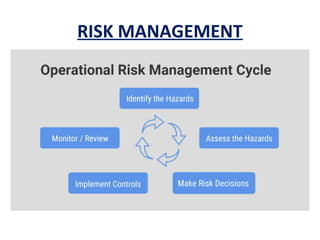

A portfolio investment comprises a variety of financial assets including stocks, bonds, and cash equivalents, while also allowing for non-traditional assets like real estate and art. Investors should tailor their portfolios based on risk tolerance, time horizon, and potential sustainable investment opportunities, with a focus on Environmental, Social, and Governance (ESG) criteria. Fund managers play a crucial role in implementing investment strategies and ensuring adherence to ESG standards while managing risks associated with investments.

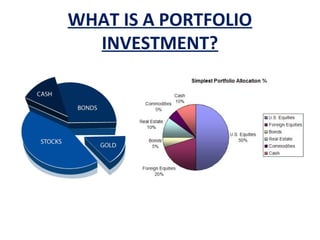

![WHAT IS A PORTFOLIO INVESTMENT?

• A portfolio investment is a basket of financial assets /

investments such as stocks, bonds, commodities, currencies

and cash equivalents including mutual, exchange-traded and

closed funds.

• A portfolio can also consist of non-publicly

tradable securities, like real estate, art, and

private investments.

• Investors should construct an investment portfolio in

accordance with their risk tolerance and investing strategies.

• Securities can build a diversified portfolio, but [stocks, bonds,

and cash] are generally considered a portfolio's core building

blocks.](https://image.slidesharecdn.com/finalprojectportfolioinvestor-190623221450/85/Final-project-portfolio-investor-2-320.jpg)