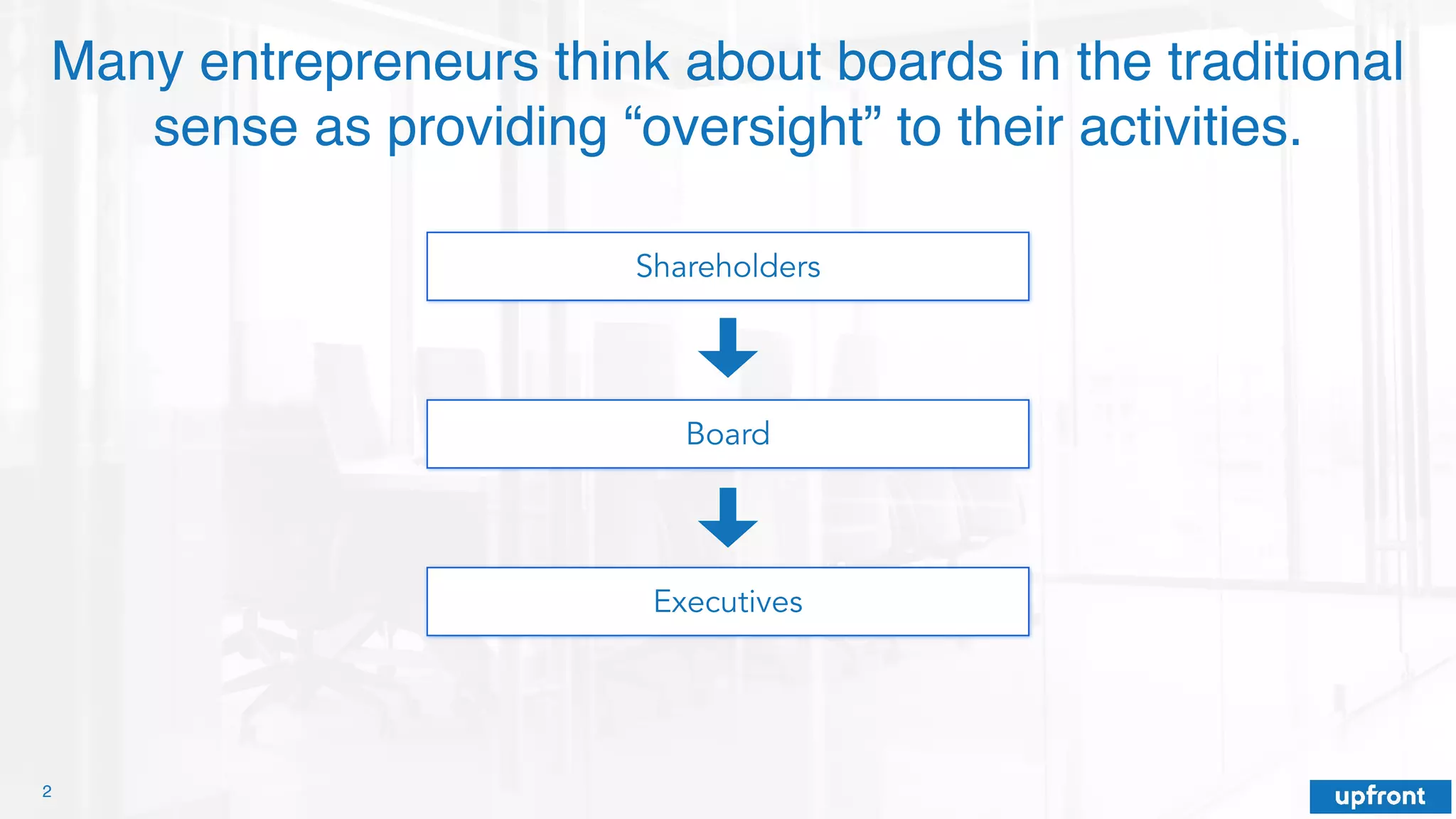

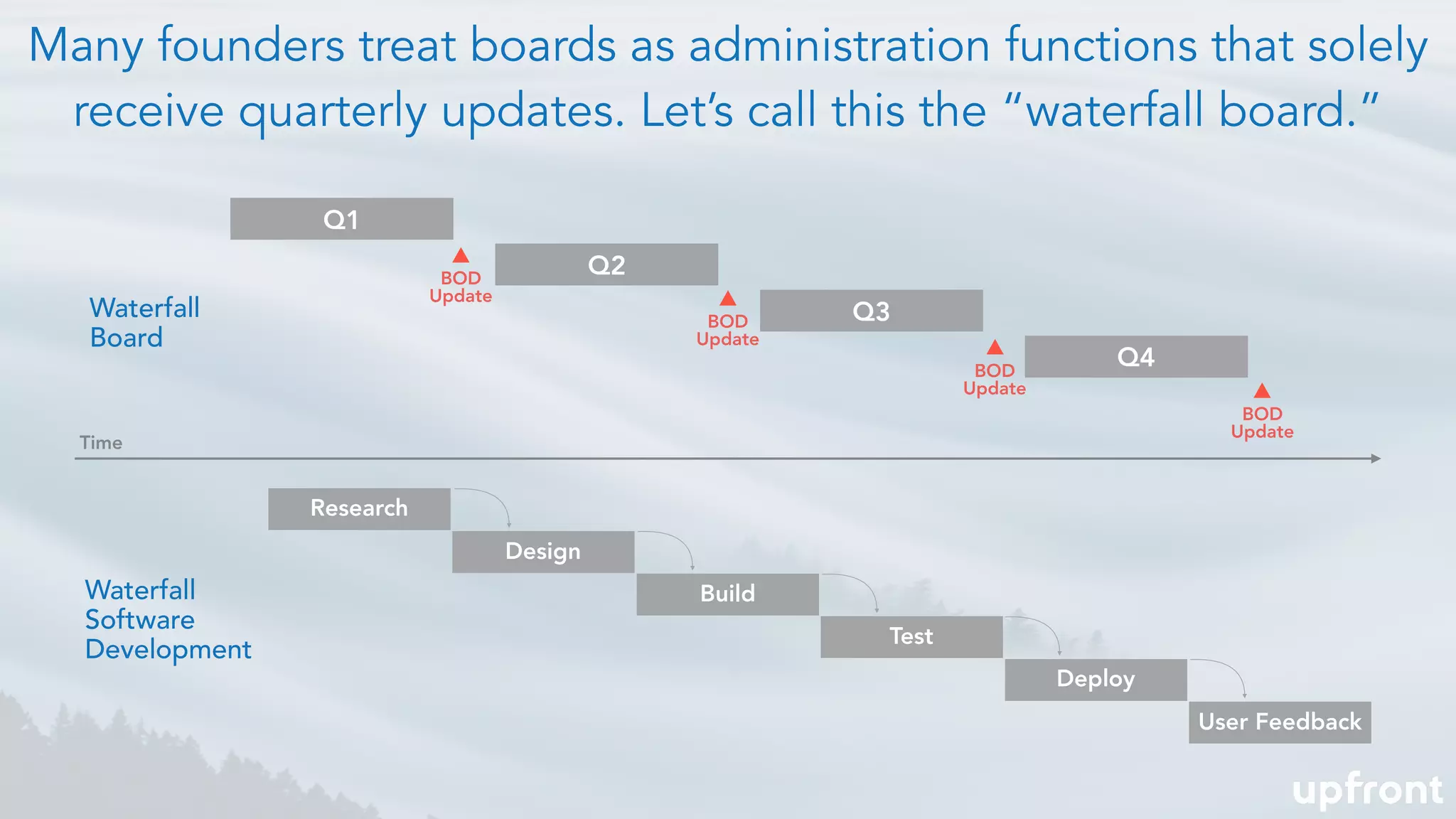

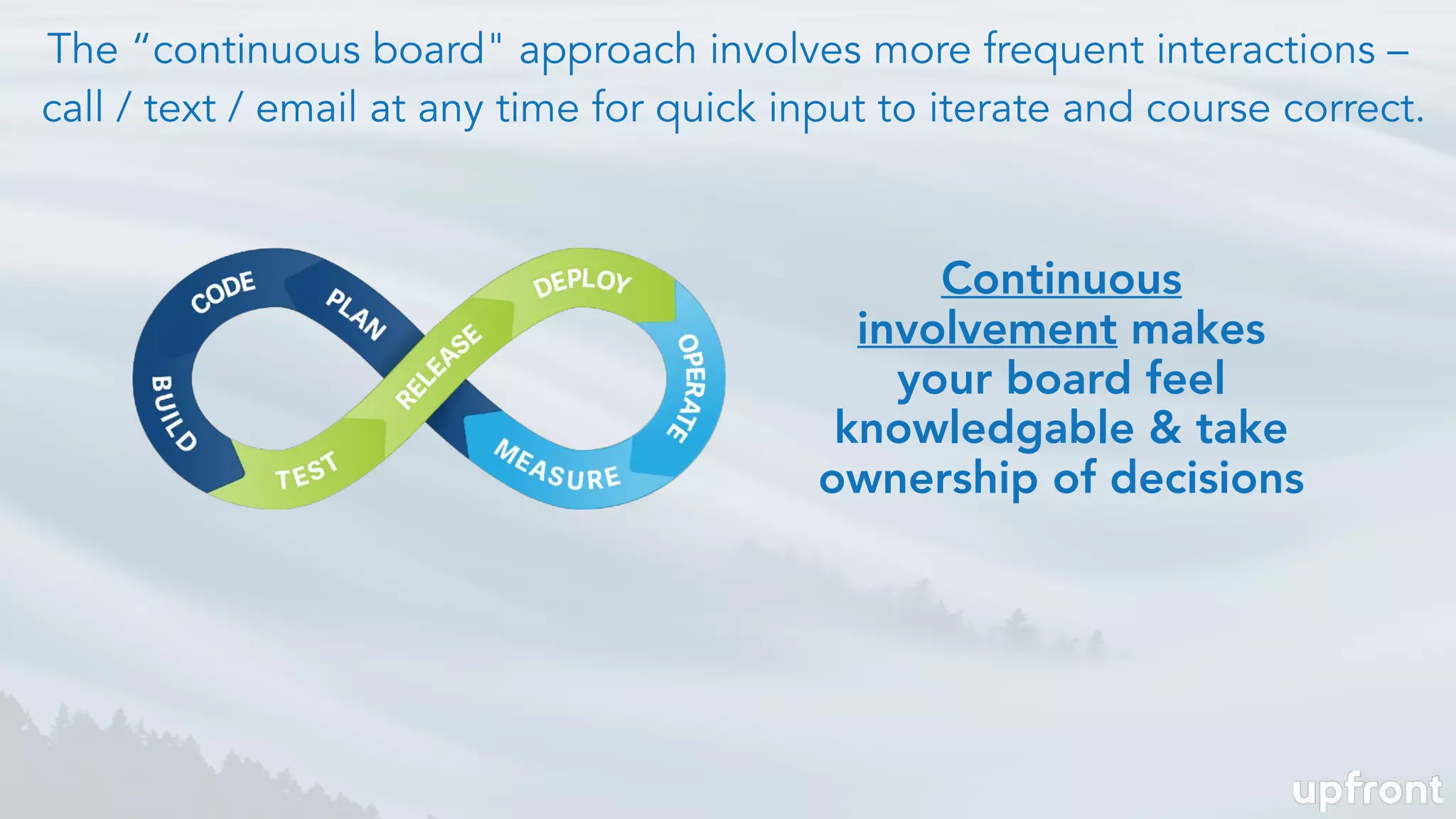

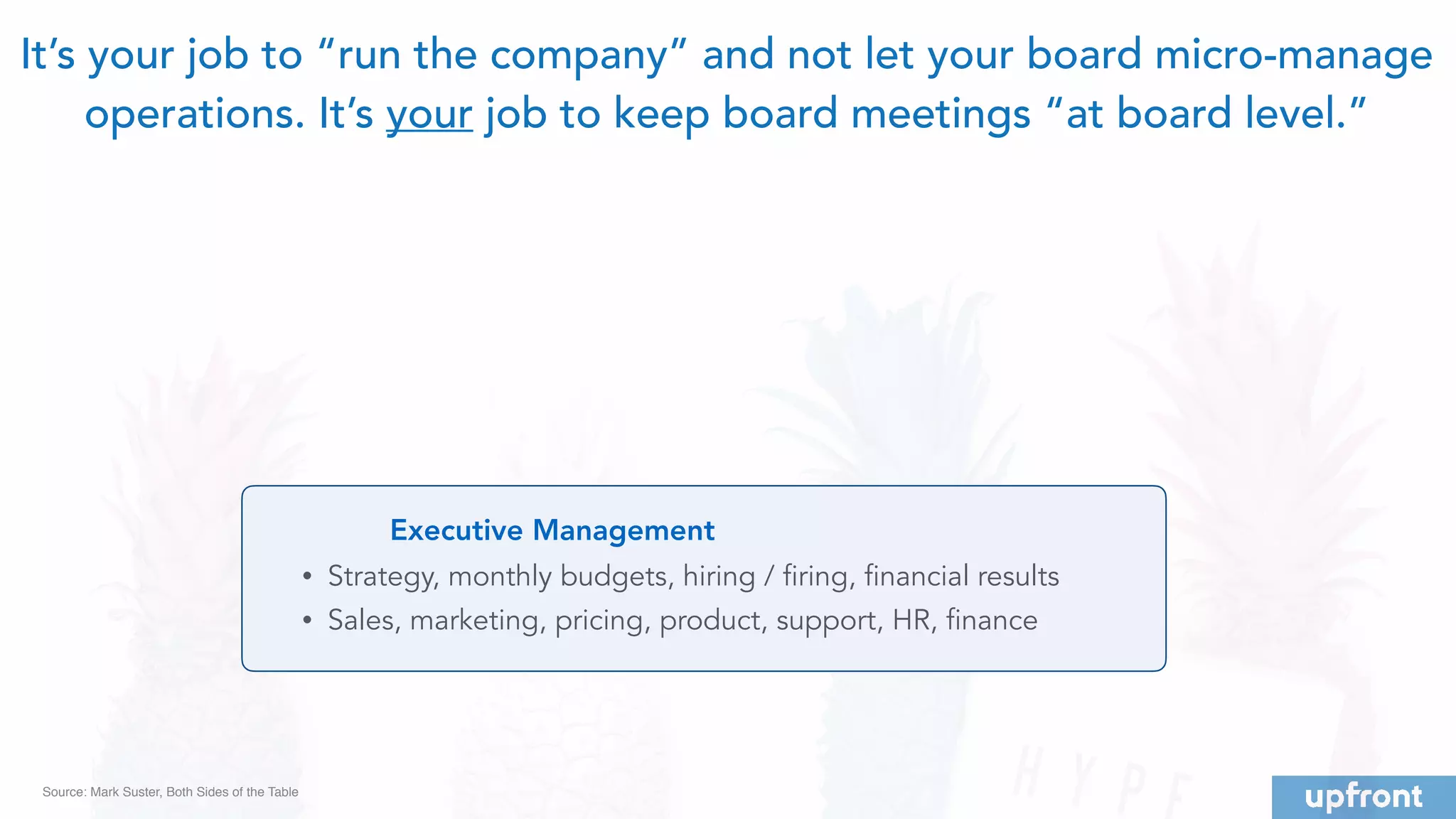

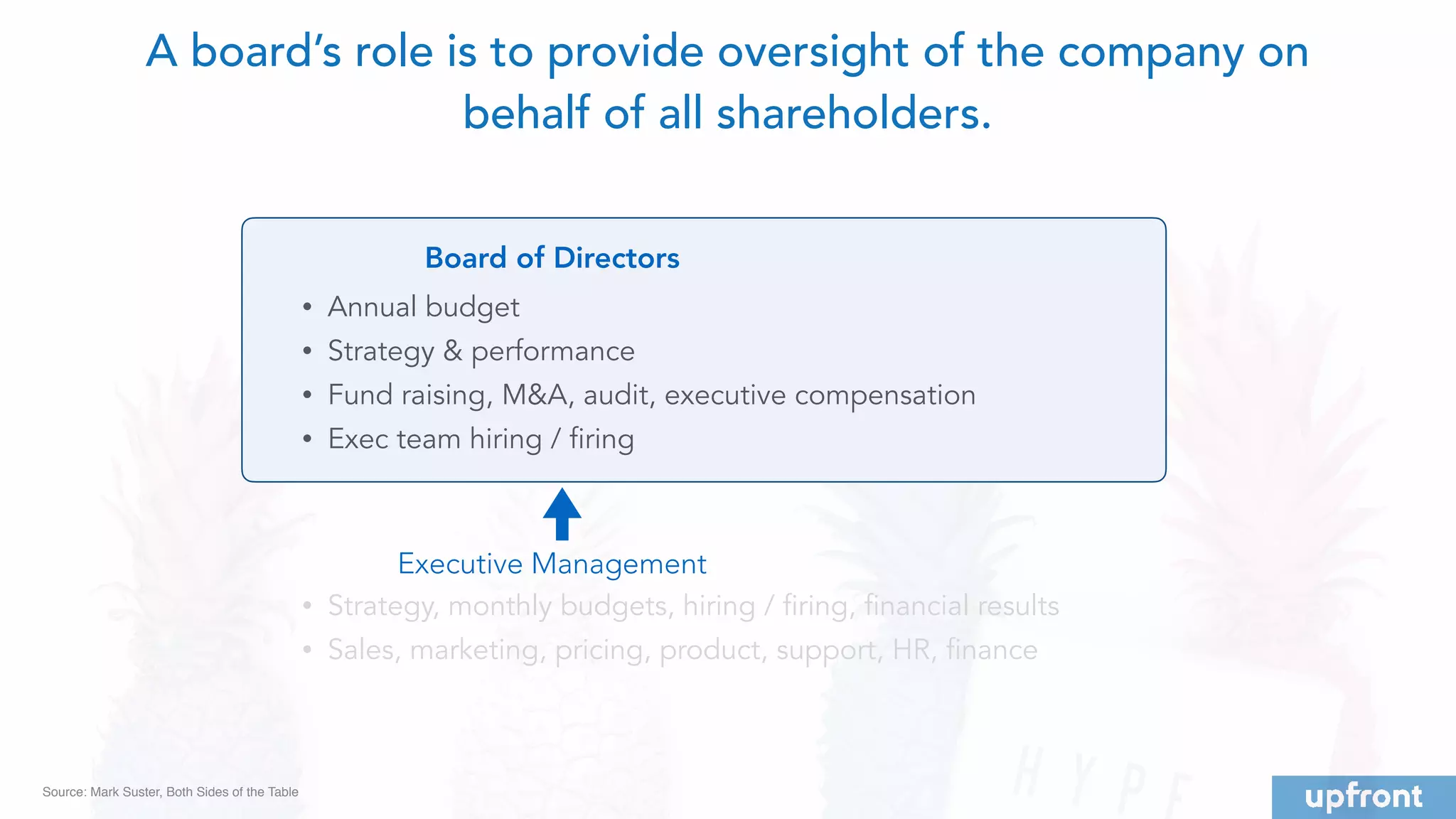

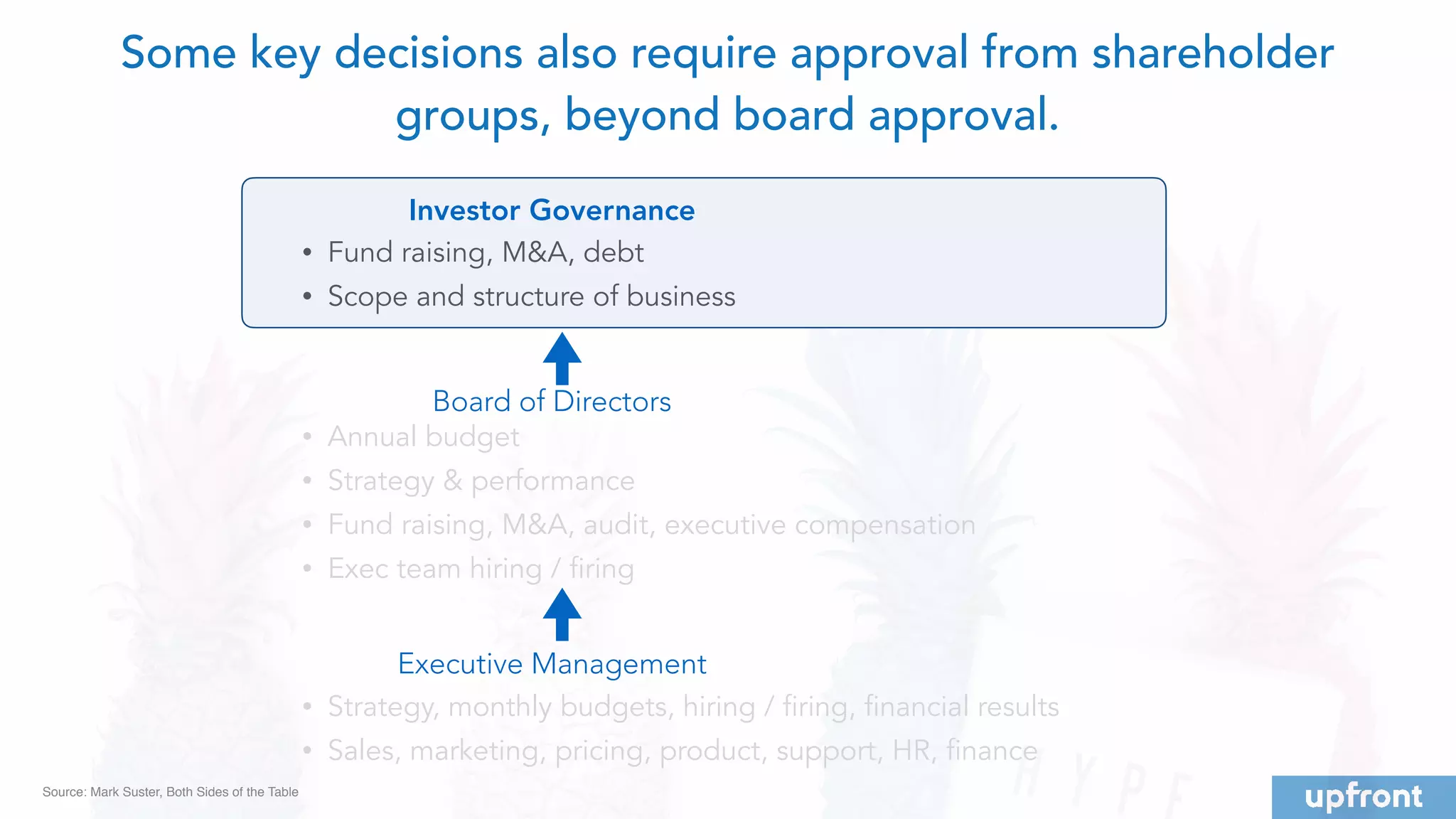

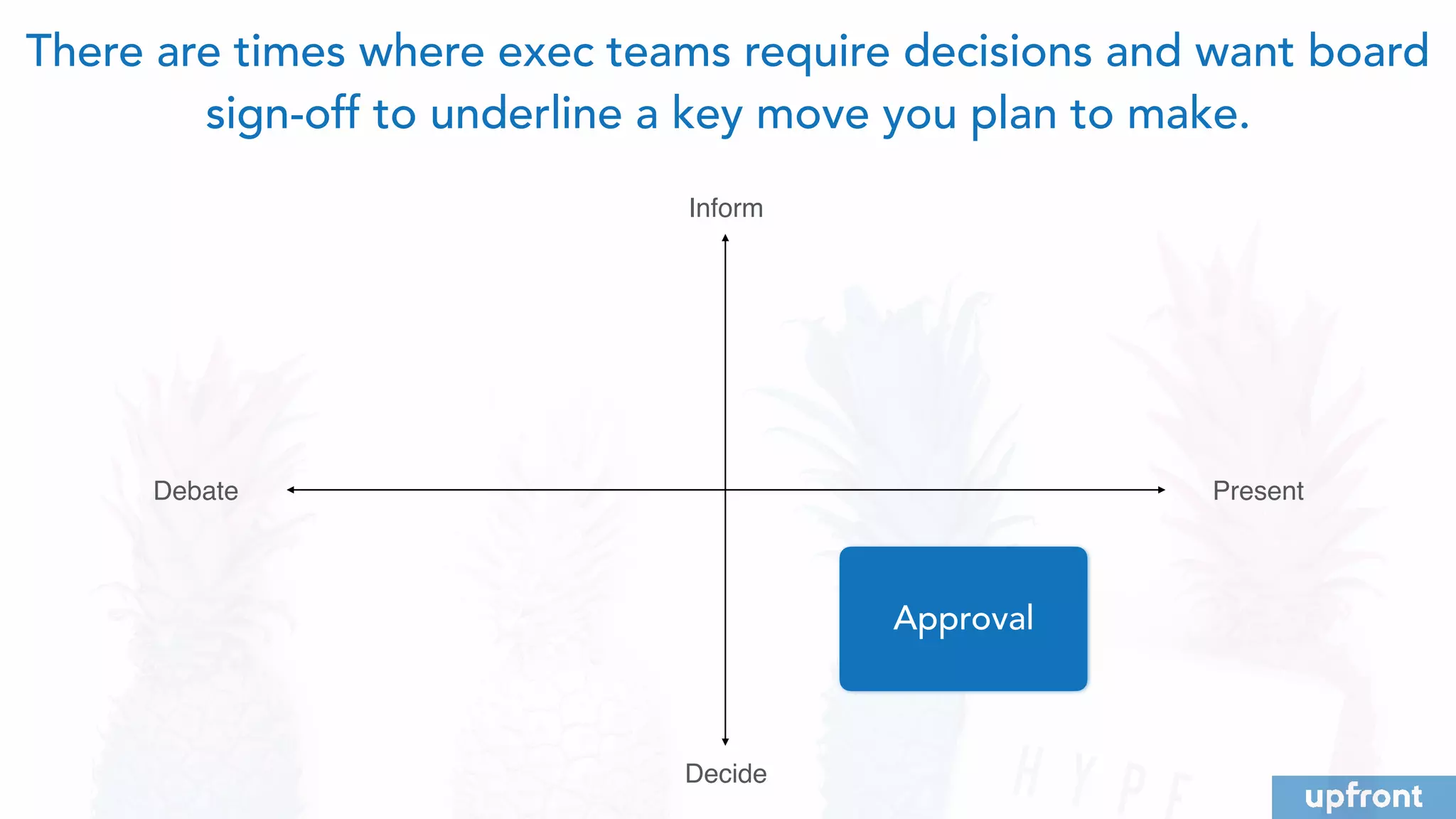

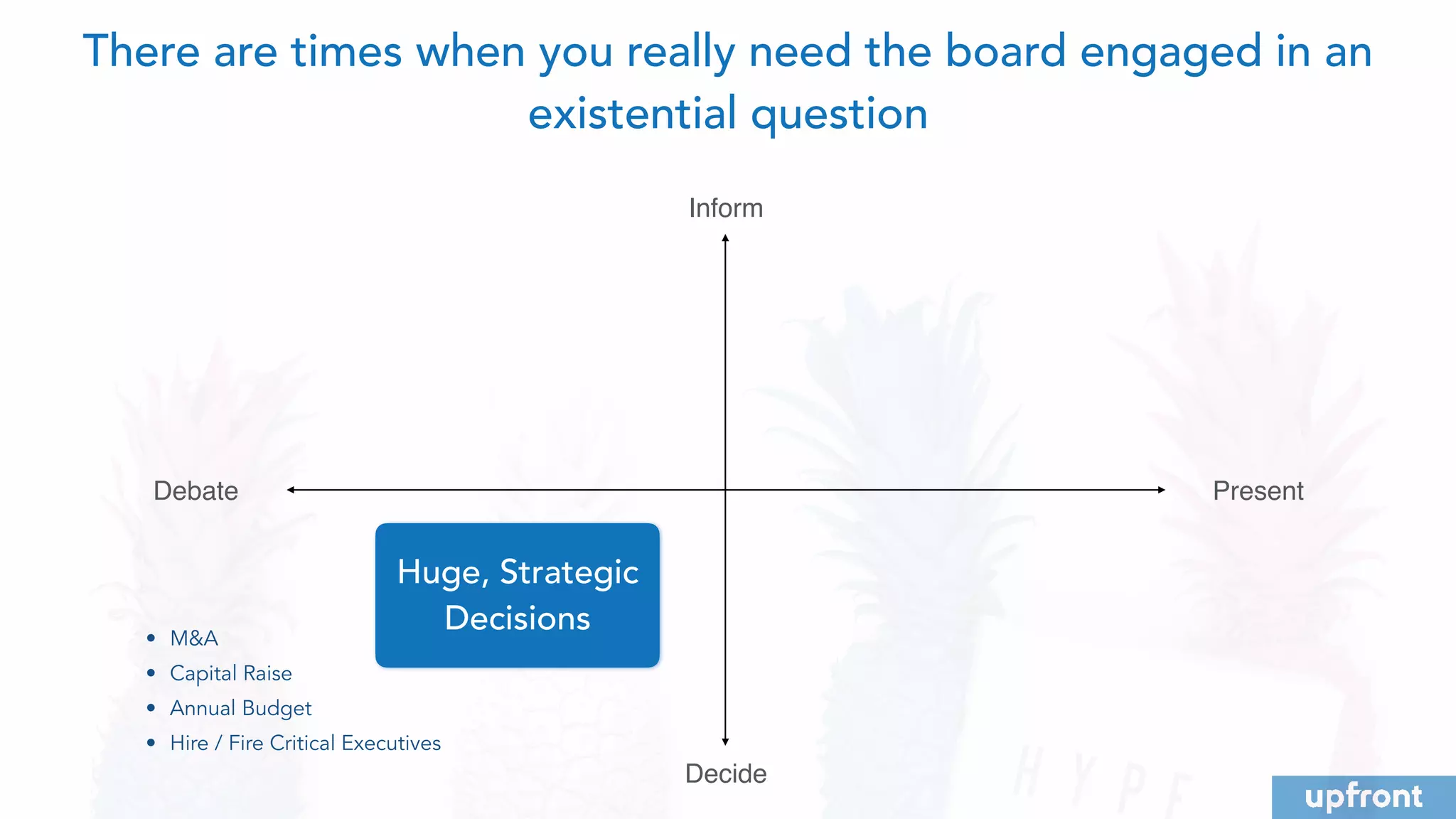

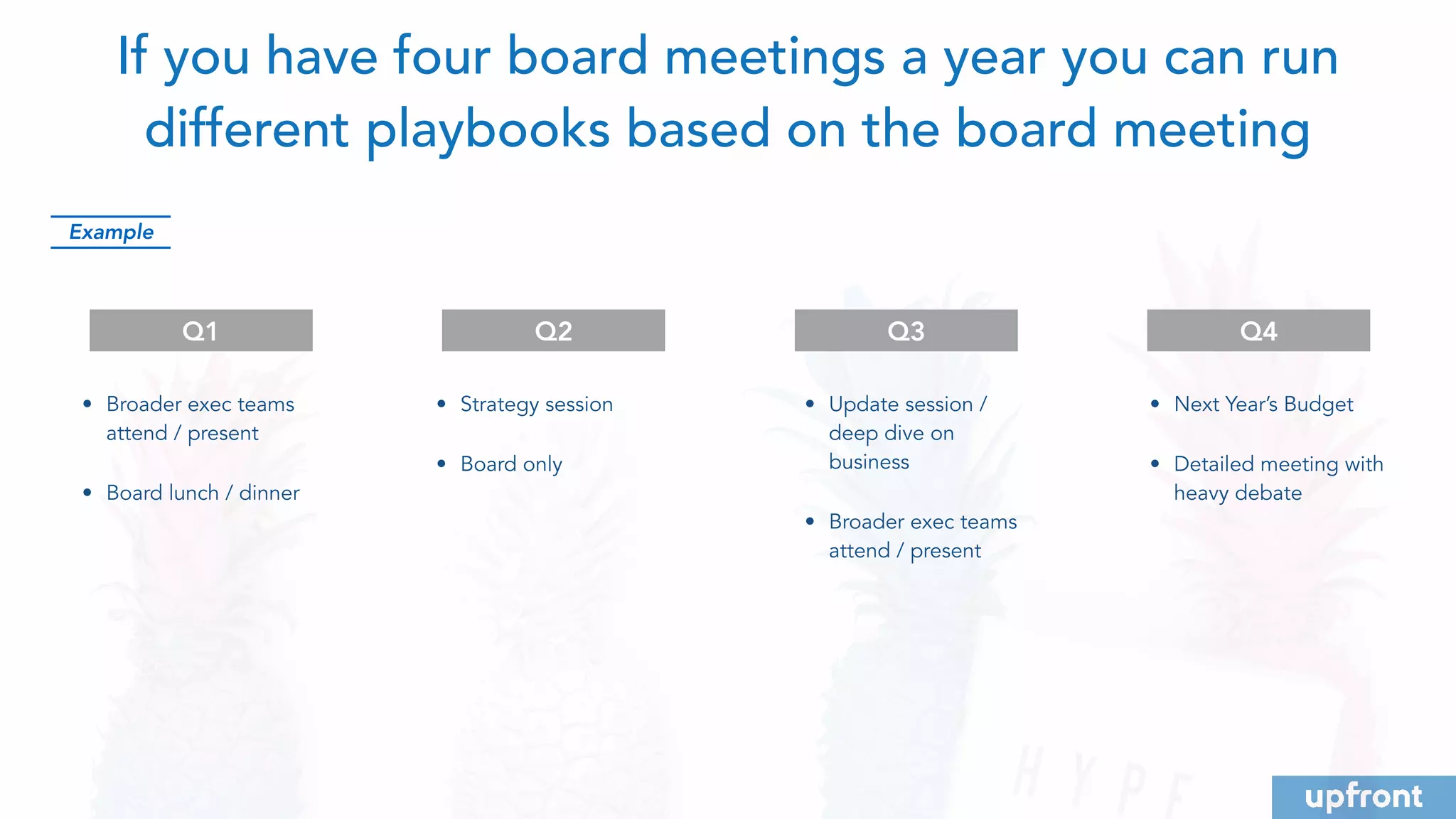

The document emphasizes the importance of effectively managing a startup board, viewing it as an extension of the executive team rather than just an oversight body. It advocates for a 'continuous board' approach with frequent interactions to build trust, enabling members to provide valuable insights and ownership of decisions. Key elements for a high-functioning board include personal relationships among members, alignment of interests, and clear understanding of the business and strategy.