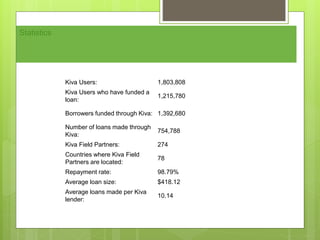

Plan Canada supports microfinancing to help alleviate poverty. Microfinancing provides small loans to those without access to capital, allowing people to start small businesses and become financially independent. Microfinancing has benefits like improved access to credit, higher loan repayment rates, better education and health outcomes, sustainability, and job creation. Plan Canada works with partners like Arariwa in Peru to facilitate village savings programs and bring microfinancing services to rural communities. Kiva and FINCA are also microfinancing organizations that provide loans and financial services to low-income entrepreneurs around the world.