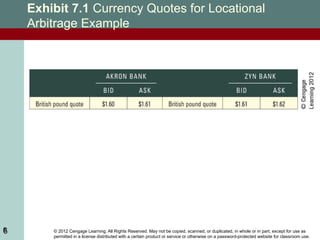

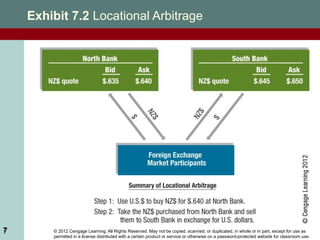

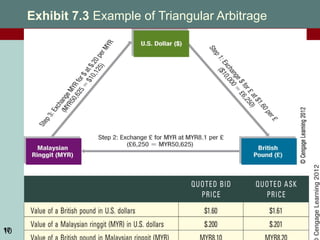

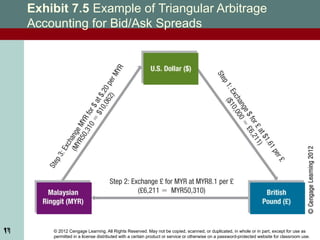

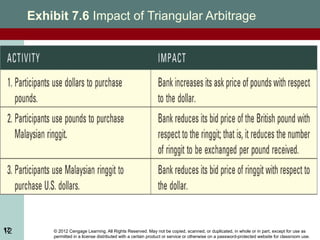

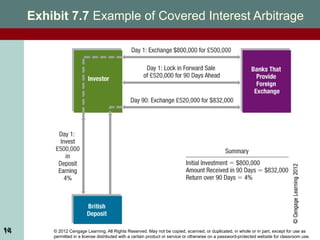

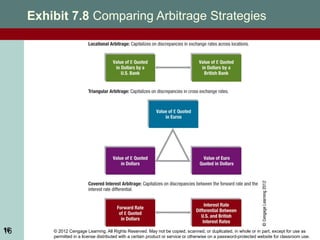

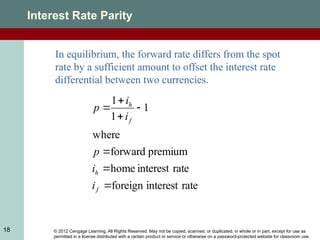

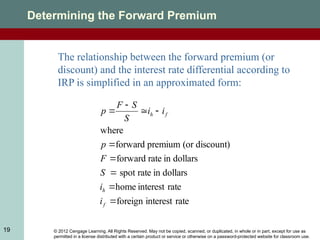

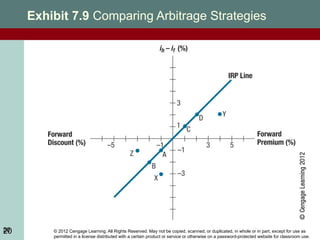

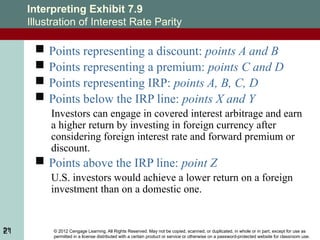

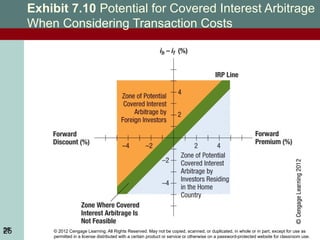

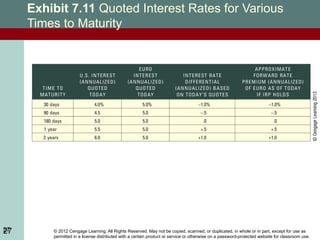

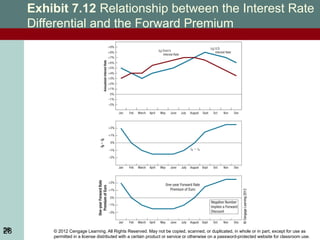

The document discusses international arbitrage and interest rate parity, detailing how capitalizing on discrepancies in foreign exchange markets can yield risk-free profits. It outlines the three forms of arbitrage: locational, triangular, and covered interest arbitrage, illustrating how each affects foreign exchange pricing. Additionally, the document explains the relationship between forward rates and interest rate differentials, emphasizing the importance of realignment in the market.