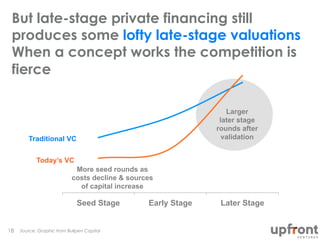

The document discusses the evolving venture capital landscape, highlighting a significant increase in fundraising activity in 2014, particularly in later-stage funds. It notes a trend where startups are remaining private longer, and private investors are capturing greater value before IPOs due to increased capital availability. Additionally, traditional VC investments have decreased, while seed funds and opportunity funds are becoming more prevalent, reflecting a bifurcation in the market.