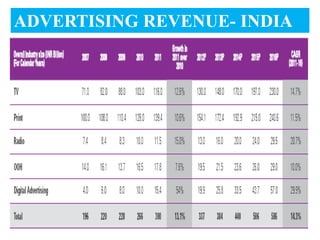

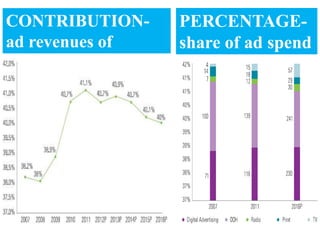

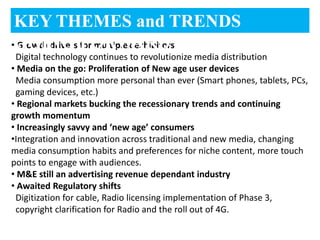

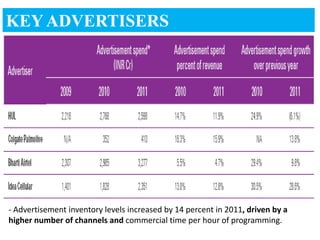

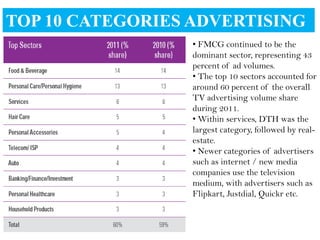

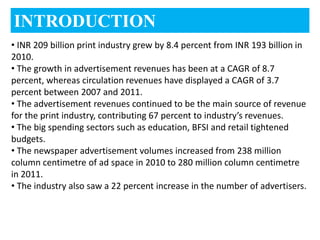

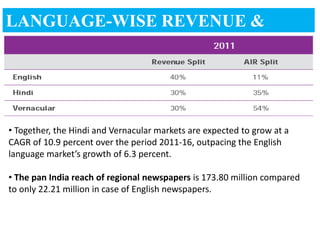

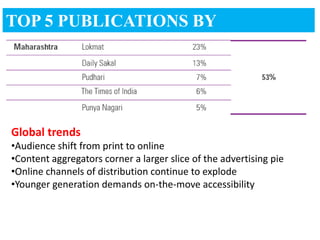

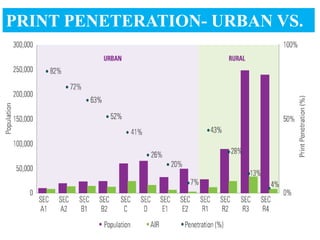

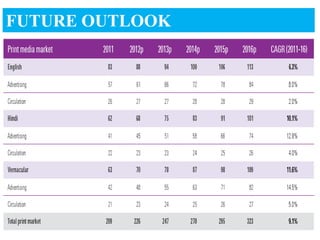

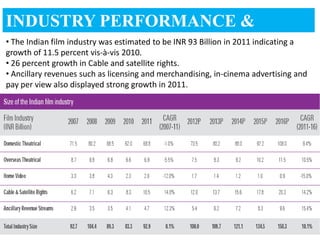

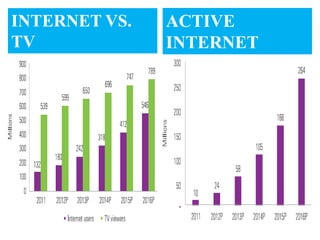

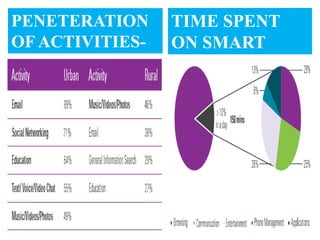

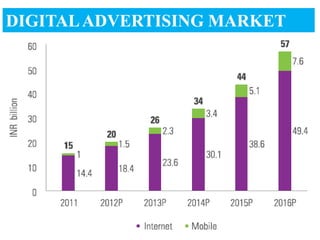

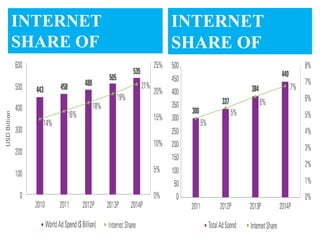

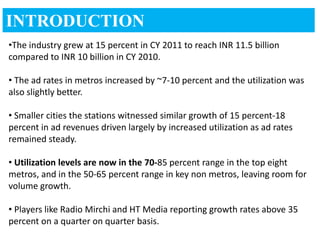

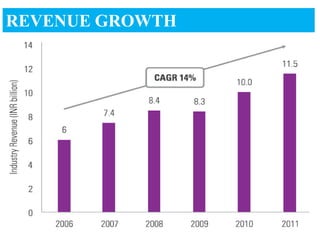

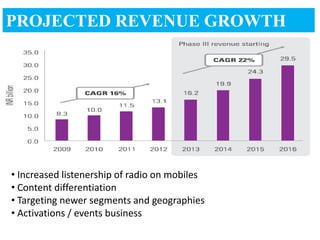

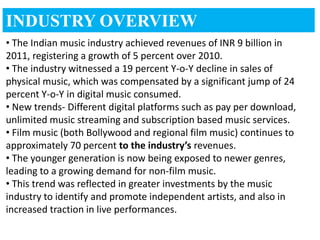

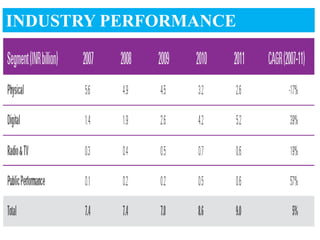

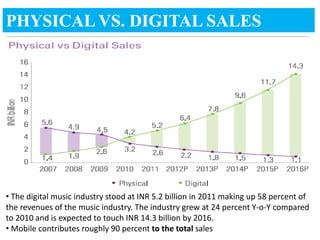

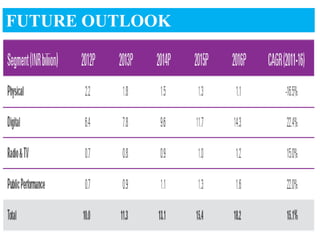

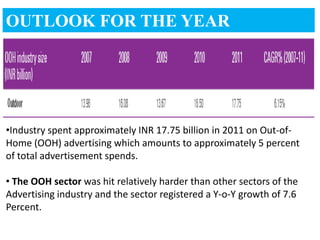

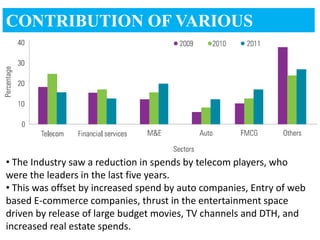

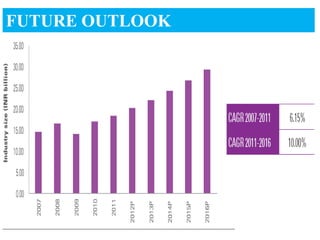

The Indian media and entertainment industry grew 12% in 2011 to $728 billion. While advertising growth was strong in the first half, it slowed in the second half. The emergence of digital distribution benefited films and music. Cable digitization and digital music consumption increased. Looking ahead, growth is projected to continue but may be modest due to a conservative economic outlook. The television, print, and film industries remained the largest segments. Regional media, digital advertising, and gaming are growing segments in the evolving new media landscape.