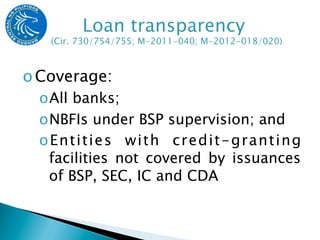

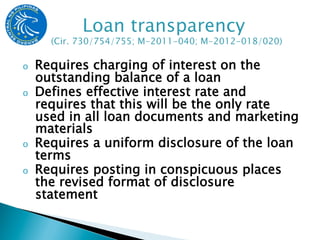

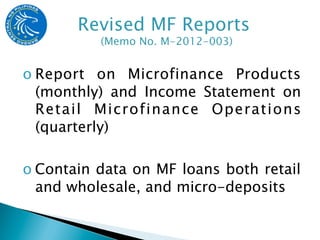

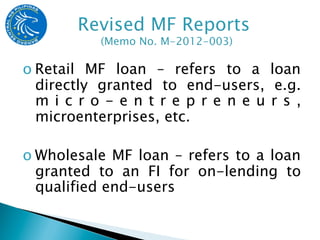

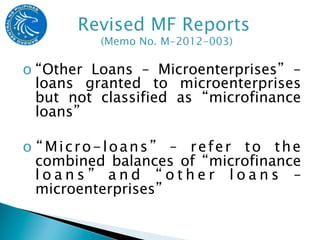

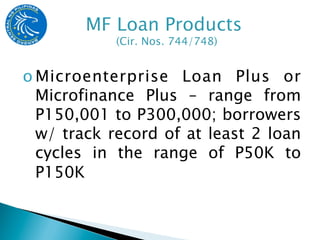

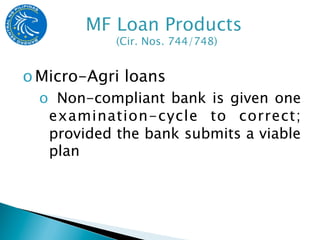

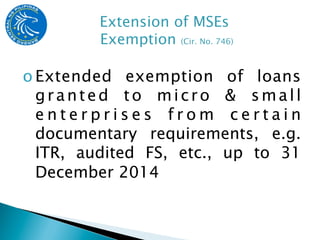

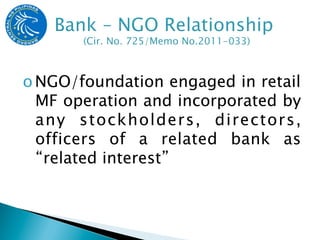

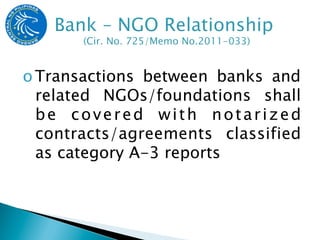

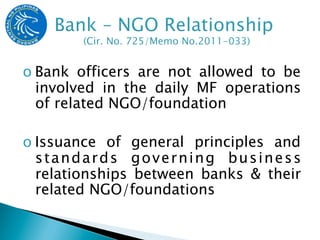

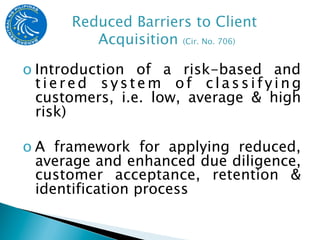

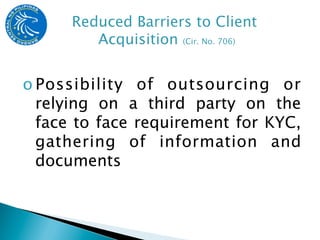

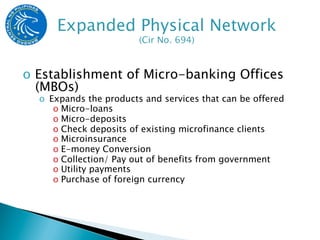

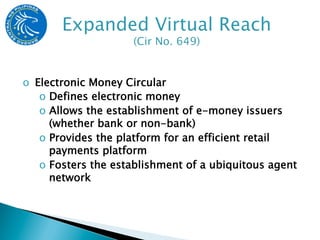

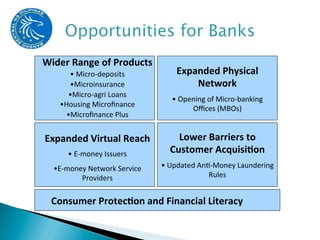

The document outlines updates on price transparency and microfinance regulations presented by Gerardo Butardo from Bangko Sentral ng Pilipinas at a national roundtable conference in June 2012. Key points include the requirement for transparent loan terms, revised microfinance reporting, and the establishment of micro-banking offices to expand services. It also discusses regulatory changes regarding relationships between banks and NGOs, customer risk classification, and the introduction of electronic money systems.