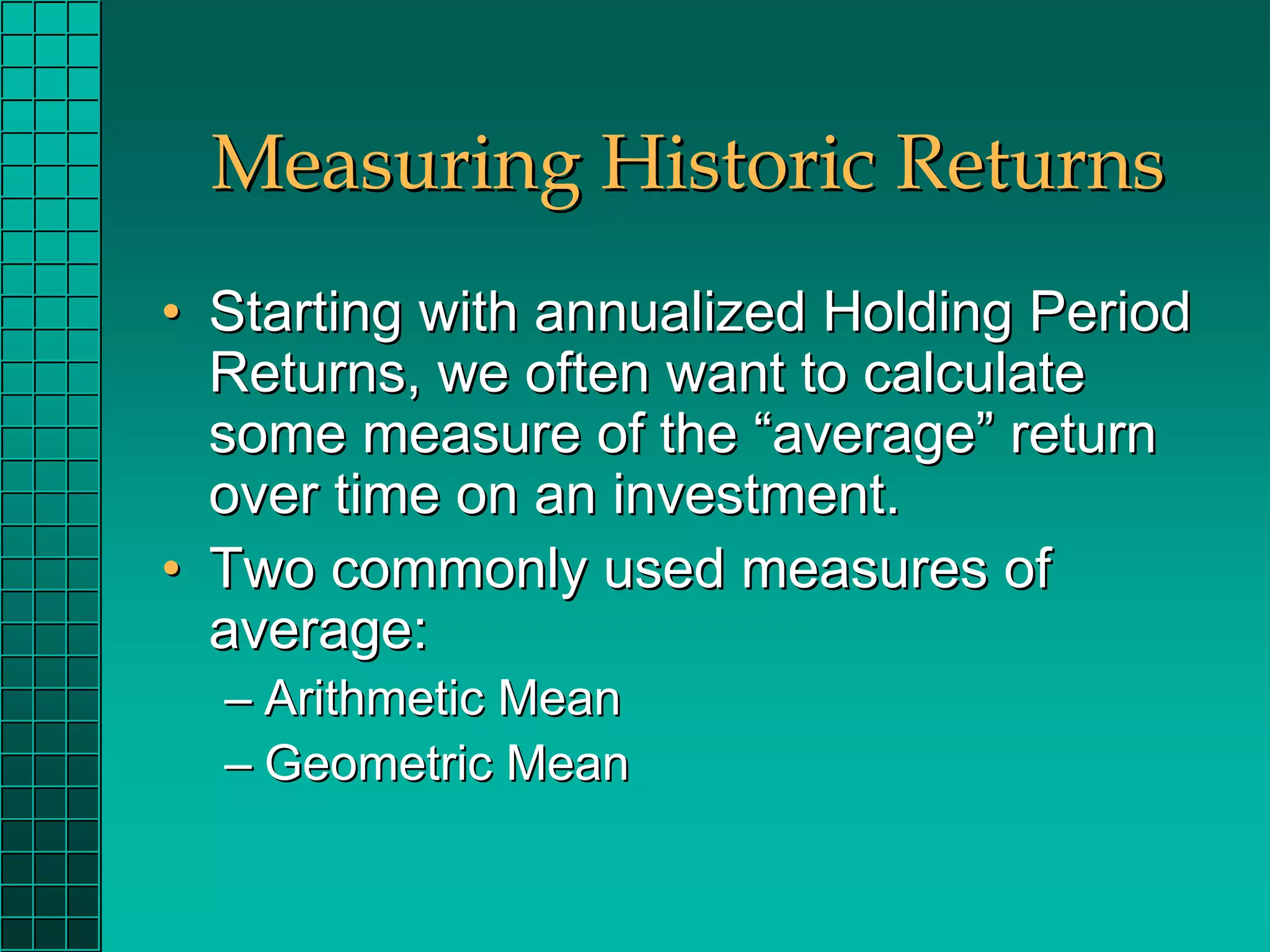

1) The chapter discusses sources of investment returns including income returns from cash flows and returns from changes in the value of investments.

2) It describes how to measure returns such as dollar returns, holding period returns, and annualized returns which allow comparisons over different time periods.

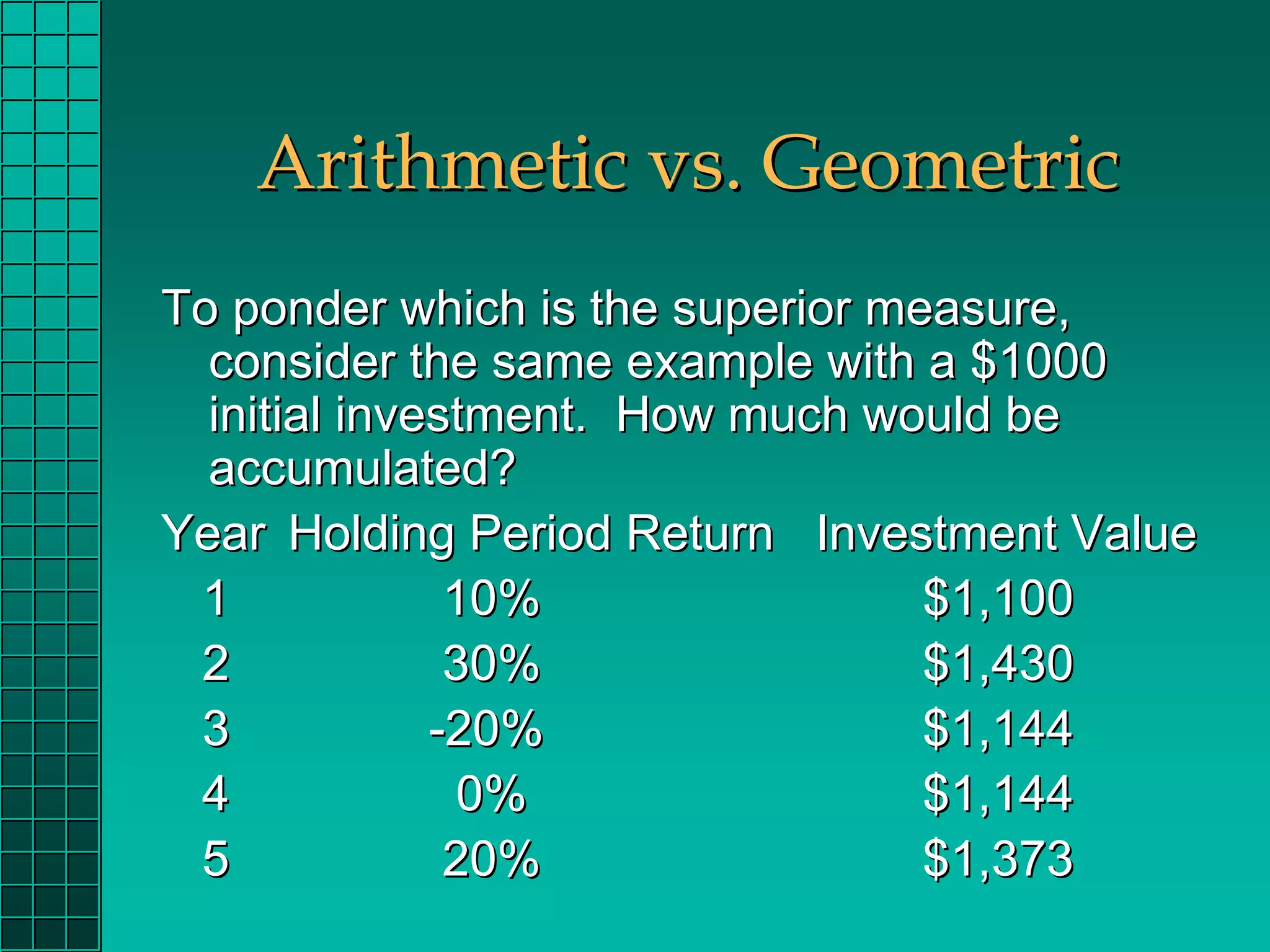

3) Risk is defined as the uncertainty of investment returns and can be measured by the variability of returns using metrics like variance and standard deviation. The higher the risk, the higher the expected return required by investors.

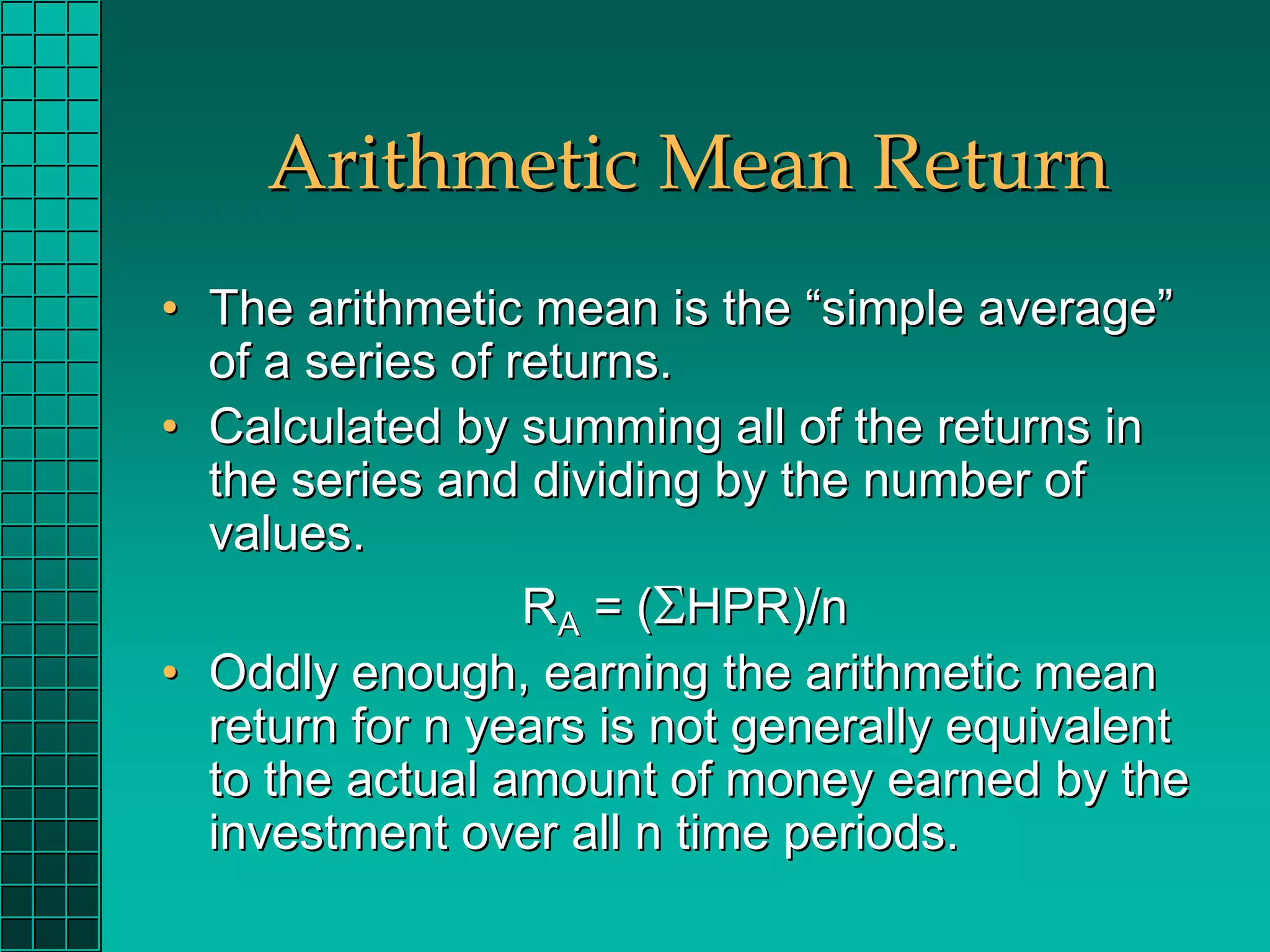

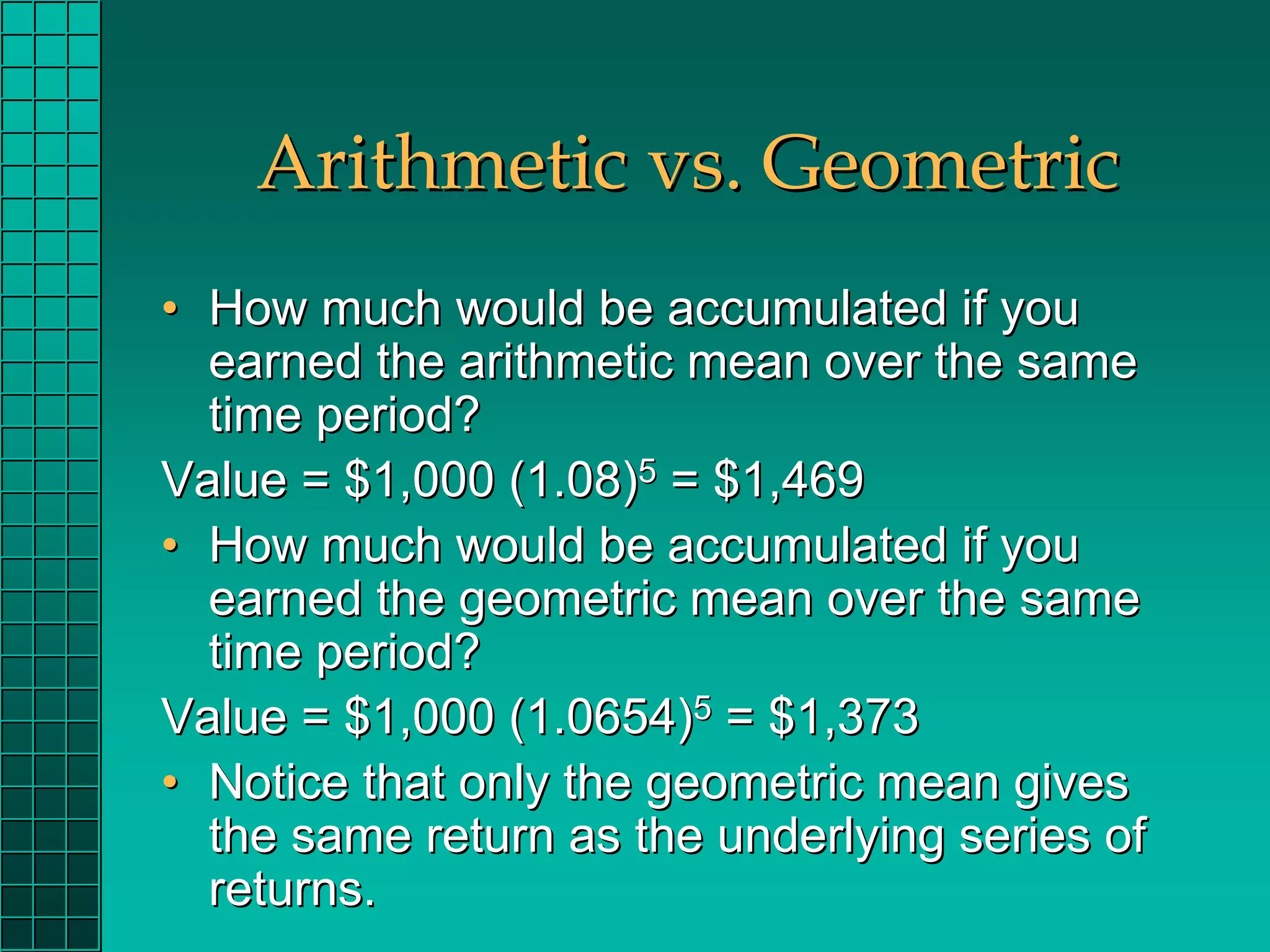

![Geometric Mean Return

• The geometric mean is the one return that, if

earned in each of the n years of an

investment’s life, gives the same total dollar

result as the actual investment.

• It is calculated as the nth root of the product

of all of the n return relatives of the

investment.

RG = [Π(Return Relatives)]1/n – 1](https://image.slidesharecdn.com/chapter02-120313103915-phpapp01/75/417Chapter-02-12-2048.jpg)

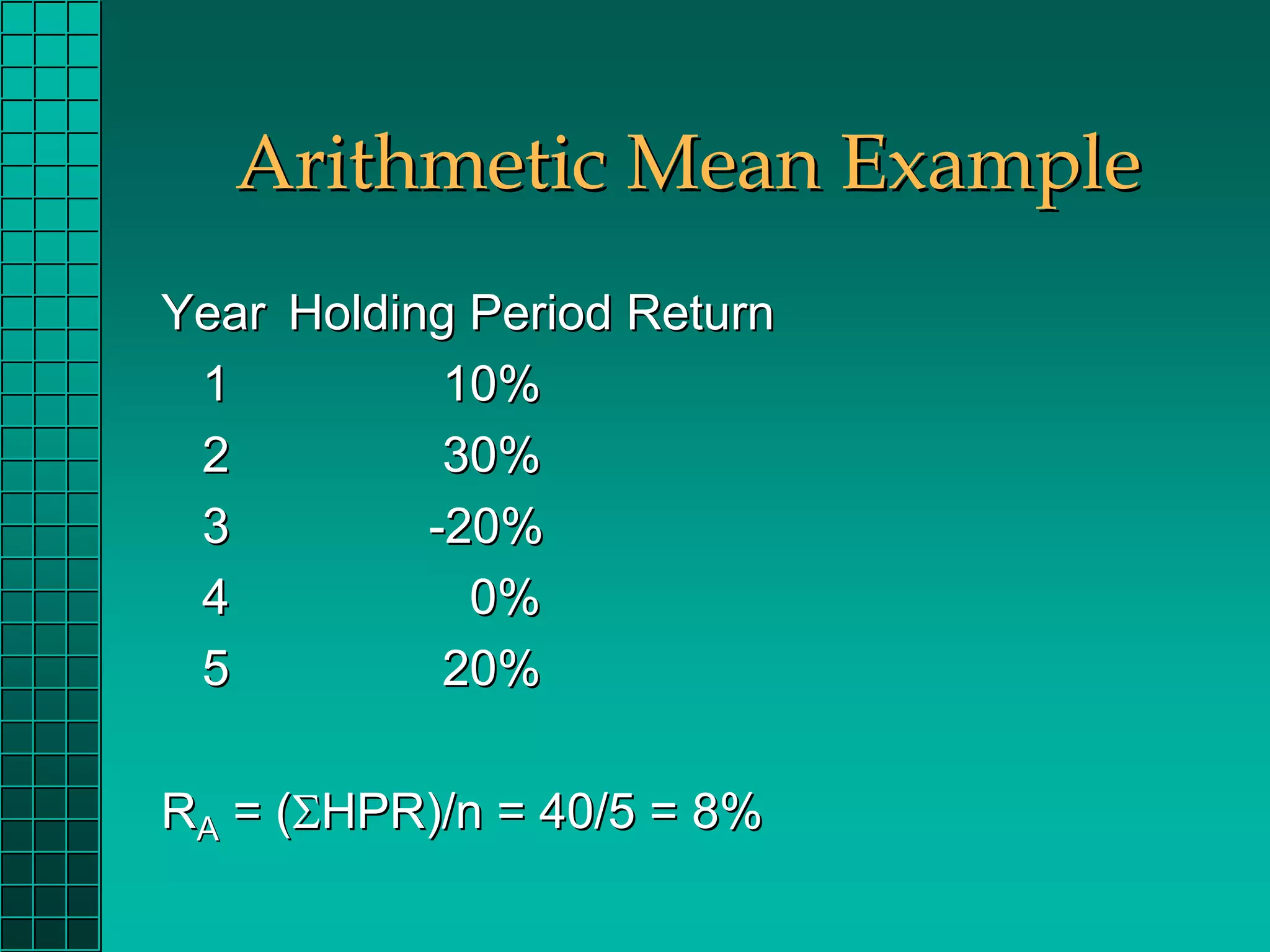

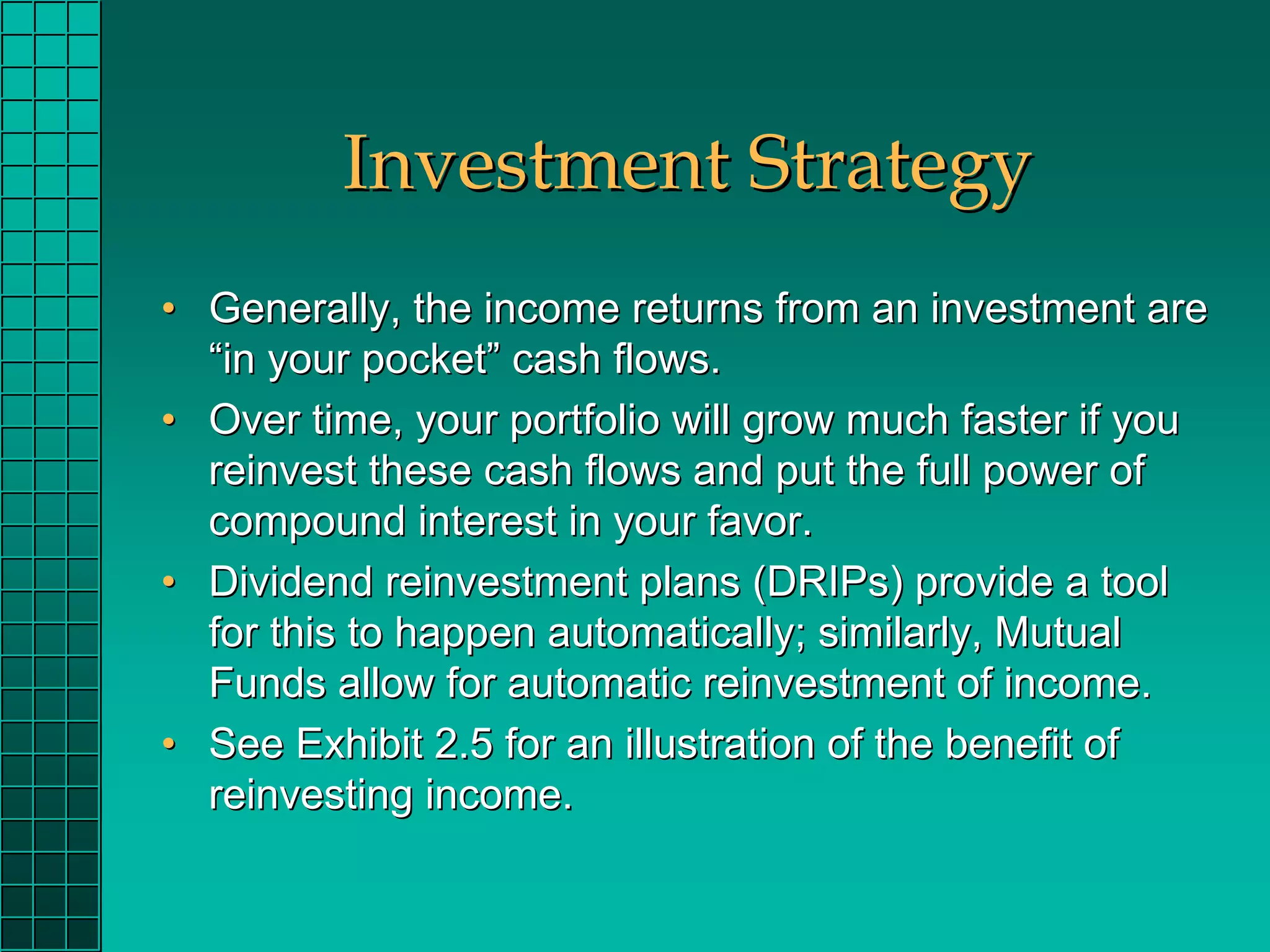

![Geometric Mean Example

Year Holding Period Return Return Relative

1 10% 1.10

2 30% 1.30

3 -20% 0.80

4 0% 1.00

5 20% 1.20

RG = [(1.10)(1.30)(.80)(1.00)(1.20)]1/5 – 1

RG = .0654 or 6.54%](https://image.slidesharecdn.com/chapter02-120313103915-phpapp01/75/417Chapter-02-13-2048.jpg)

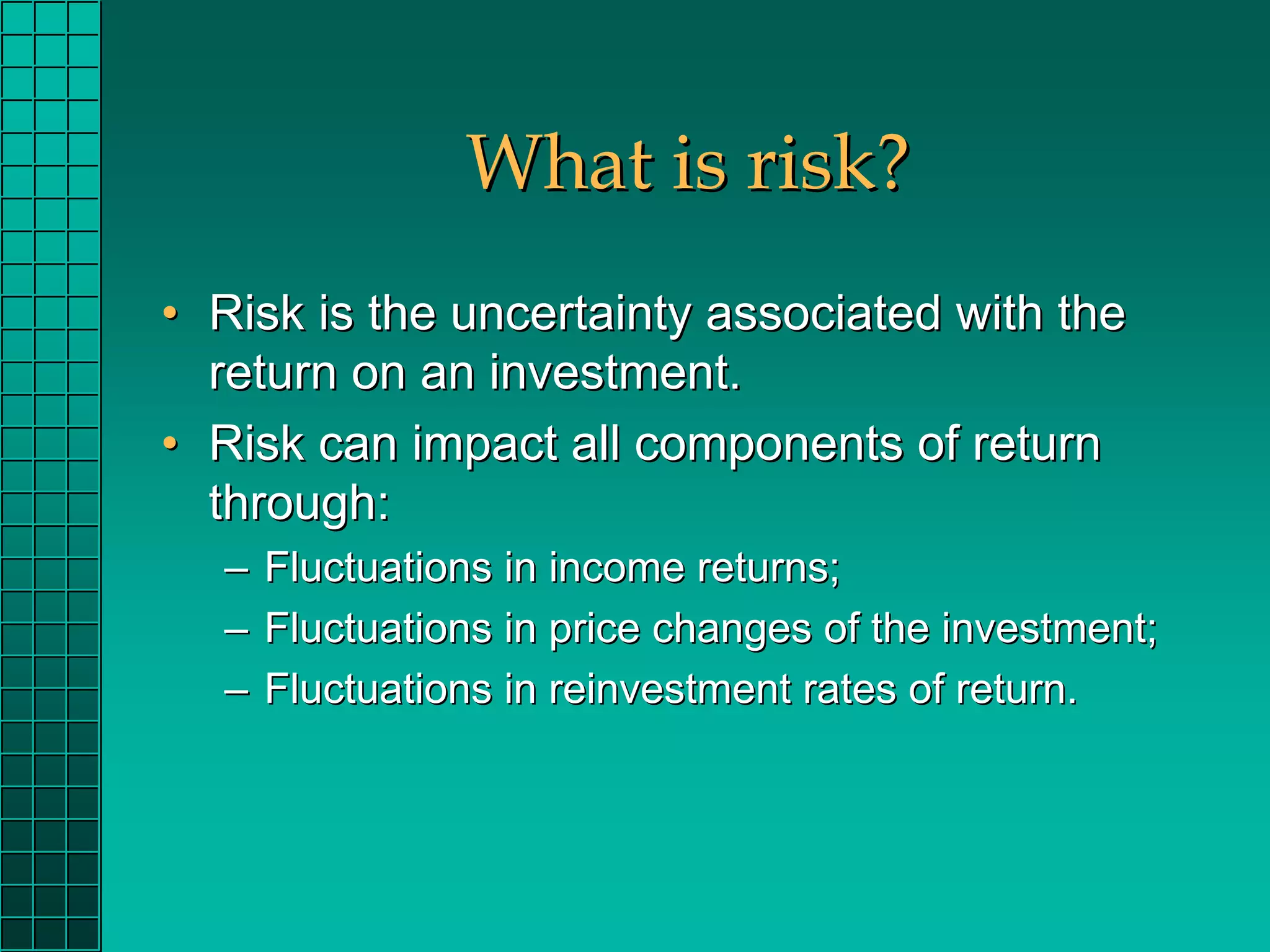

![How can we measure risk?

• Since risk is related to variability and

uncertainty, we can use measures of

variability to assess risk.

• The variance and its positive square root, the

standard deviation, are such measures.

– Measure “total risk” of an investment, the

combined effects of systematic and asset-specific

risk factors.

• Variance of Historic Returns

σ2 = [Σ(Rt-RA)2]/n-1](https://image.slidesharecdn.com/chapter02-120313103915-phpapp01/75/417Chapter-02-19-2048.jpg)

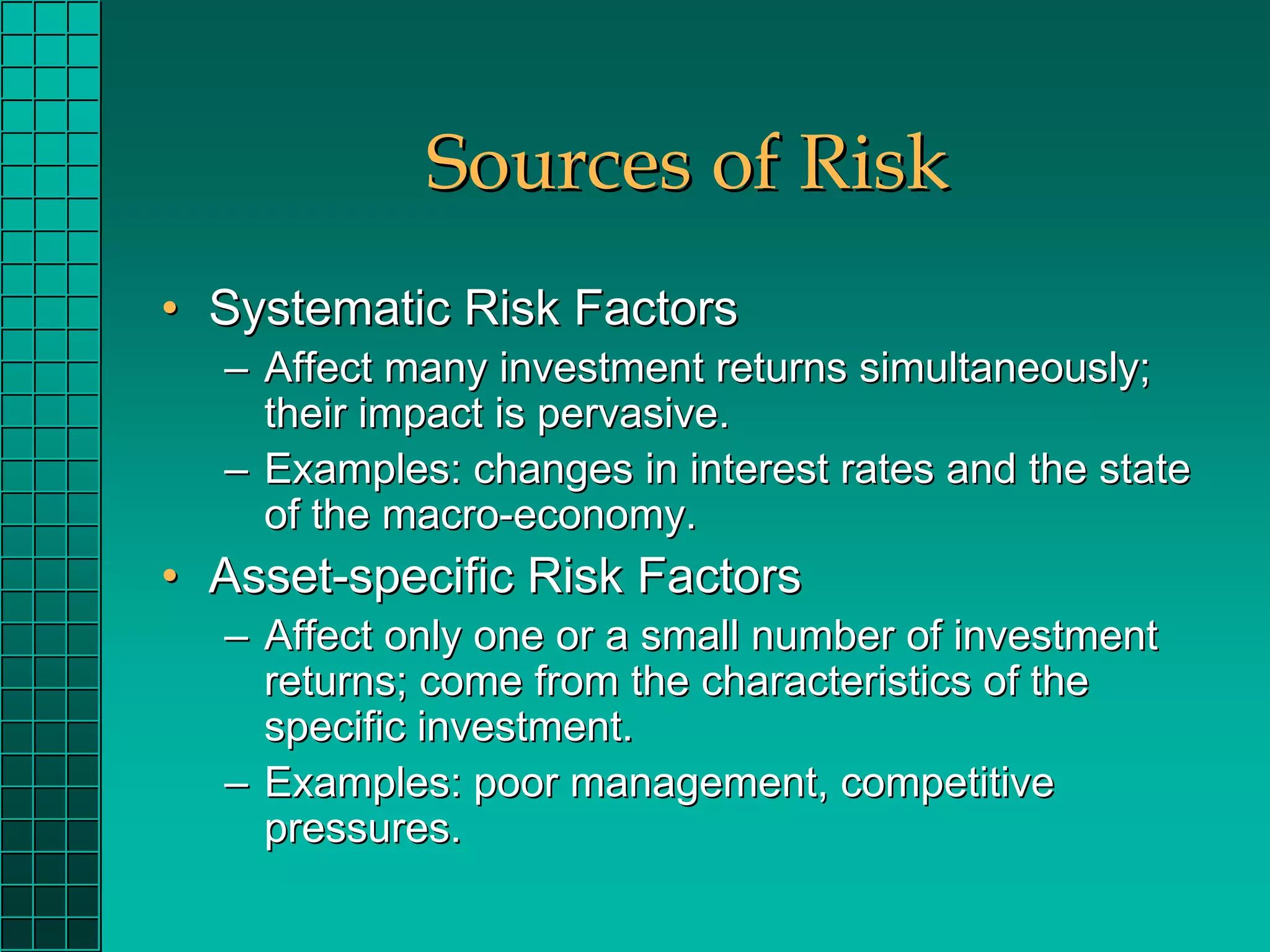

![Standard Deviation of Historic

Returns

Year Holding Period Return

1 10% RA = 8%

2 30% σ2 = 370

3 -20% σ = 19.2%

4 0%

5 20%

σ2 = [(10-8)2+(30-8)2+(-20-8)2+(0-8)2+(20-8)2]/4

= [4+484+784+64+144]/4

= [1480]/4](https://image.slidesharecdn.com/chapter02-120313103915-phpapp01/75/417Chapter-02-20-2048.jpg)