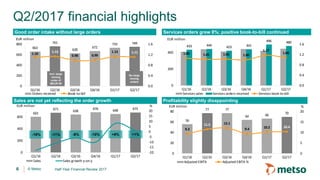

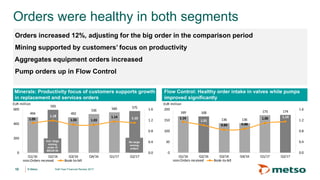

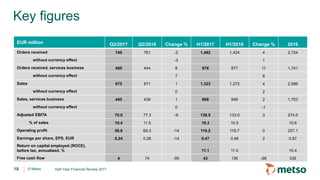

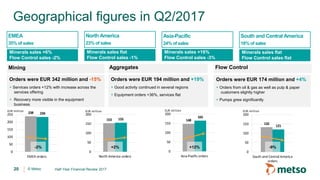

- Orders received in the second quarter were slightly lower than the previous year, adjusting for a large mining order in the comparison period. Service order intake grew 8% with positive momentum across all regions and segments.

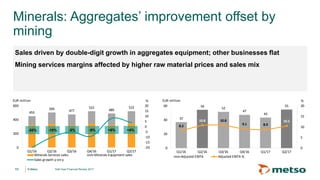

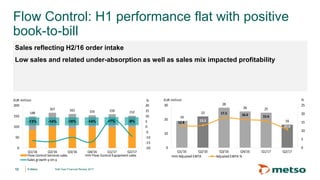

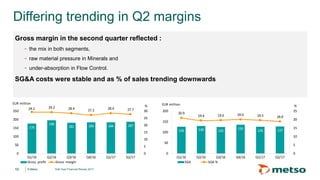

- Sales were up 1% overall but did not yet reflect the growth in orders due to timing of deliveries. Profitability was impacted by lower sales, unfavorable sales mix, and raw material price pressure.

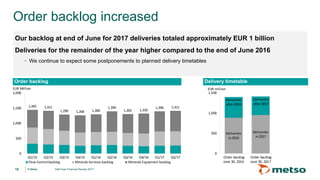

- The order backlog increased and provides a solid base for deliveries in the second half of the year, although some postponements are still expected compared to planned delivery timetables.