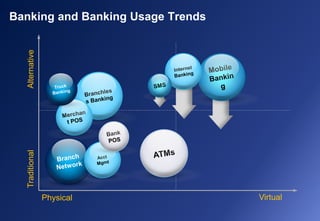

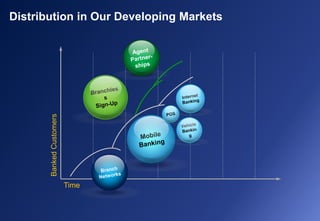

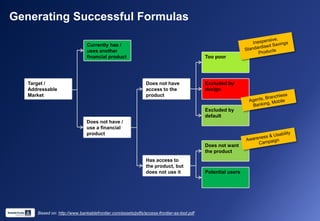

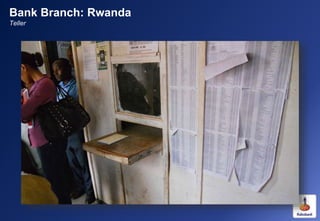

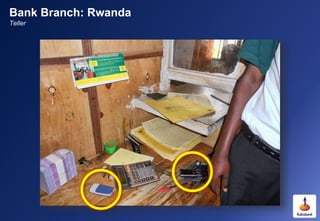

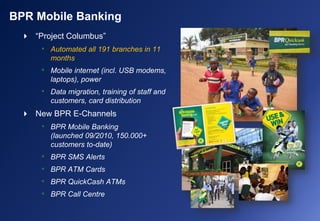

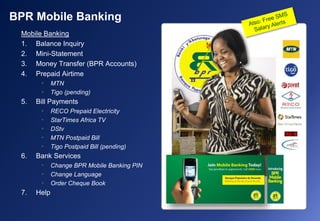

Rabo Development is using mobile and branchless banking models to expand access to financial services in sub-Saharan Africa. They have launched several successful mobile banking programs through their partner banks in countries like Zambia, Malawi, Tanzania, and Rwanda. These programs allow customers to access services like balance checks, money transfers, bill payments, and prepaid services directly from their mobile phones without needing to visit a traditional bank branch. For example, in Rwanda, Rabo Development helped automate all 191 branches of the largest bank, BPR, and launch a mobile banking program that now has over 150,000 customers.