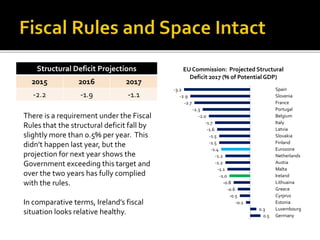

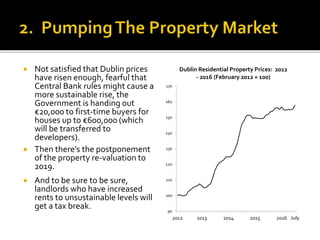

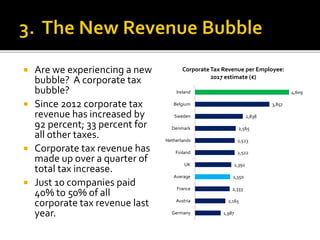

The document discusses Ireland's fiscal policy in light of the 2017 budget, emphasizing the importance of maintaining a balanced budget and prudent financial management amid global risks. It critiques current trends such as tax base erosion and rising property prices, while raising concerns about potential new economic bubbles and the implications of Brexit. The author advocates for a reevaluation of fiscal strategies, the expansion of the tax base, and a focus on long-term sustainable economic growth through innovative public policies.