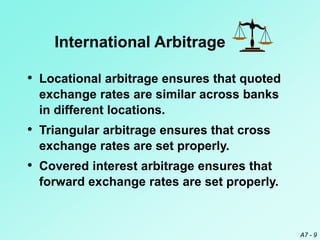

This chapter discusses international arbitrage opportunities that arise when exchange rates are not in equilibrium across locations or when interest rates create arbitrage possibilities. It defines three types of arbitrage: locational, triangular, and covered interest. Interest rate parity (IRP) explains how covered interest arbitrage forces the forward exchange rate to offset interest rate differences. IRP holds in practice although deviations can occur due to transaction costs, political risk, and tax differences. The chapter also reviews how arbitrage affects multinational corporations' values.

![A7 - 12

Derivation of IRP

• When IRP exists, the rate of return

achieved from covered interest arbitrage

should equal the rate of return available in

the home country.

• End-value of a $1 investment in covered

interest arbitrage = (1/S)(1+iF)F

= (1/S)(1+iF)[S(1+p)]

= (1+iF)(1+p)

where p is the forward premium.](https://image.slidesharecdn.com/basic07-200320045308/85/MKI_Basic07-12-320.jpg)