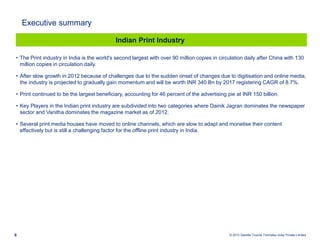

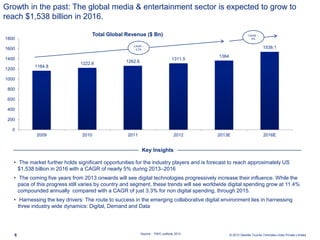

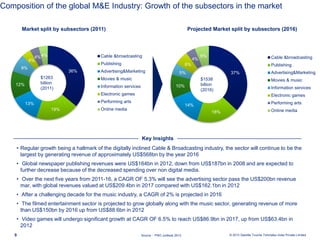

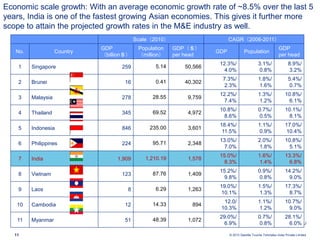

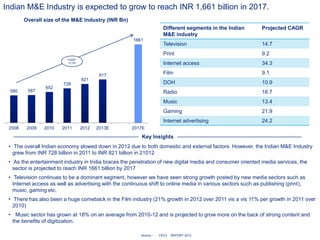

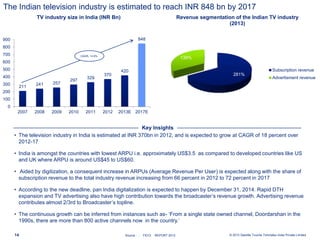

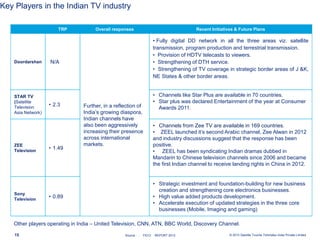

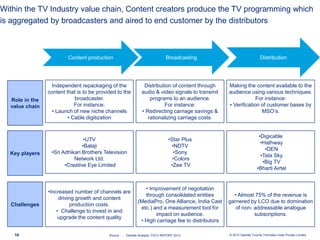

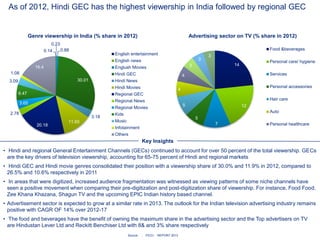

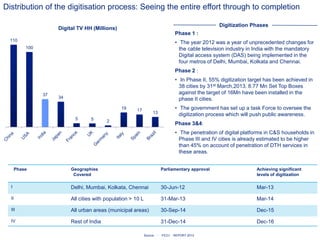

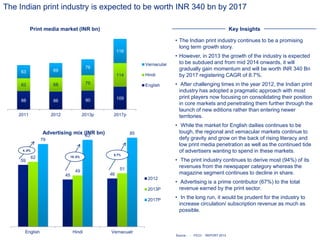

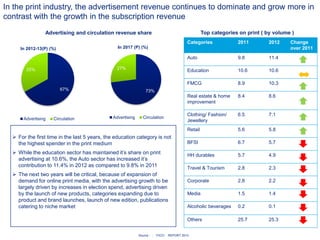

The document provides an overview of the global and Indian media and entertainment industries. It discusses that the global M&E market is expected to grow to $1,538 billion by 2016, with cable and broadcasting remaining the largest segment. In India, the M&E industry grew 12.6% in 2012 to INR 821 billion and is projected to reach INR 1,661 billion by 2017. The television industry in India is estimated at INR 370 billion in 2012 and is projected to grow at an 18% CAGR to INR 848 billion by 2017, aided by digitization.