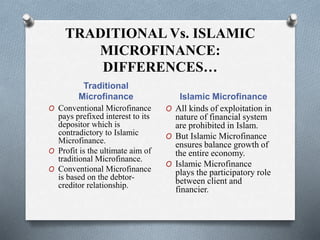

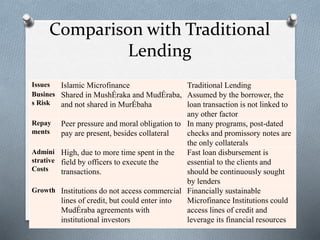

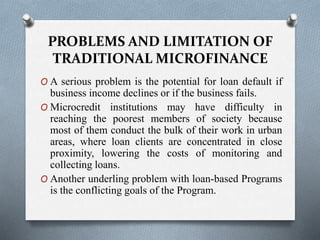

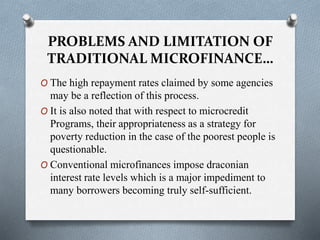

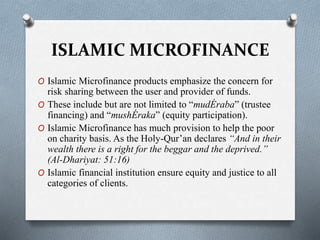

This document compares traditional and Islamic microfinance approaches to poverty alleviation. It discusses how Islamic microfinance is based on Islamic principles of avoiding interest and ensuring fairness. Key Islamic microfinance tools discussed are zakat, which requires charity for the poor, and waqf, where wealth is contributed for public benefit. The document argues that by sharing risks and ensuring equity, Islamic microfinance can more effectively help the poor compared to traditional interest-based microloans.