Embed presentation

Download as ODP, PPTX

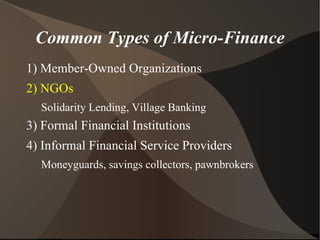

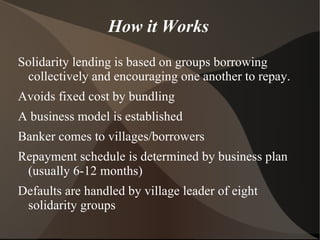

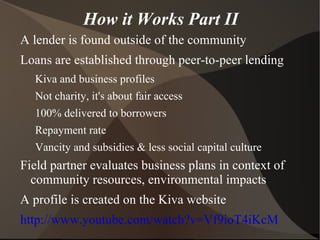

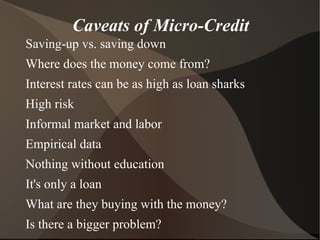

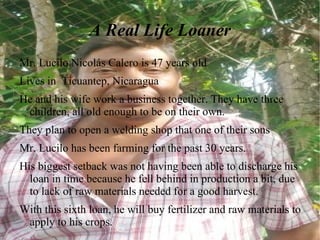

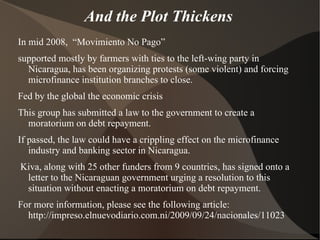

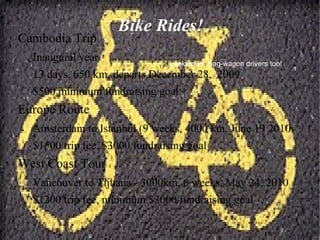

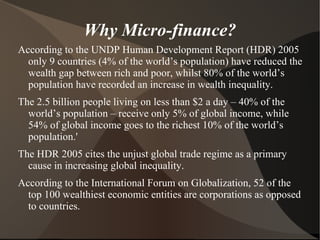

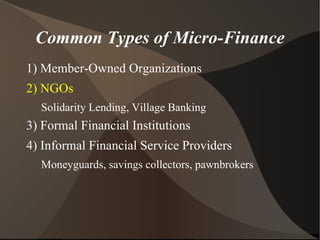

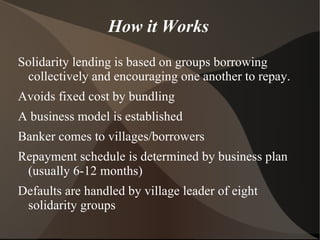

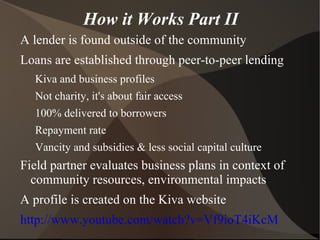

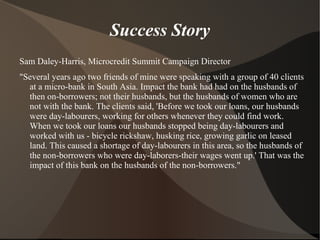

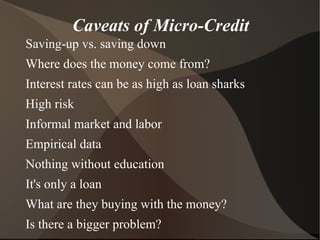

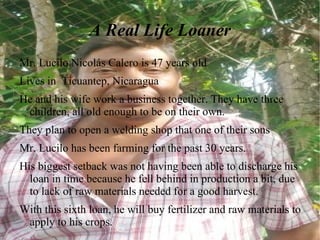

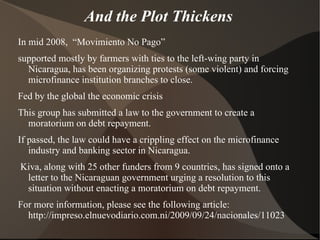

Micro-finance provides small loans and other financial services to low-income individuals who do not have access to traditional banking services. It has helped many people start small businesses and increase their incomes. However, some argue that interest rates on micro-loans are sometimes too high and micro-finance does not address the underlying structural causes of poverty. The document discusses different models of micro-finance organizations and provides examples of how micro-loans have helped individuals and families in developing countries.