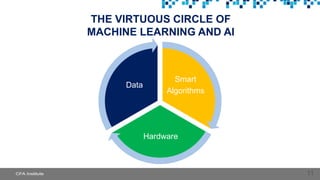

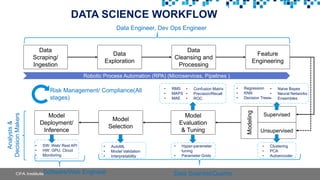

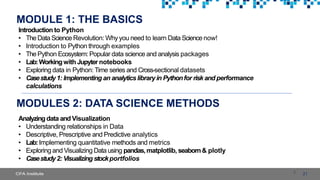

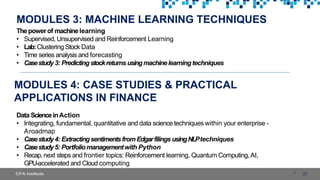

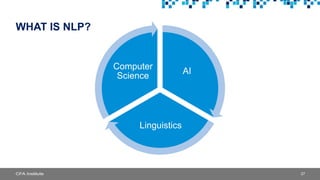

The document details an information session on the 'Python and Data Science for Investment Professionals' program offered by CFA Institute, focusing on key concepts needed to utilize Python for financial data analysis. It covers topics such as the growing importance of data science, machine learning applications in finance, and practical case studies on analyzing financial datasets. The program provides a structured online learning experience, inclusive of hands-on labs and case studies, and is designed for financial professionals seeking to enhance their data science skills.