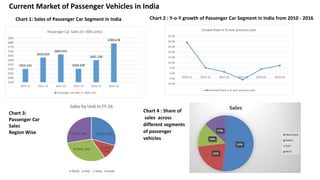

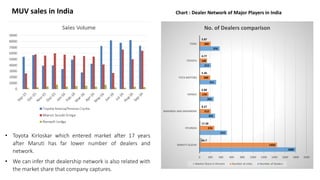

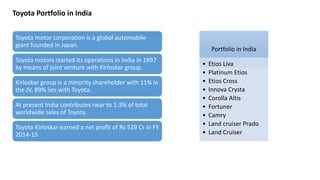

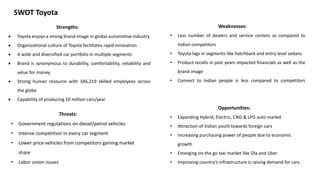

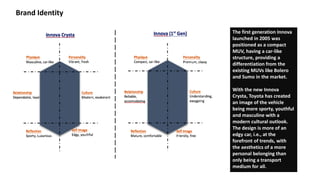

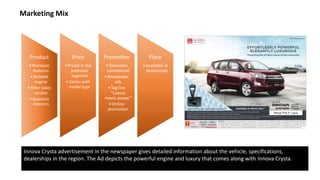

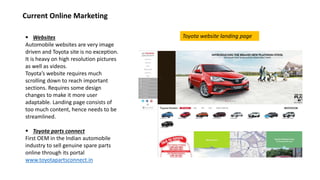

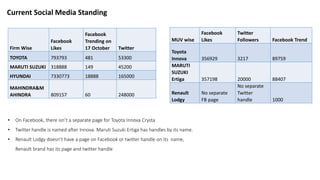

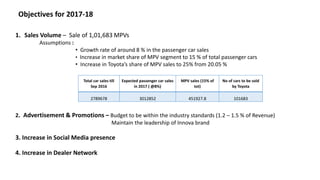

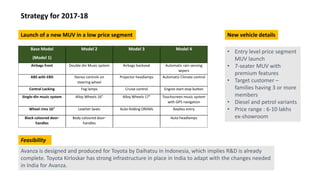

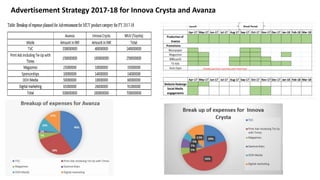

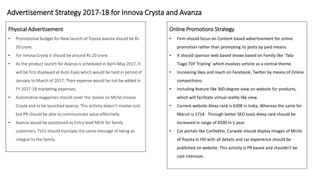

The document outlines a marketing plan for Toyota's new product launch in the Indian passenger vehicle market for FY 2017-18, highlighting market trends, sales performance, and Toyota's competitive positioning. It includes SWOT analysis, target segmentation, and proposed advertising strategies for the Innova Crysta and a new entry-level MUV, the Avanza. Key objectives include increasing sales volume and market share, enhancing social media presence, and expanding the dealer network.