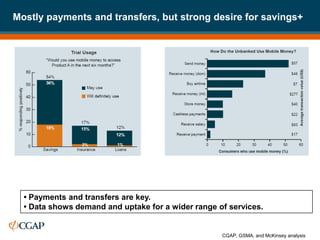

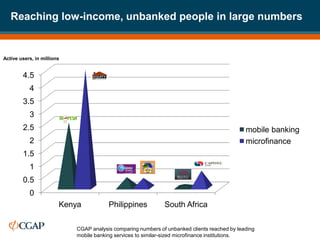

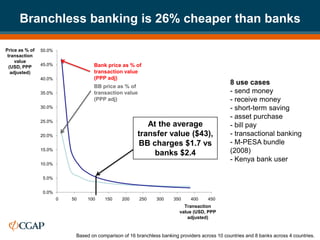

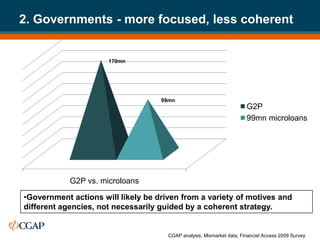

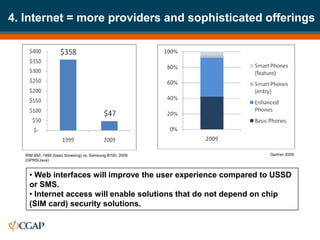

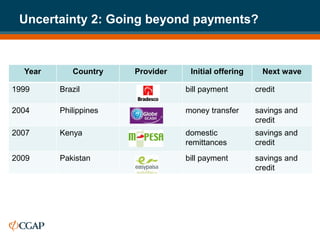

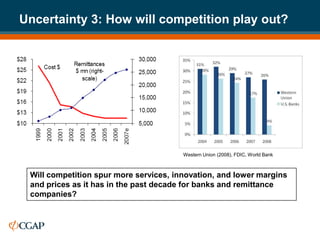

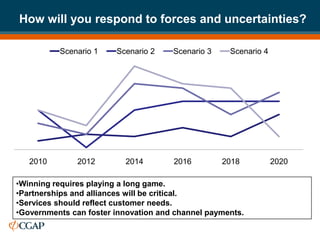

CGAP is a global project that works on expanding access to financial services for poor people in developing countries. It has 12 active projects in 9 countries focusing on mobile banking adoption among low-income users. CGAP's analysis shows that mobile banking has reached millions more customers than similar microfinance programs in some countries. While payments and transfers are popular, there is demand for savings and other services as well. The future of mobile banking will depend on uncertainties around regulations, the types of services offered, competition, and how failures could impact consumer trust.