Embed presentation

Downloaded 53 times

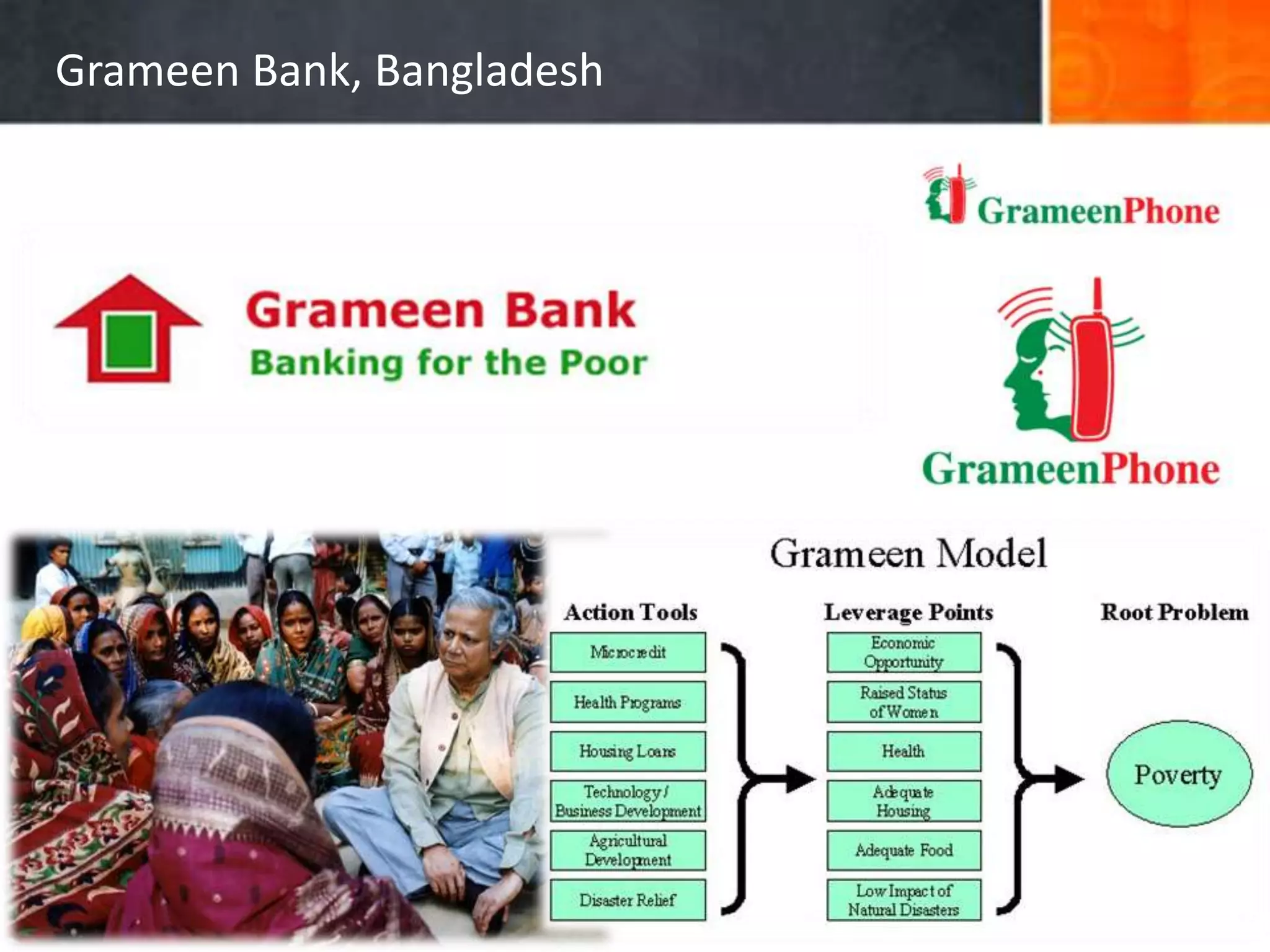

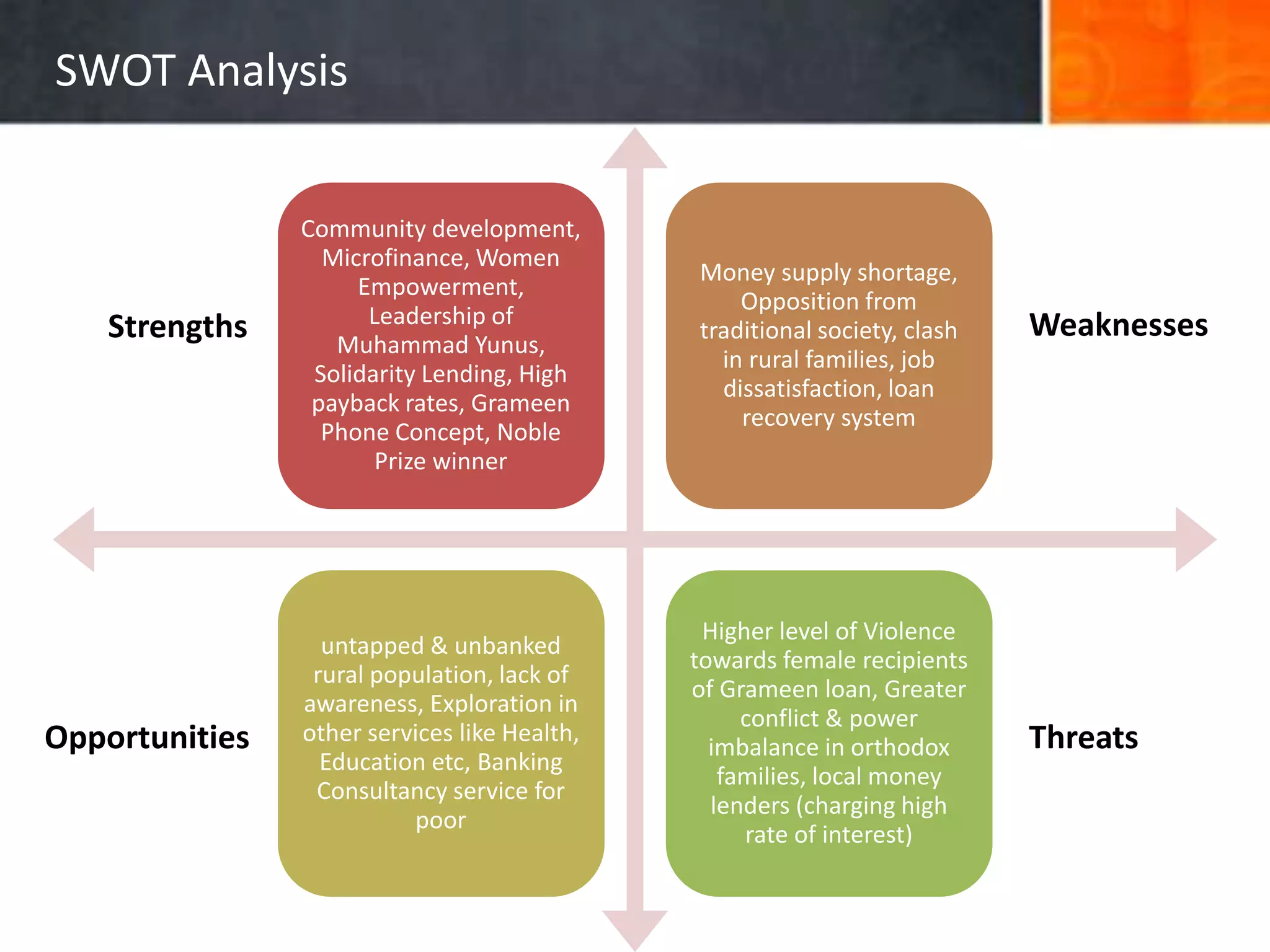

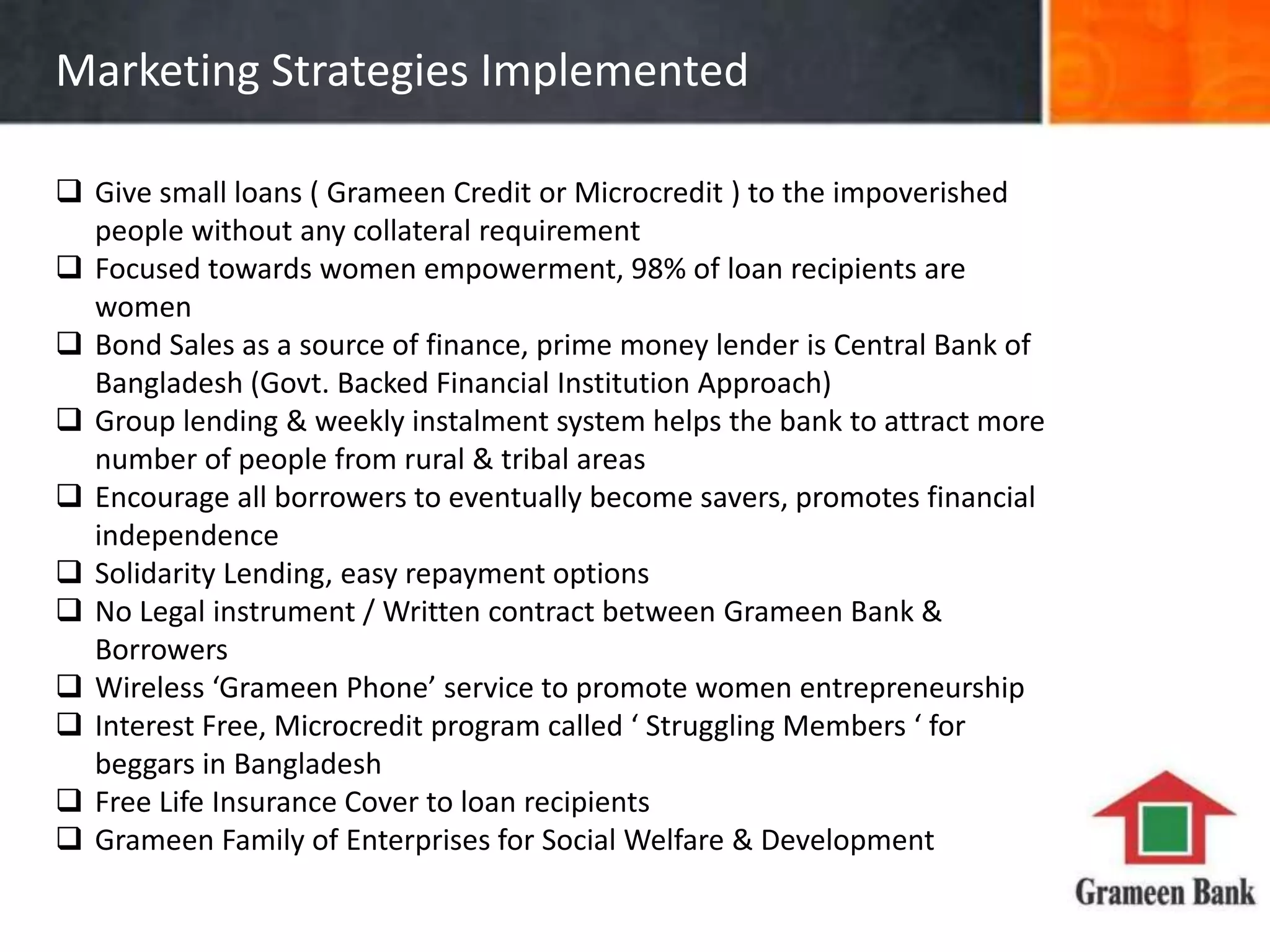

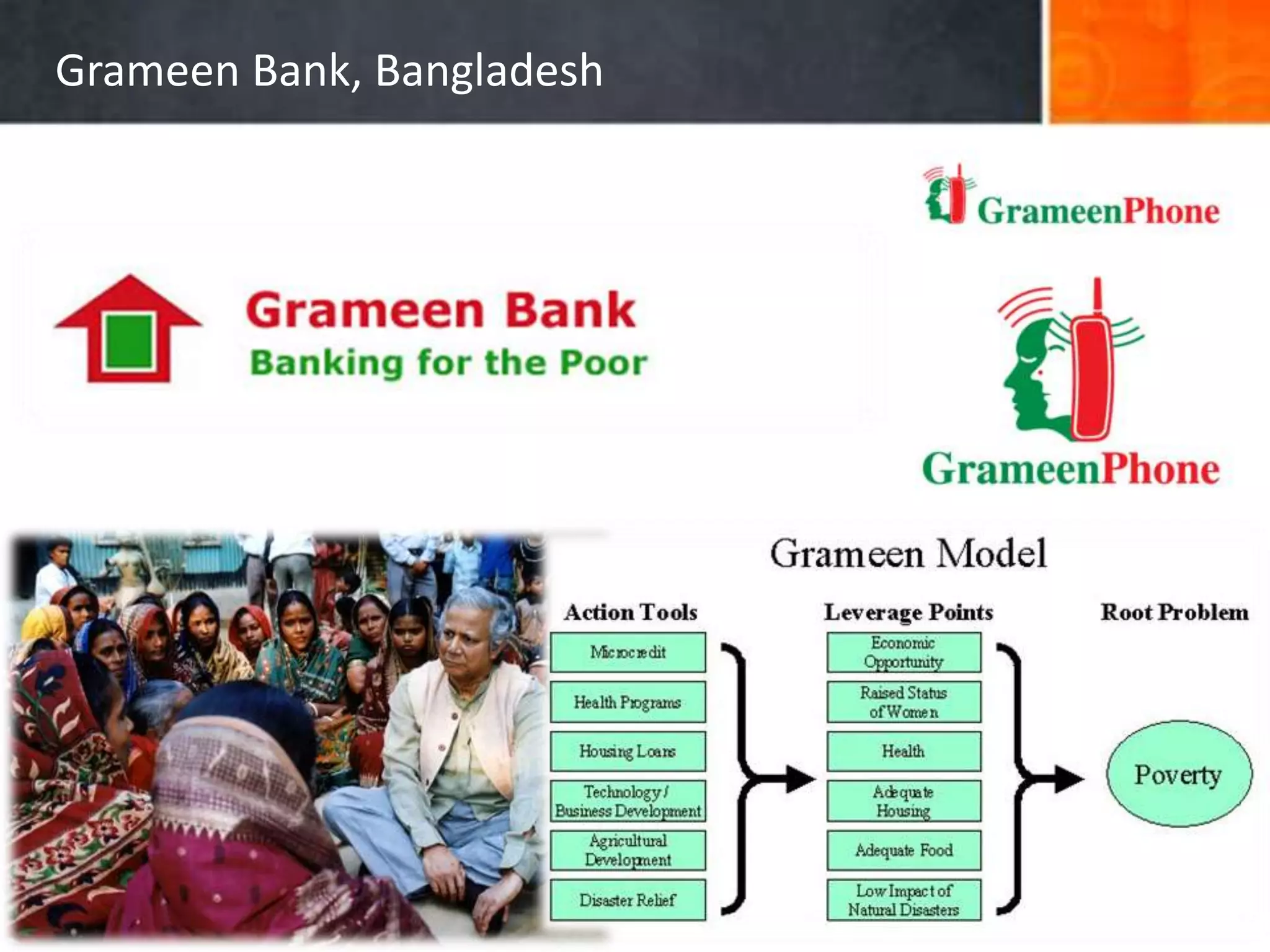

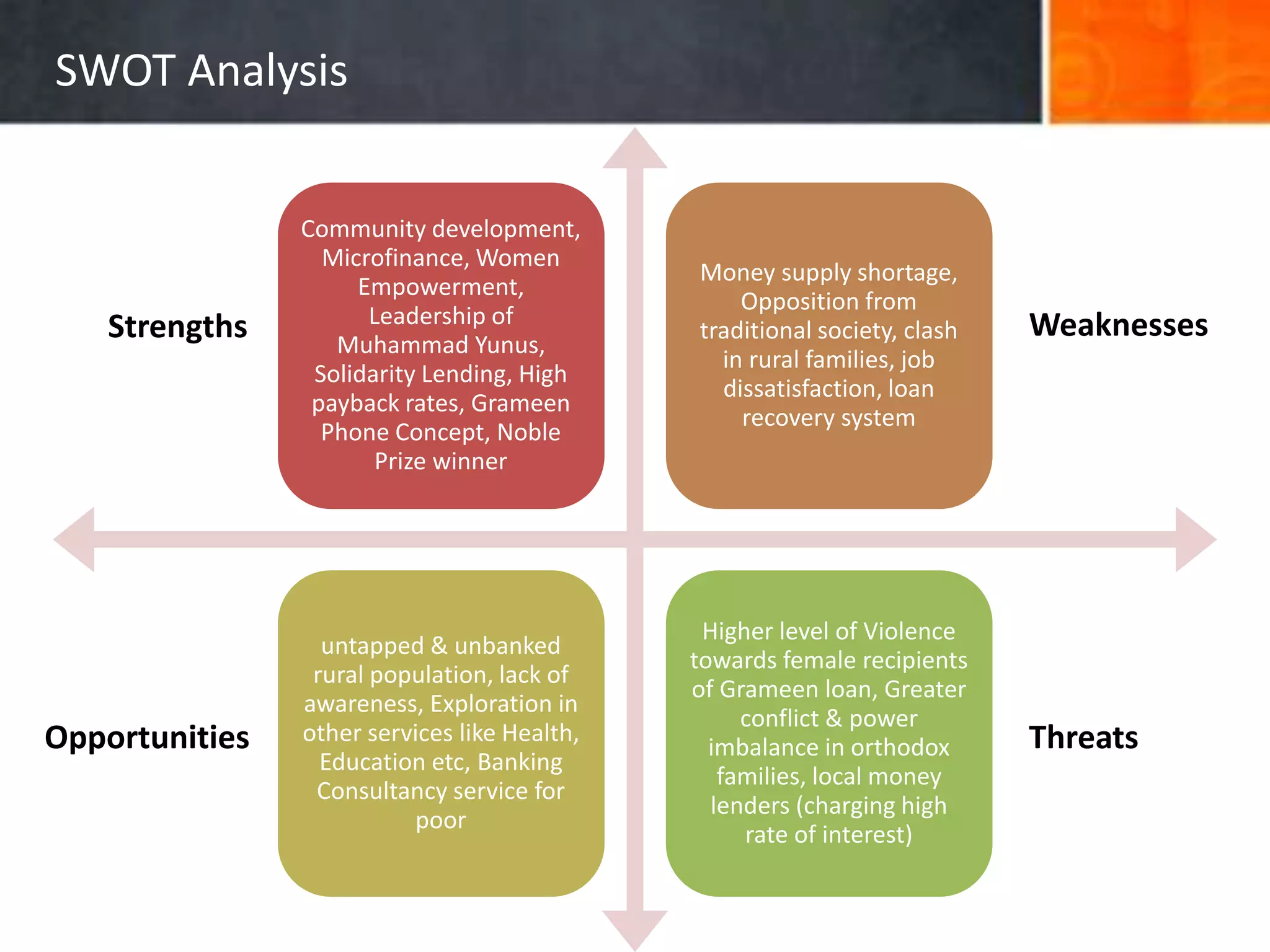

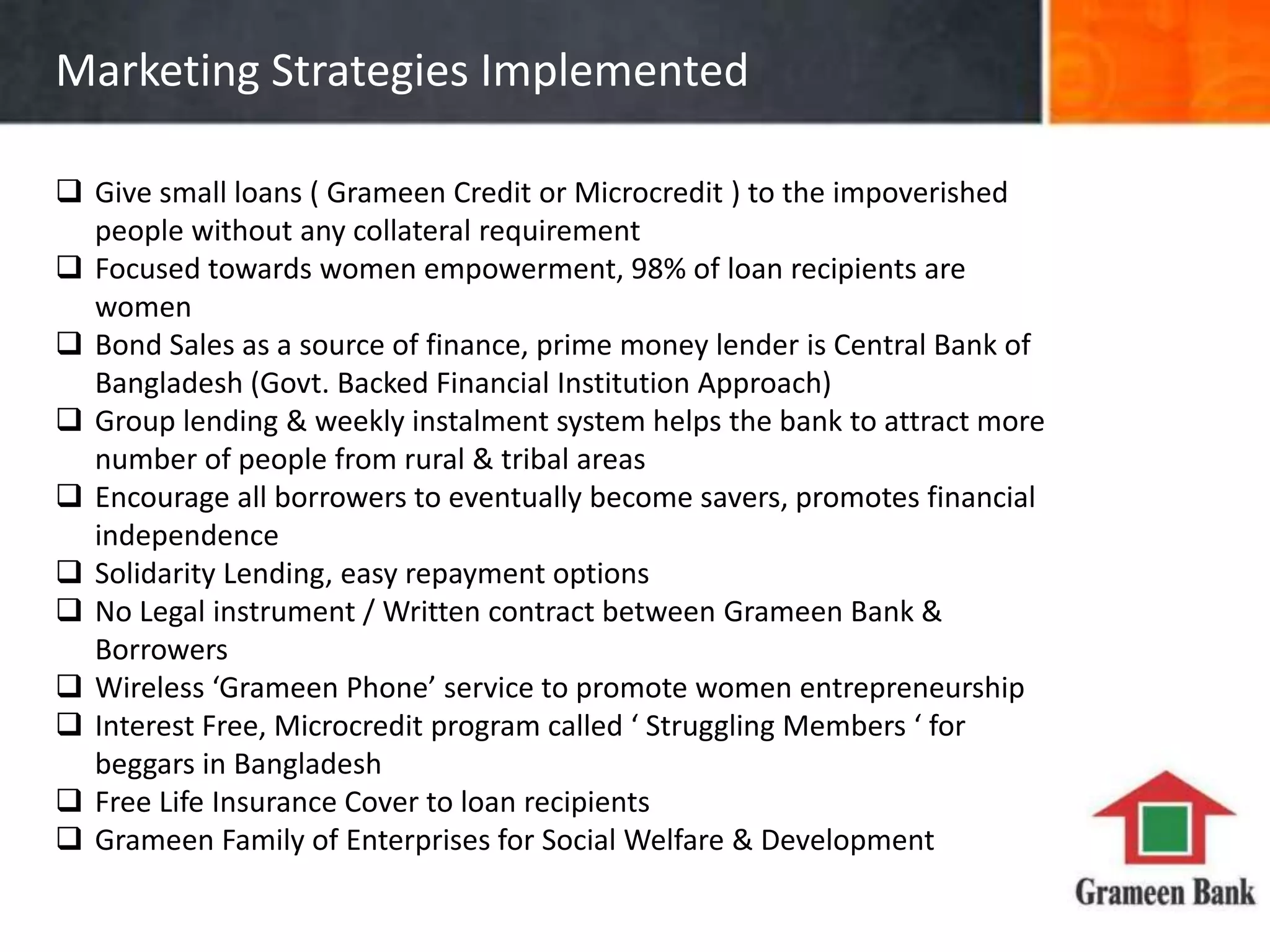

The document provides a SWOT analysis of Grameen Bank in Bangladesh, highlighting its focus on community development and women's empowerment through microfinance initiatives. Key strengths include its high repayment rates and innovative banking strategies, while challenges include societal opposition and violence towards female loan recipients. Opportunities involve expanding services into health and education, and threats arise from local money lenders and systemic societal issues.