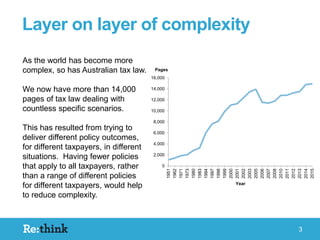

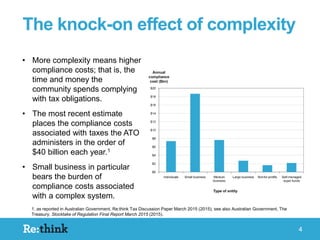

The document discusses the increasing complexity of Australia's tax system, which has expanded from around 1,080 pages in the 1950s to over 14,000 pages due to various policy adaptations. This complexity results in significant compliance costs, estimated at $40 billion annually, with small businesses particularly burdened. A more streamlined tax policy applicable to all taxpayers could potentially reduce this complexity and associated costs.