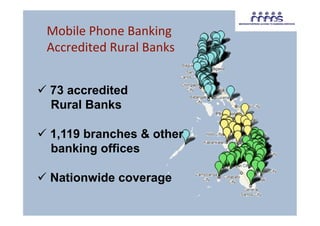

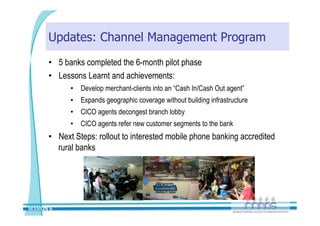

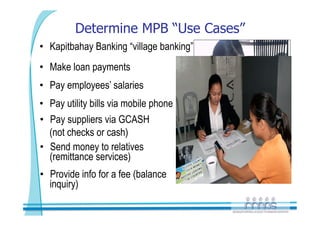

The document outlines updates from the mobile banking sector shared during the RBAP-MABS conference in November 2011, highlighting the growth in mobile banking adoption among rural banks in the Philippines, including over 297,000 clients and significant transaction volumes. It discusses training sessions for accreditation in mobile banking and the successful completion of a channel management program that helps banks expand capabilities through agent partnerships. Furthermore, it emphasizes the importance of financial education initiatives aimed at enhancing understanding and usage of mobile banking services among clients.