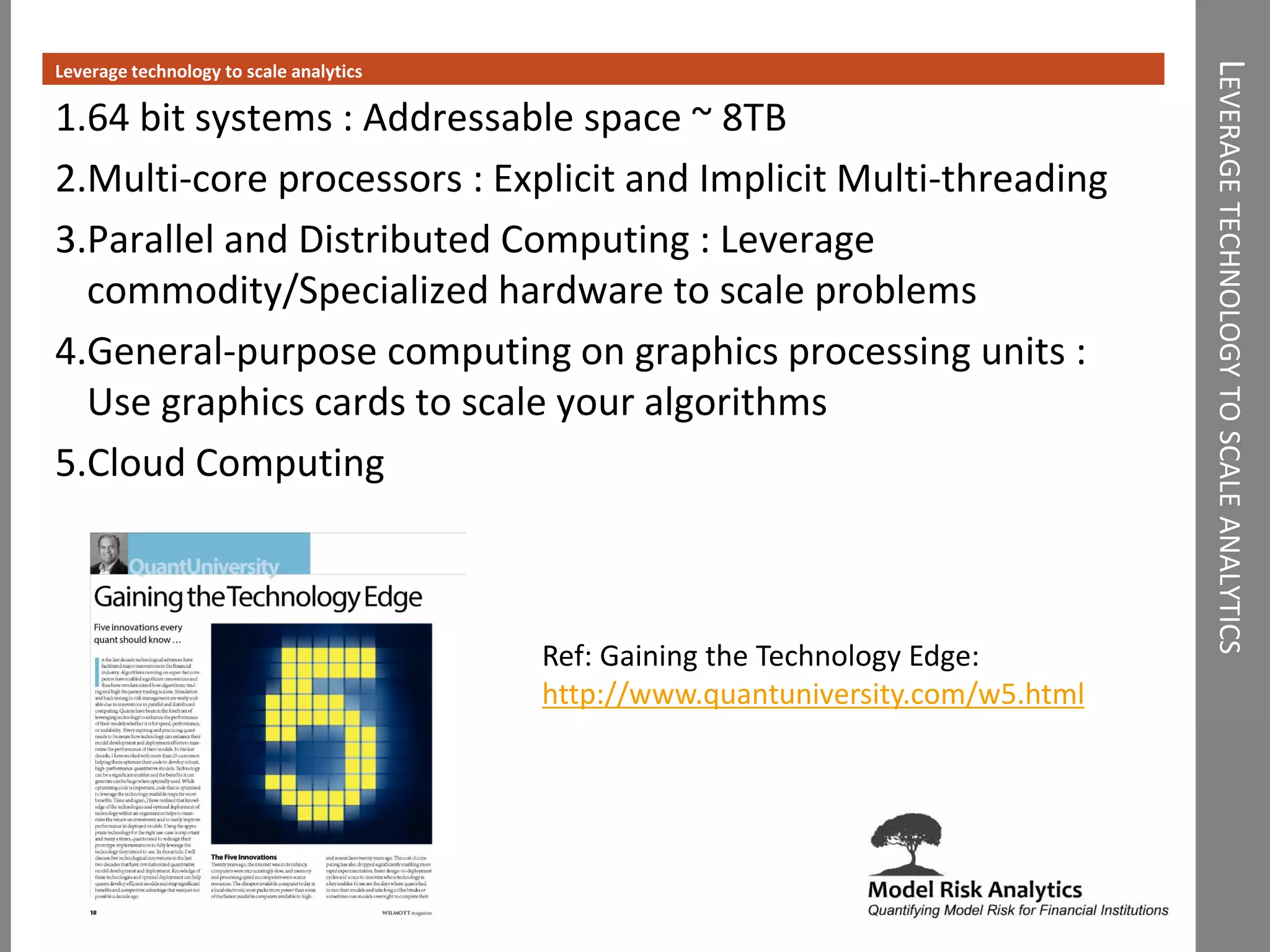

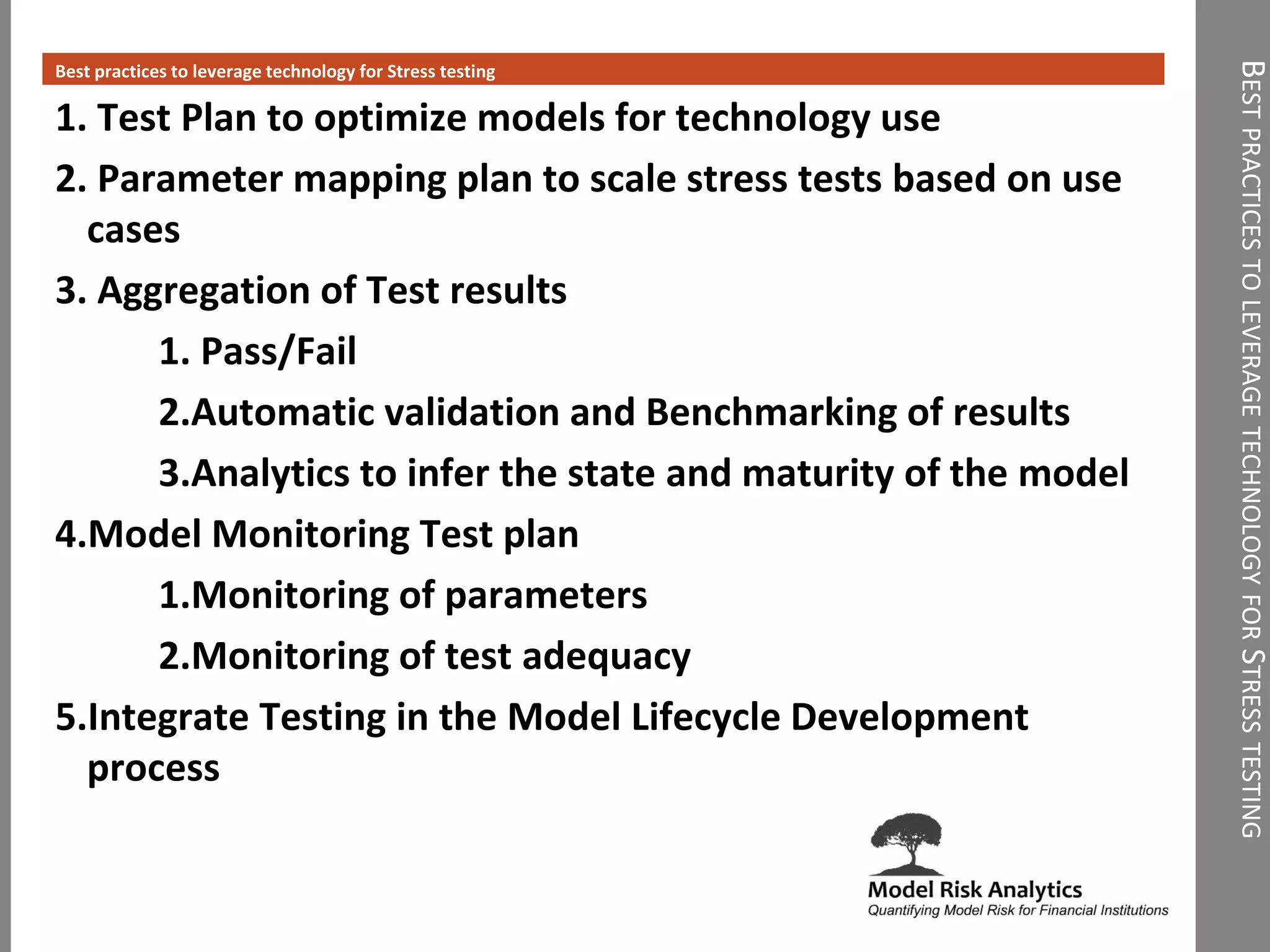

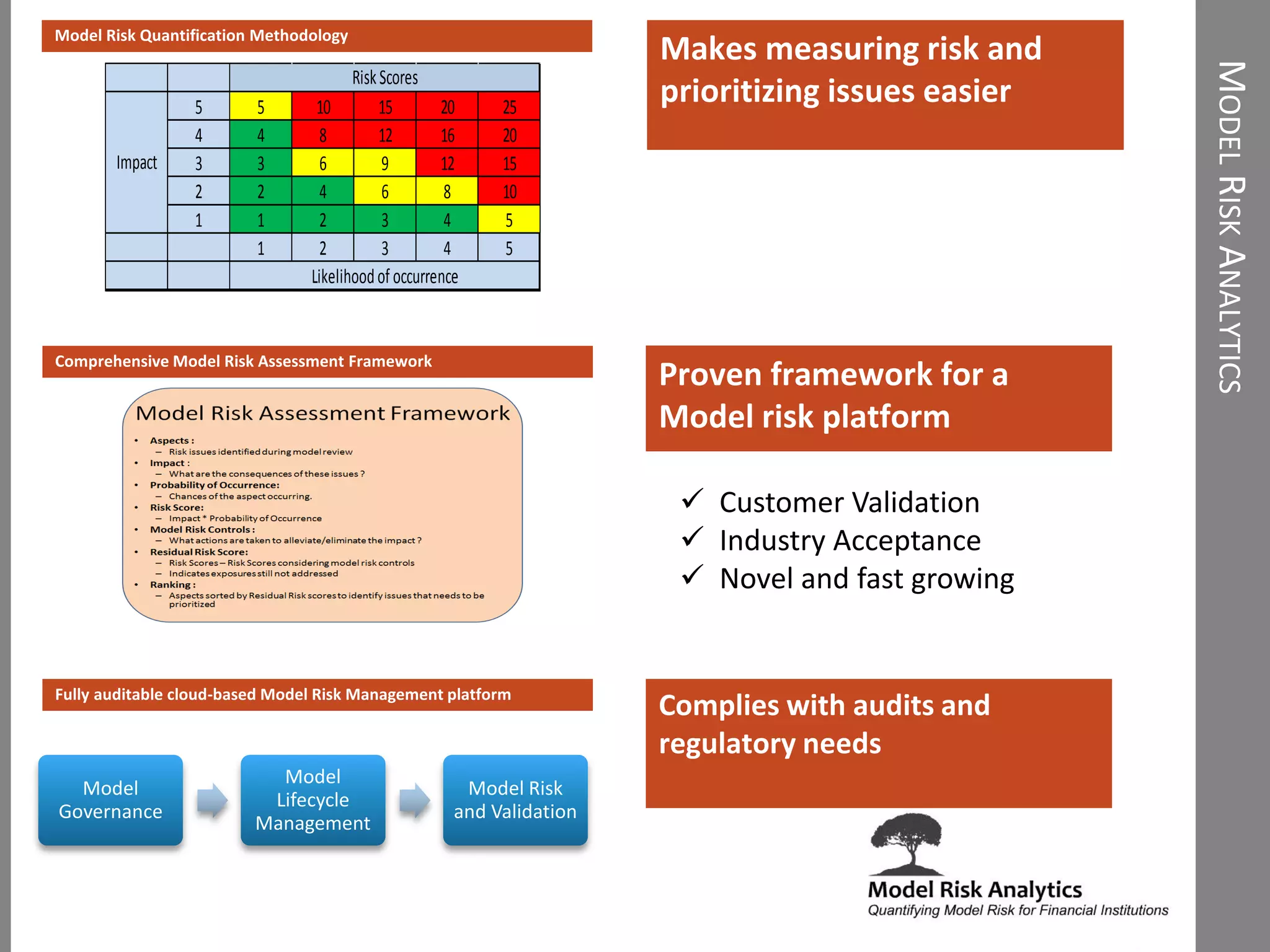

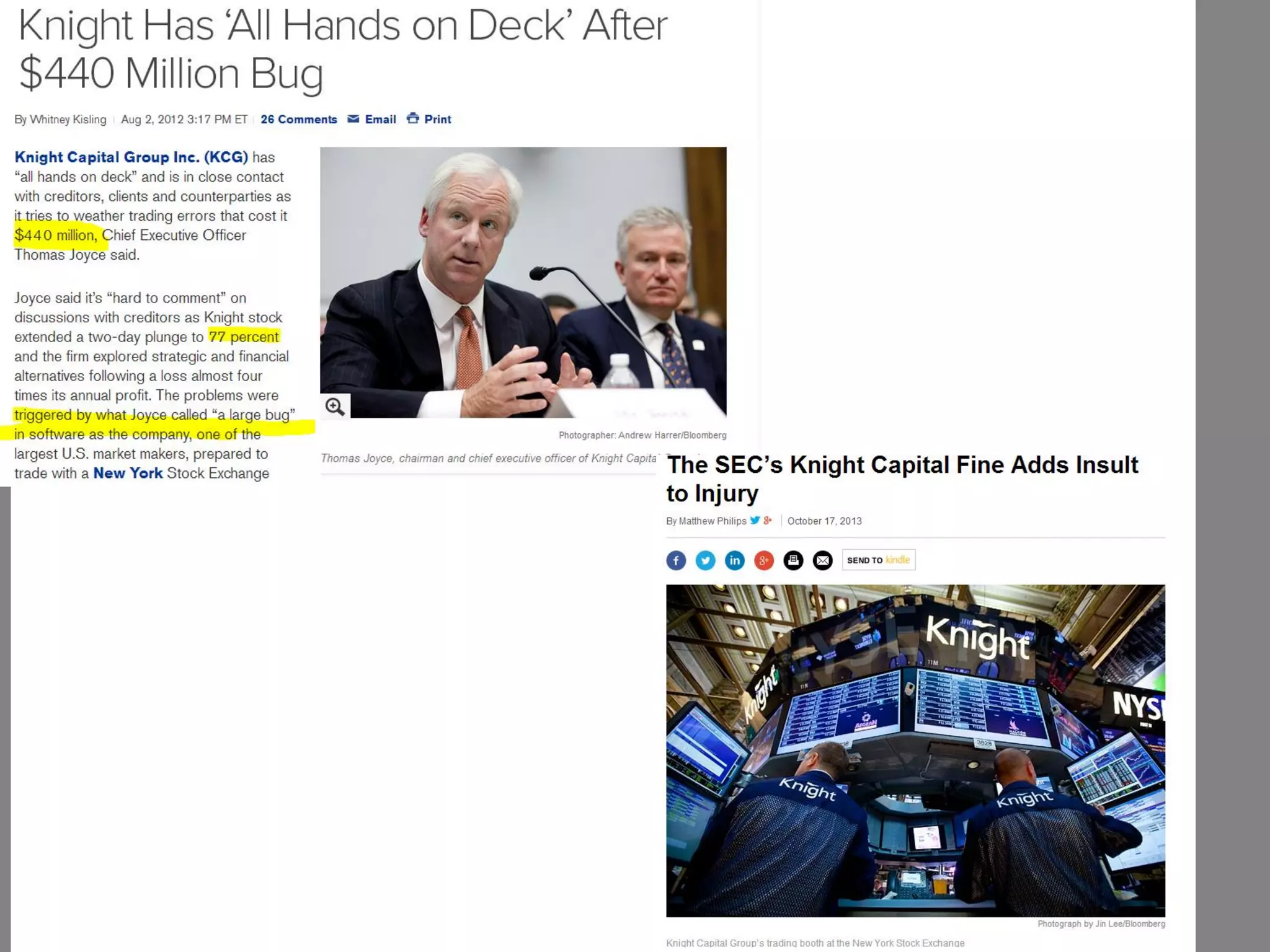

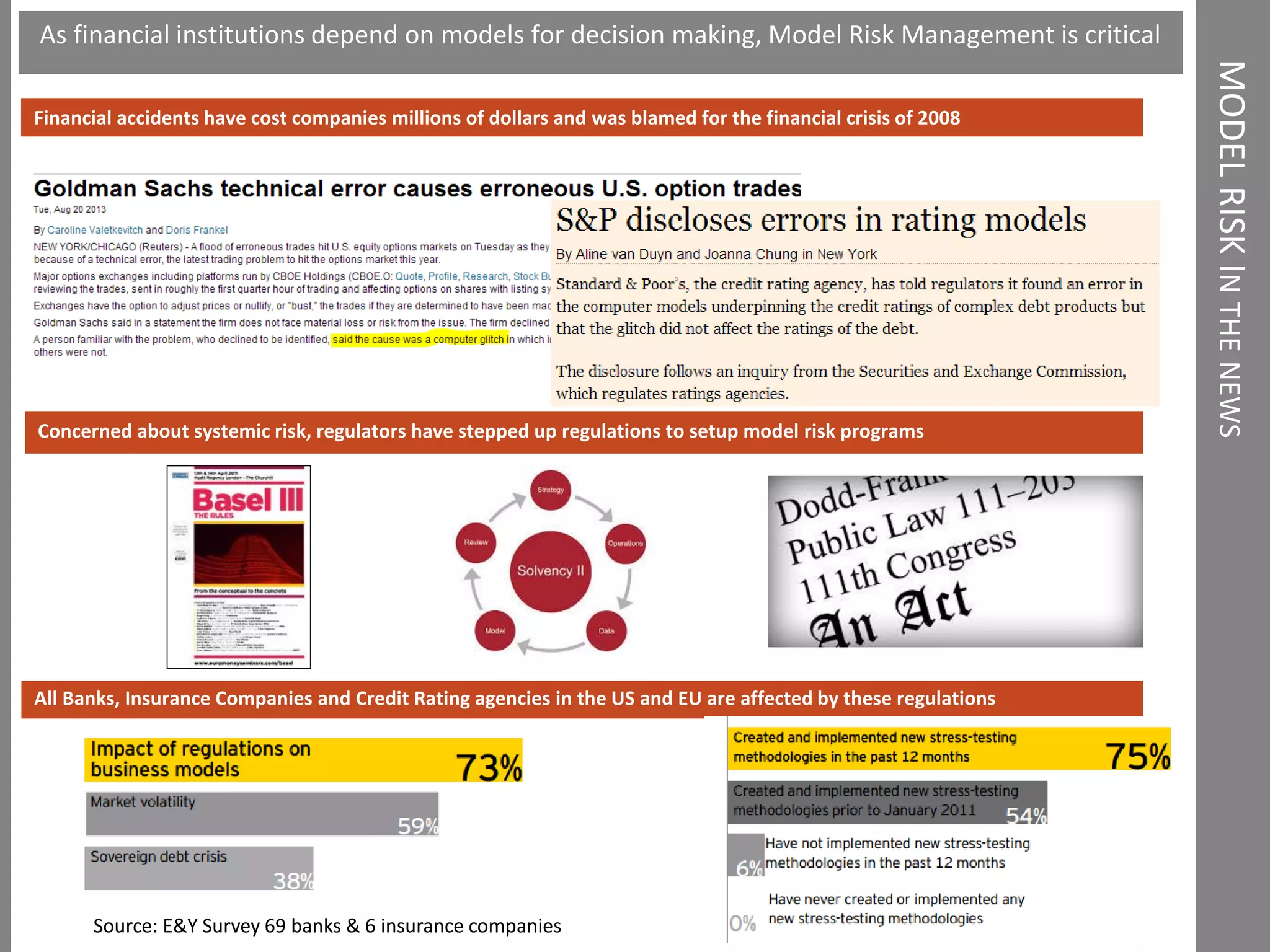

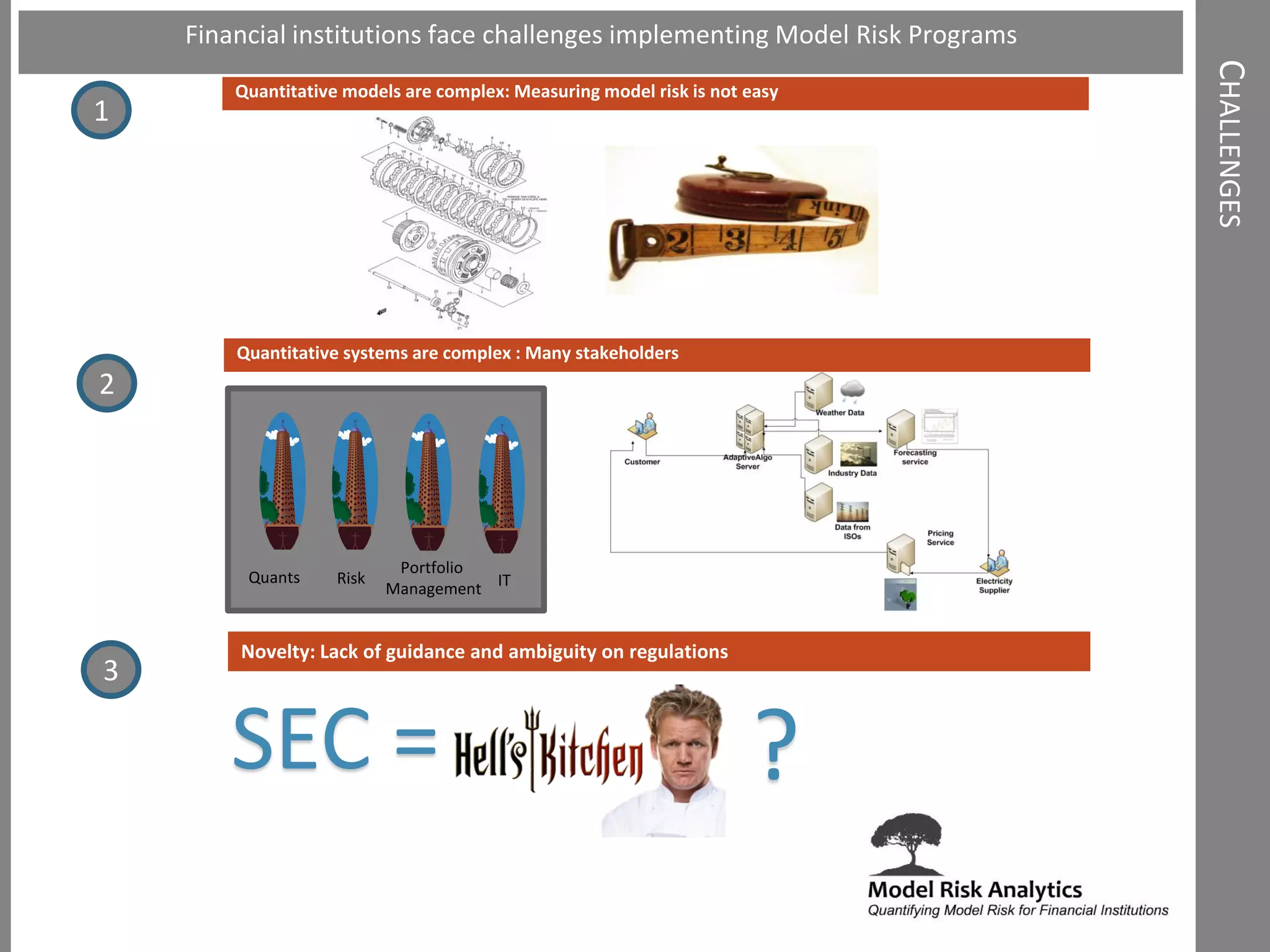

The document presents a framework-driven approach to model risk management in financial institutions, highlighting the importance of effective model governance, lifecycle management, and validation processes. It discusses the challenges faced in quantifying and managing model risk due to complex quantitative systems and regulatory requirements. Additionally, it emphasizes leveraging technology and analytics for stress testing and scenario analysis to enhance model risk management practices.

![MODELRISK

“Model refers to a quantitative method, system, or

approach that applies statistical, economic, financial,

or mathematical theories, techniques, and

assumptions to process input data into quantitative

estimates” [1]

Ref:

[1] . Supervisory Letter SR 11-7 on guidance on Model Risk

Model Risk Defined

Input

Assumptions/Data

Processing

component

Output/

Reporting

component](https://image.slidesharecdn.com/modelriskanalyticsdataanalyticsfinancialpresentationjuly222014-share-140722181326-phpapp01/75/A-Framework-Driven-Approach-to-Model-Risk-Management-www-dataanalyticsfinancial-com-10-2048.jpg)

![MODELVALIDATION

“Model risk is the potential for adverse

consequences from decisions based on incorrect or

misused model outputs and reports. “ [1]

“Model validation is the set of processes and activities

intended to verify that models are performing as

expected, in line with their design objectives and

business uses. ” [1]

Ref:

[1] . Supervisory Letter SR 11-7 on guidance on Model Risk

Model Risk and Validation Defined](https://image.slidesharecdn.com/modelriskanalyticsdataanalyticsfinancialpresentationjuly222014-share-140722181326-phpapp01/75/A-Framework-Driven-Approach-to-Model-Risk-Management-www-dataanalyticsfinancial-com-11-2048.jpg)