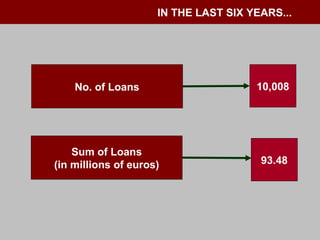

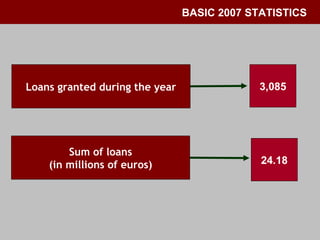

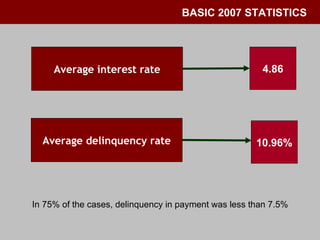

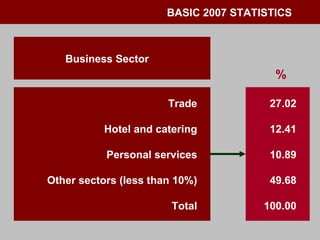

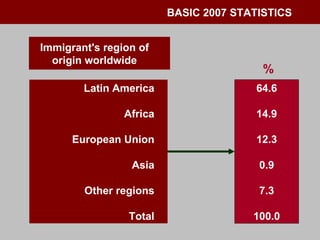

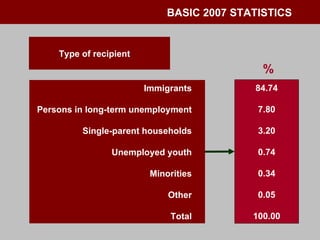

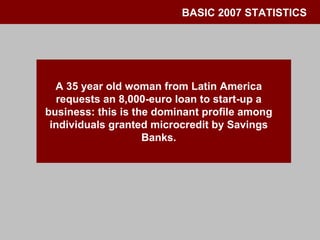

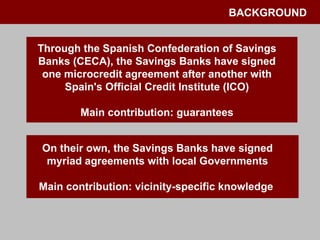

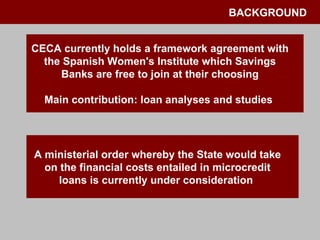

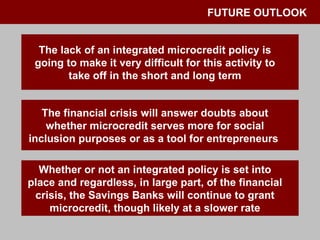

The document discusses the challenges faced by microcredit in Spain, highlighting statistics from 2007 regarding loans, interest rates, and recipient profiles. It outlines the role of the Spanish Confederation of Savings Banks in microcredit agreements and emphasizes the need for an integrated microcredit policy to foster growth in the sector. The potential impact of the financial crisis on microcredit's effectiveness for social inclusion and entrepreneurship is also examined, alongside the necessity for coordinated efforts among governmental bodies to build a viable microfinance sector.