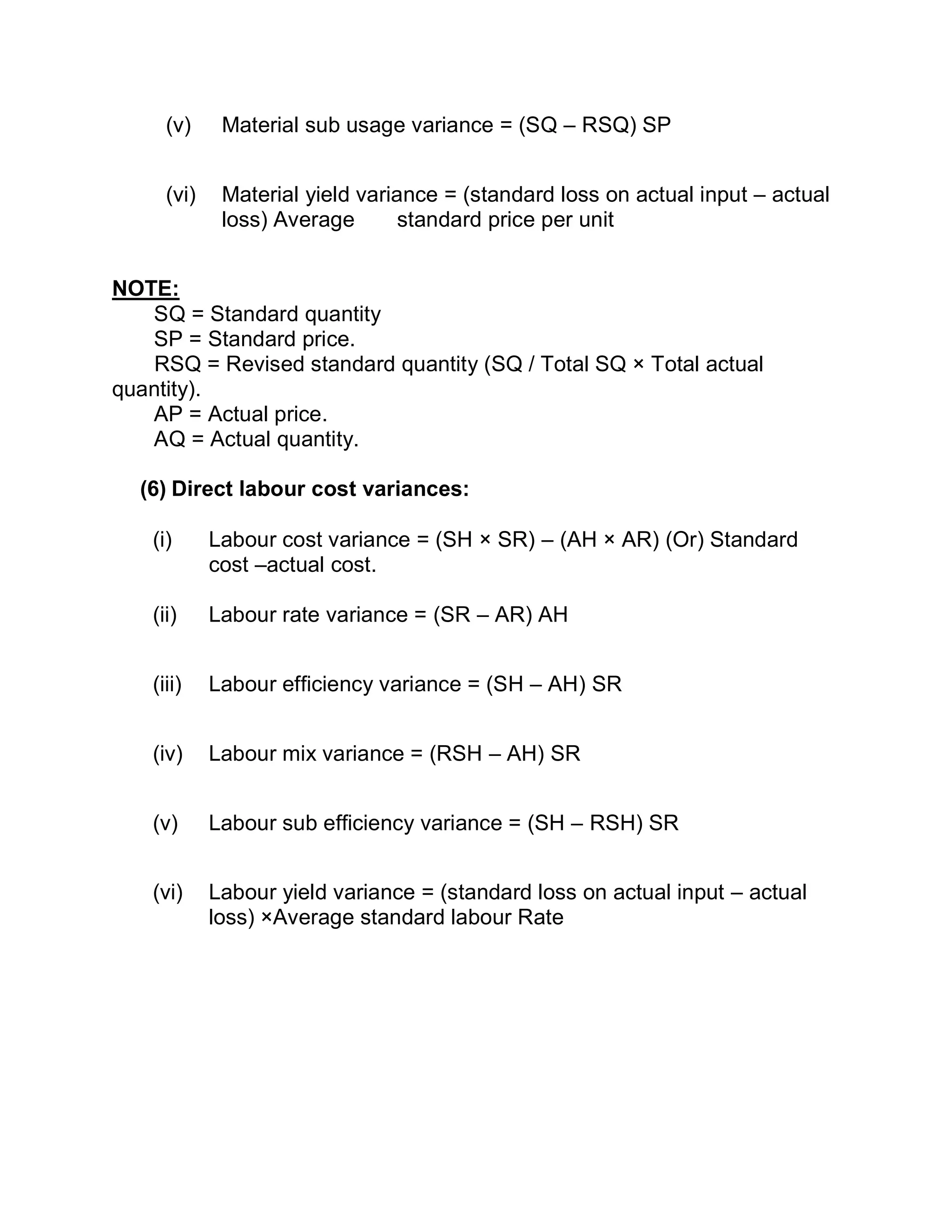

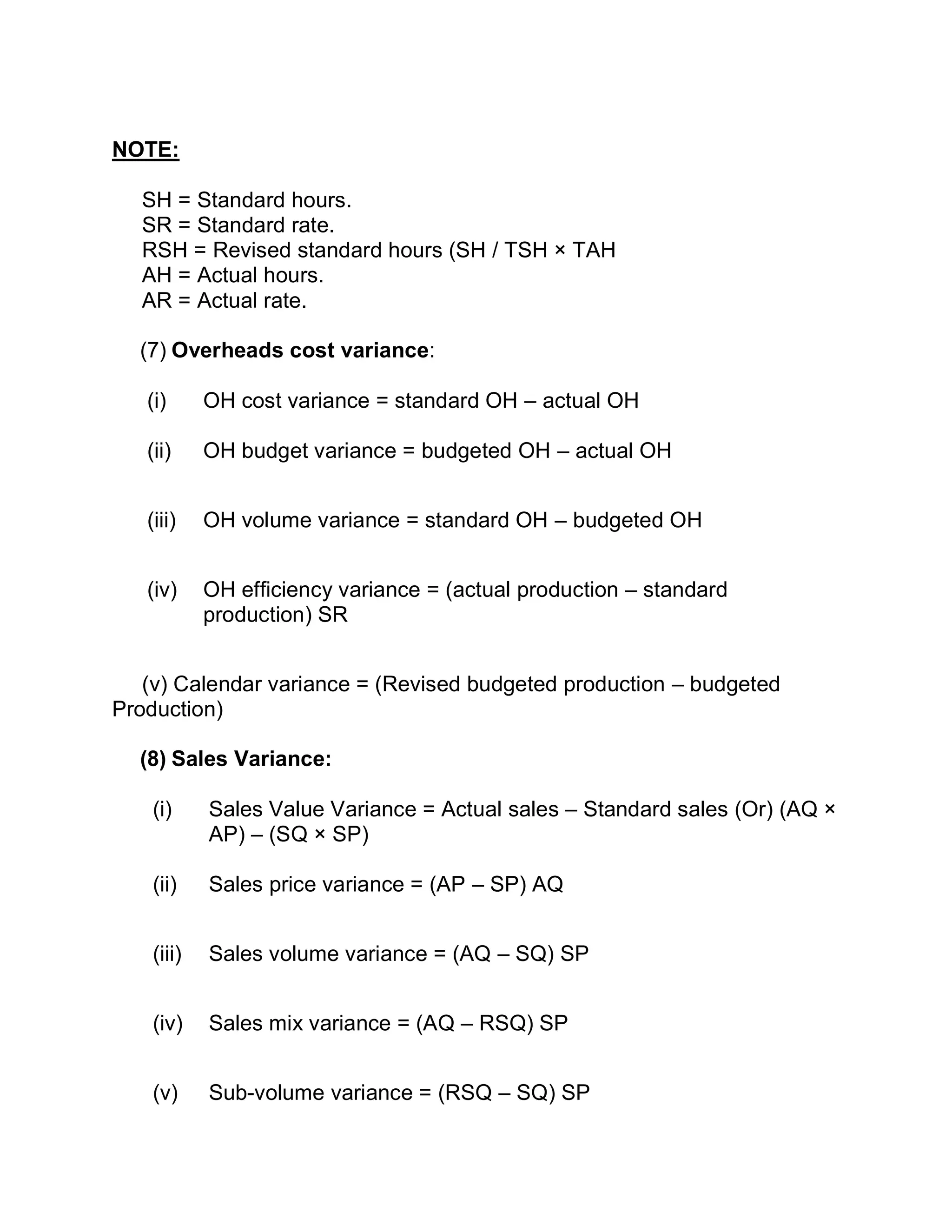

This document discusses concepts related to marginal costing and standard costing. It defines key terms like contribution, profit volume ratio, break-even point, and margin of safety. It provides formulas for calculating these metrics. It also explains the basic concepts of standard costing such as standard types, variance analysis, and formulas for calculating variances in direct material costs, direct labor costs, and overhead costs. Variances allow comparison between actual and standard costs.