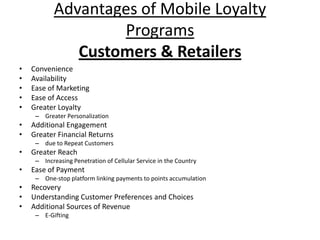

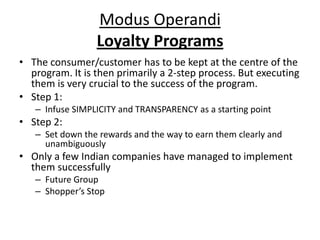

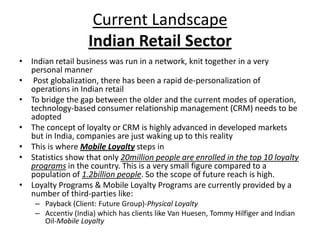

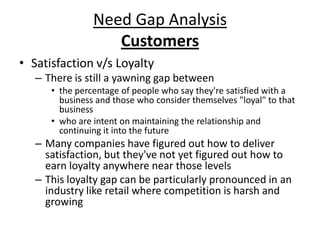

Mobile loyalty programs have advantages for both customers and retailers. For customers, mobile loyalty apps allow them to track rewards progress, redeem rewards, get coupons, and check-in at stores. For retailers, mobile loyalty programs build customer loyalty, increase brand value, understand customer purchase behavior, and aid financial well-being by identifying important customers. However, there are still needs around strengthening IT infrastructure in Indian retail, improving customer authentication methods, and creating simpler interfaces for mobile loyalty programs. Addressing these gaps could help bridge the gap between customer satisfaction and loyalty.