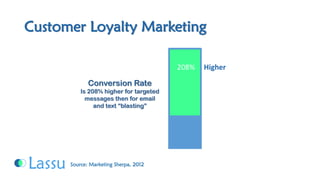

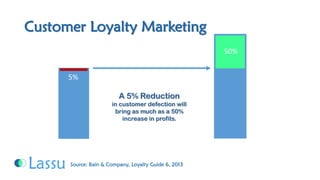

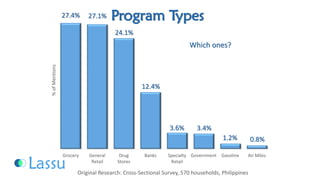

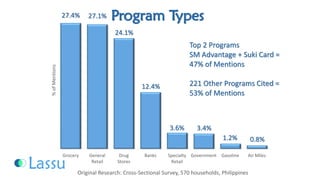

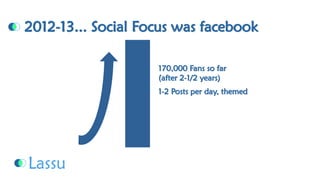

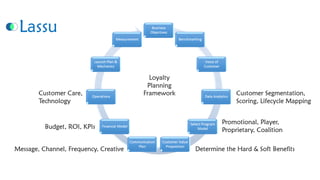

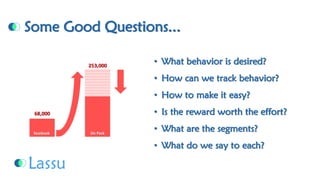

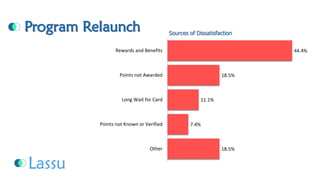

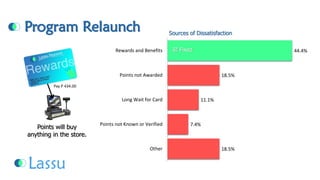

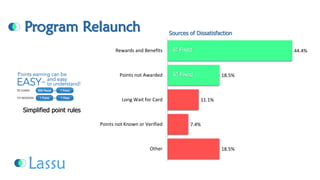

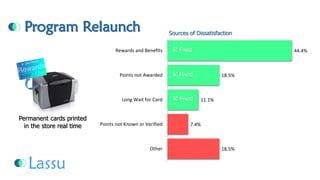

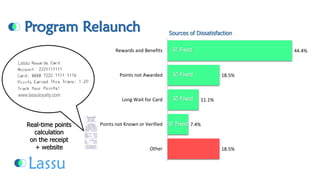

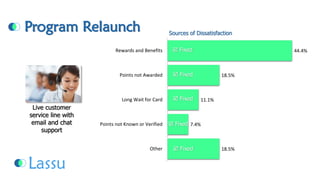

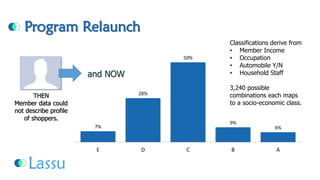

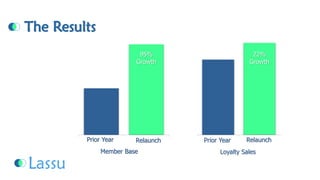

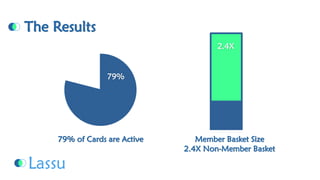

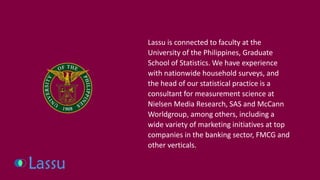

The document discusses customer loyalty marketing through analogies to the story of the three little pigs, illustrating various marketing leader approaches to loyalty programs. It highlights best practices, the importance of data integration for targeted communications, and the growing necessity of effective loyalty strategies in competitive markets. Additionally, it outlines survey results, challenges faced by loyalty managers, and the potential profitability of improved customer retention efforts.